Trump Tariff Talk: No Easy Substitute for Canadian Crude

Trump’s threatened tariffs on Canadian oil risks injuring a symbiotic relationship that cannot be easily replicated with domestic or other international grades of crude

If you’re already subscribed and/or appreciate the free summary, sharing my research and hitting the LIKE button is one of the best ways to support my ongoing work.

US oil tariffs may not be happening immediately but they’re absolutely still on the table, threatening the two-decades long symbiotic relationship between the US and Canadian oil industries.

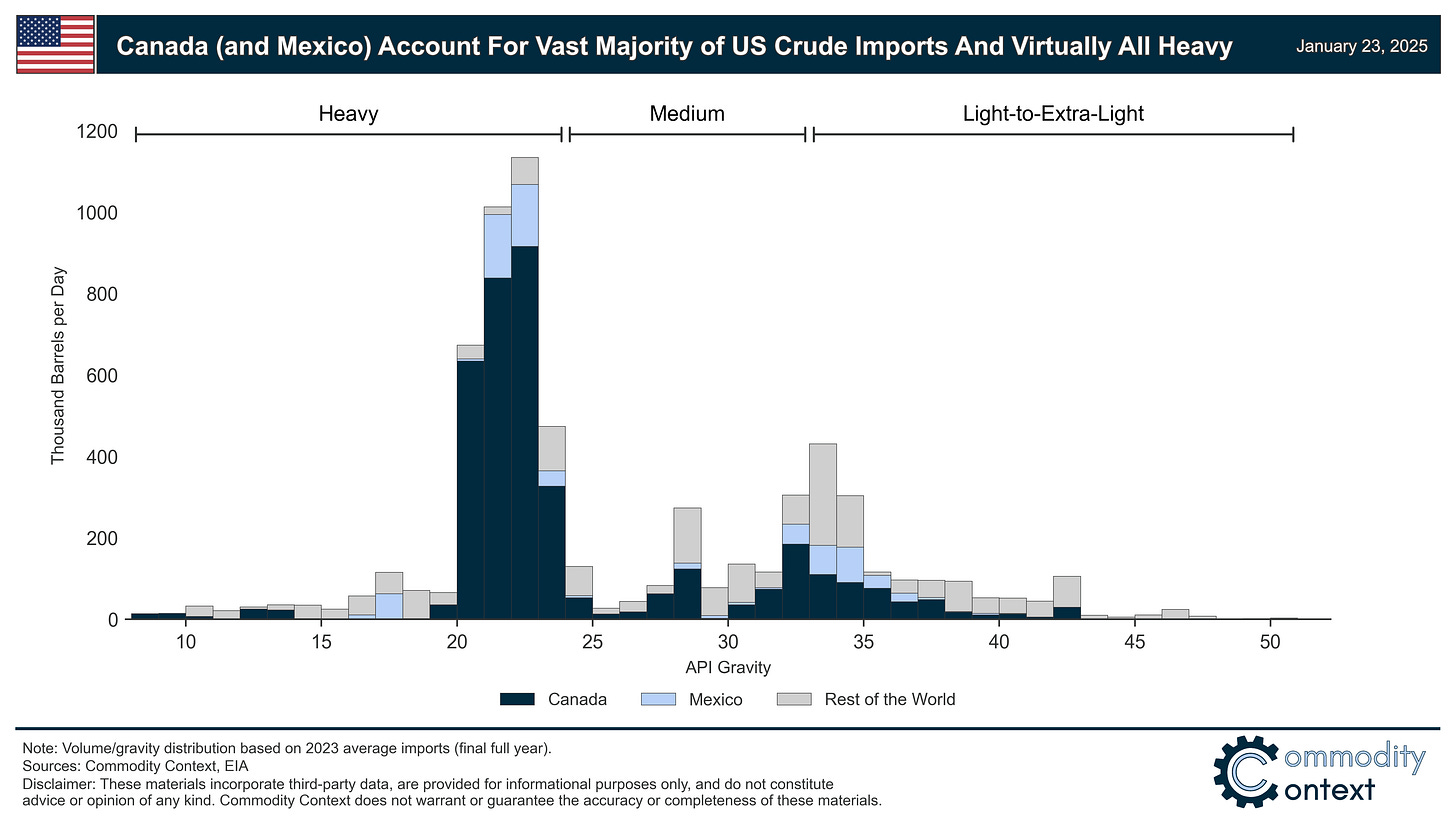

The US is still dependent on imports—and specifically, Canadian crude—given the mismatch between the types of crude oil that is increasingly produced (i.e., “Light Tight Oil”) and the barrels that its refiners prefer to process (i.e., heavier, and cheaper, crude grades).

Canada accounts for more than half of total US crude oil imports because (i) Canadian heavy crude is structurally cheaper, (ii) US refineries have spent decades investing in technologies designed to process these grades, and (iii) there is significant physical infrastructure (read: pipelines) that would take time and gobs of money to shift materially.

There are no easy substitutes for Canadian crude given crude qualities and physical infrastructure: the closest option, Mexico, is under similar tariff threats and the next best option, Venezuela, faces stiffer sanctions.

On the morning of President Trump’s inauguration, the North American oil industry breathed a sigh of relief following reports that the incoming president wasn’t going to—immediately, anyway—impose tariffs on exports from Canada, or any country for that matter. But, while US oil tariffs may not be happening immediately, they’re absolutely still on the table. Indeed, later that day Trump mused that those tariffs on Canada and Mexico were still happening, but probably not until February 1st (Yay?). Whether or not such tariffs come into effect on February 1st as most recently threatened, or as is likely they’re delayed yet again, the North American petroleum industry will be riven by acute uncertainty over the coming weeks and months—if not years. And it’s a risk that particularly impacts my native land, Canada, given the structurally-dominant role of Canadian crude in US refineries.

Indeed, Trump doubled down earlier today in a speech at Davos, saying that “we don’t need [Canada’s] oil and gas. We have more than anybody”. So, until Trump drops this particular bone, I will be undertaking to write a deepening series of posts focused on the US oil sector and its supporting trade linkages, with particular focus on the importance of Canadian crude flows. Today, let’s start with, arguably, the highest-level question: where can US oil refineries source their crude oil?