Public Report on Canadian Refining

Our new report with the Macdonald-Laurier Institute looks at the current state and ongoing value of Canada’s oil refinery fleet

Source: Macdonald-Laurier Institute

Hello Commodity Context subscribers, something a bit different for you today.

I’m a globally-focused oil market analyst, but I’m also Canadian. I have always made sure to dedicate particular research focus to Canadian oil and gas markets and contribute to the discussion concerning the evolving policy environment in which Canadian oil and gas companies operate.

As part of that ongoing work, I'm excited to announce our new report with the Macdonald-Laurier Institute, a leading independent Canadian policy think tank, that considers the ongoing value of Canada’s oil refining sector—both as a national hedge against the global refined product market volatility we’ve experienced over the past three years and as a crucial outlet for Canadian crude, without which Canada would require yet more export pipelines.

I encourage you to check out the full public report for here and in PDF format here.

This report builds off of research that I’ve published here on Commodity Context over the past two years, including Canadian Refining Regionalism, Oil Refining In North America, Collapsed Bridge to the Refining Crisis, Refiners’ Unbalanced Barrel, Cracking Up (Again), and Pipeline from Perdition.

A special thanks to Heather Exner-Pirot, Senior Fellow and Director of Natural Resources, Energy and Environment at Macdonald-Laurier, for her guidance and support.

Excerpt from report

Introduction

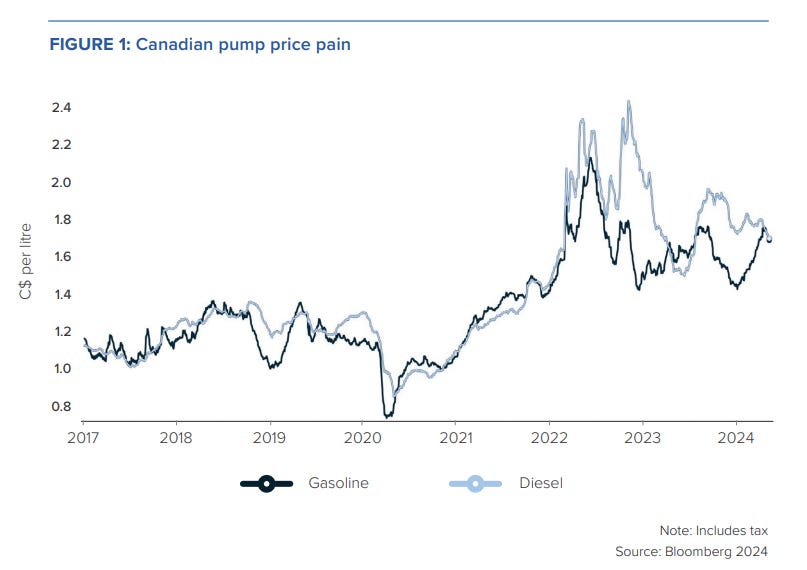

Governments across Canada, and around the world, have announced a suite of policies aimed at reducing the consumption of petroleum products over the coming decade(s). However, these fuels remain a critical piece of Canada’s economy as well as a top-of-mind concern for Canadian motorists today (Figure 1). The importance of oil refining capacity came into sharp focus in the summer of 2022 when a combination of surging crude oil prices, an even steeper run-up in refinery margins, a comparatively weaker Canadian dollar, and the structural uplift of higher consumer carbon taxes pushed average Canadian retail gasoline and diesel prices above $2 per litre for the first time in history and have kept them well above the pre-pandemic norm since.

The path between our current petroleum product reliance and policy-targeted lower-emitting future is both uncertain and certain to be bumpy. There is value to Canada’s refining sector as it exists today and into the future. Canadian refineries provide a valuable source of economic activity and high-income employment, a domestic outlet for our prolific crude production, and act as a hedge against further price gains and volatility in refined product markets. While $2 pump prices were a regressive drag on Canadian consumers, Canadian refineries were able to capture that economic upside and largely prevented that value from leaking outside Canada’s borders. Canadian refineries also provide a crucial domestic outlet for prolific Canadian crude production, which would otherwise require export and, thus, further strain the already-scarce pipeline capacity.

With this backdrop in mind, it’s important to understand the current state of Canada’s refining fleet. The number of Canadian refineries has fallen steadily over the past decades as pre-COVID-19 market pressures, the fleet’s generally advanced age (some of these facilities are more than a century old!), and higher operating costs – both labour and environmental compliance – in advanced economies weighed on operations.

Remarkably, Canadian refining capacity has remained relatively stable and, even more, import dependence has been steadily declining and output has been heavily tilted towards high-value consumer fuels, the vast majority of which is consumed domestically. The future of Canada’s refining industry hangs on several critical points, from mounting pressure on its core business from rising electric vehicle adoption to political attacks against key feedstock supply pipelines in central Canada to the potential for mismanaging the regulation of a volatile and trade-exposed industry.

[Read the rest of the full ~5,000-word report here and in PDF format here.]

Disclaimer: These materials incorporate third-party data, are provided for informational purposes only, and do not constitute advice or opinion of any kind. Commodity Context does not warrant or guarantee the accuracy or completeness of these materials.