Public Report on Exceptional Western Canadian Crude Price Strength

Our new report with the Macdonald-Laurier Institute looks at how Canadian crude markets are as optimistic as they’ve been in months regarding US tariffs—but the industry is still far from safe.

Source: Macdonald-Laurier Institute

Hello, Commodity Context subscribers.

I'm excited to announce our new report with the Macdonald-Laurier Institute, a leading independent Canadian policy think tank, that examines why Western Canadian crude prices are so uncommonly strong at the moment.

I encourage you to check out the full report, which draws on more comprehensive research in Canadian Crude Drops Tariff Discount, Crude Mercantilism, No Easy Substitute for Canadian Crude, and Tough Tariff Talk, as well as more frequent coverage in our Oil Context Weekly reports.

A special thanks to Heather Exner-Pirot, Senior Fellow and Director of Natural Resources, Energy and Environment at Macdonald-Laurier, for her guidance and support.

Excerpt from report

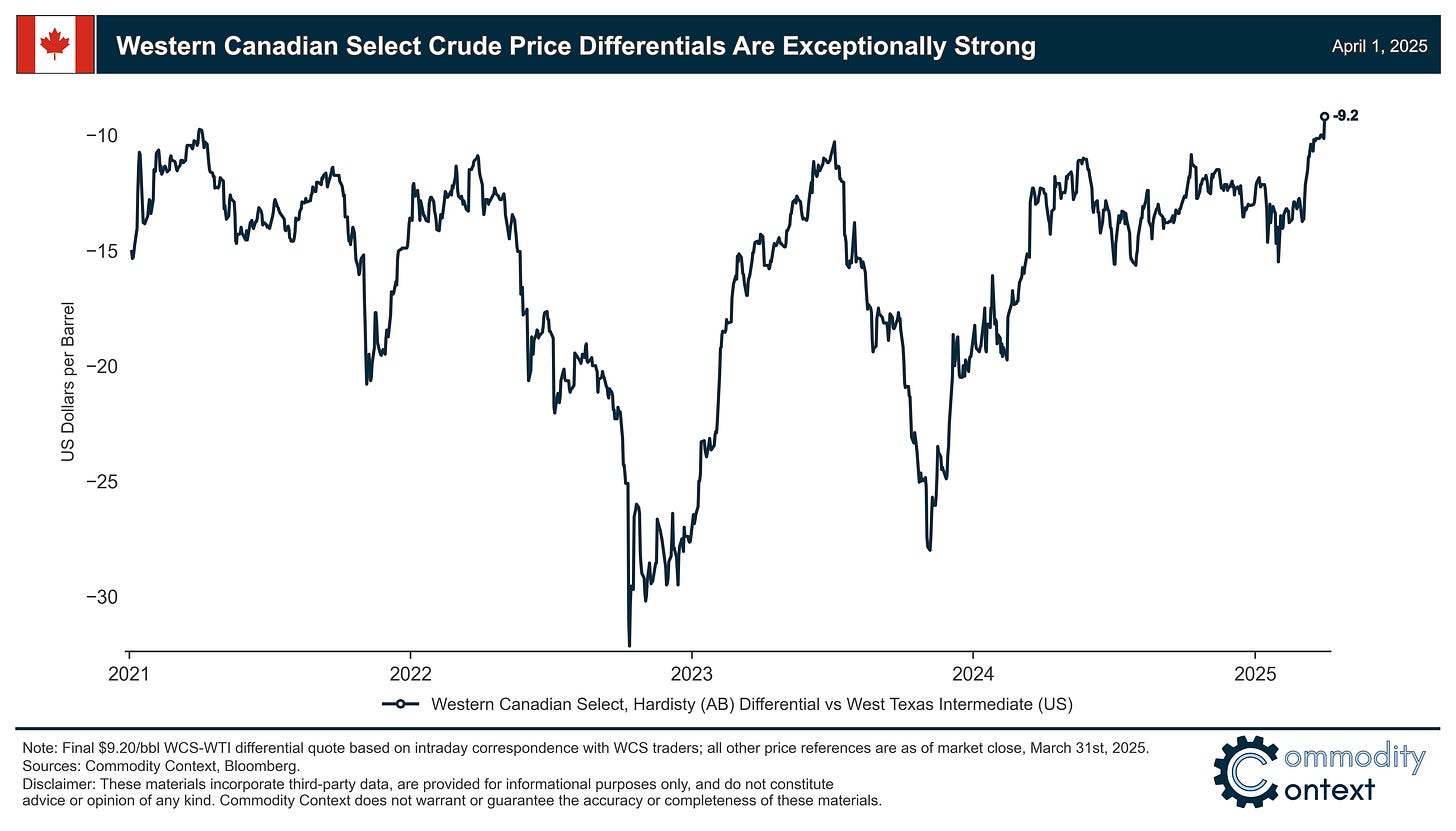

Western Canadian heavy crude oil prices are remarkably strong at the moment, providing a welcome uplift to the Canadian economy at a time of acute macroeconomic uncertainty. The price of Western Canadian Select (WCS) crude recently traded at less than $10/bbl (barrel) under US Benchmark West Texas Intermediate (WTI): a remarkably narrow differential (i.e., “discount”) for the Canadian barrel, which more commonly sits around $13/bbl but has at moments of crisis blown out to as much as $50/bbl.

Stronger prices mean greater profits for Canadian oil producers and, in turn, both higher royalty and income tax revenues for Canadian governments as well as more secure employment for the tens of thousands of Canadians employed across the industry. For example, a $1/bbl move in the WCS-WTI differential drives an estimated $740 million swing in Alberta government budget revenues.

Why are Canadian oil prices so strong today? Well, it’s been the perfect storm of three distinct yet beneficial conditions:

Newly sufficient pipeline capacity following last summer’s startup of the Trans Mountain Expansion pipeline, which eliminated – albeit temporarily – the effect of egress constraint-driven discounting of Western Canadian crude;

Globally, the bolstered value of heavy crudes relative to lighter grades – driven by production cuts, shipping activity, sanctions, and other market forces – has benefited the fundamental backdrop against which Canadian heavy crude is priced; and

The near elimination of tariff-related discounting as threat of US tariffs has diminished, after weighing on the WCS differential to the tune of $4–$5/bbl between late-January through early-March.

[Read the rest of the full Macdonald-Laurier Institute Inside Policy Report here.]

Disclaimer: These materials incorporate third-party data, are provided for informational purposes only, and do not constitute advice or opinion of any kind. Commodity Context does not warrant or guarantee the accuracy or completeness of these materials.

Looks like the Canadian crude scene is buzzing with optimism, but it’s a reminder that the road ahead is still bumpy. Definitely something to keep an eye on!