Oil Refining in North America

An overview of North American refinery trends, relative capacities, and how US, Canadian, and Mexican refiners have performed through the pandemic

Back to detailed North American oil industry work this week, extending the upstream data and analysis in the North American Oil Data Deck to include a view of continental refining activity.

Note: I’m traveling this week and wasn’t able to record a voiceover for this post—apologies to regular audio listeners.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

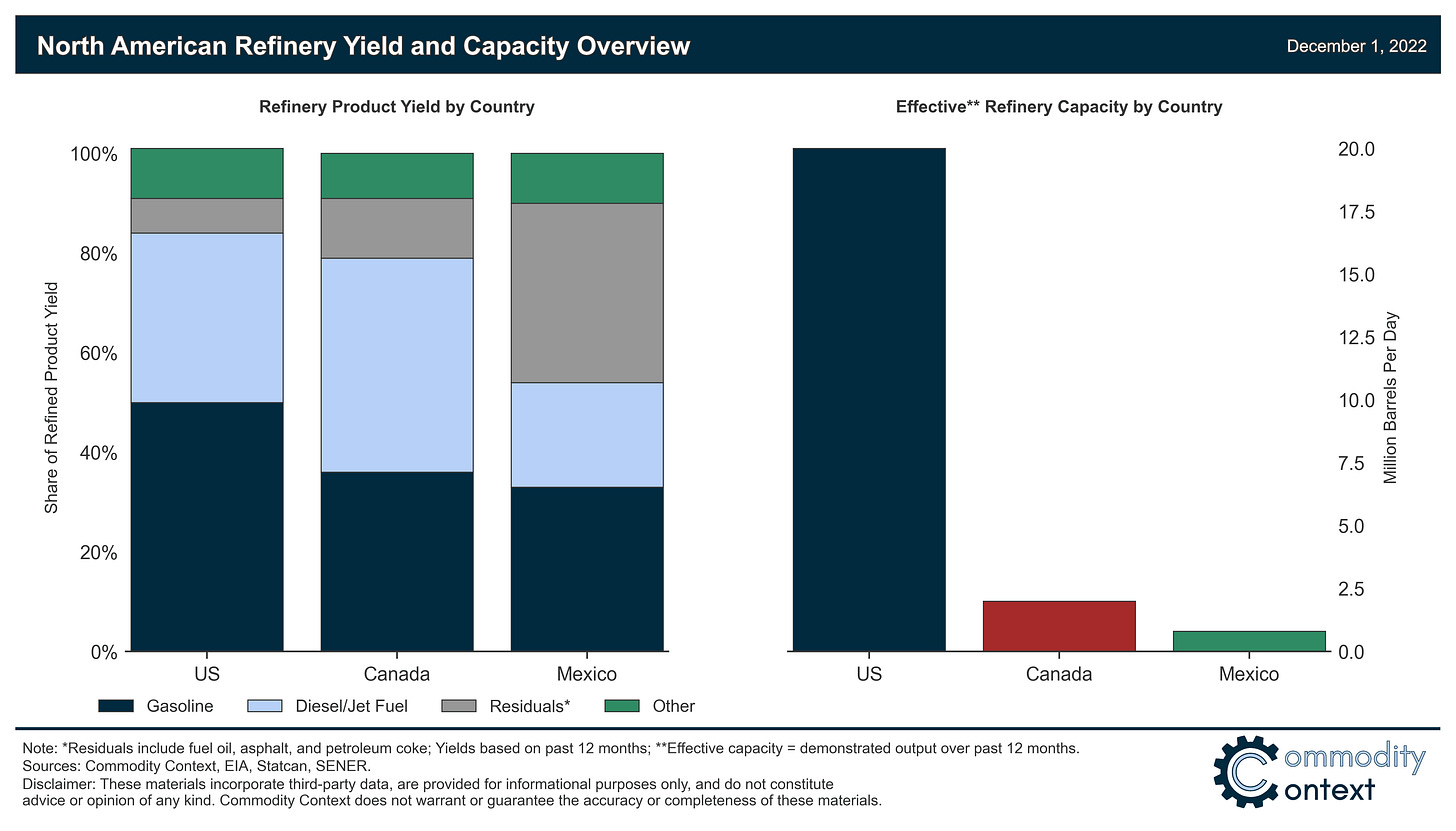

North America possesses one of the largest, most sophisticated refining centers in the world, but there is little doubt that the continent is past its crude processing peak; capacity across the US and Canada is on a downward trajectory, while Mexico has lofty growth ambitions following a dismal decade but seems destined to fall far short.

US refined petroleum product output is down ~1.2 MMbpd year-to-date (Jan-Aug) relative to the same period in 2019—this capacity loss is the single-largest national capacity reduction through the pandemic and ground zero of the global refinery capacity losses that continue to roil the industry.

In Canada, total refined product output is also down 155 kbpd year-to-date vs. the same period in 2019, suffering one major refinery loss (Newfoundland’s Come by Chance Facility) and then seeing the commercial inauguration of another smaller facility in Alberta.

Meanwhile, Mexico’s refined product output is actually up by 240 kbpd (vs. 2019), but this isn’t a sign of strength but rather speaks to the deep dysfunction in a national refining sector plagued by neglect and unprofitability—indeed, current total refined product output remains only roughly half of nameplate capacity.

There’s a shortage of effective refining capacity globally and it’s distorting the relative value of refined petroleum products—put simply, there isn’t nearly enough diesel and there’s too much of basically everything else. As outlined last week in Refiners’ Unbalanced Barrel, this shortage comes on the back of pandemic-shuttered refineries and the delayed startup of planned capacity additions, reduced Chinese exports on the back of longer-term environmental goals, and logistical chaos related to Russian product flow disruptions—the last of which will only be inflamed by the upcoming embargoes and price caps.

While both sanctions against Russia and Chinese export policy are outside the purview of North American refiners, let’s look at how refineries in the US, Canada, and Mexico have performed through the pandemic and what that performance tells us about the broader refining industry. The United States obviously dominates North American refining capacity at roughly 20 MMbpd of product output capacity, which is roughly ten-fold larger than Canada at around 2 MMbpd and more than 20-fold larger than Mexico’s functional output at less than 1 MMbpd (although this is far lower than Mexico’s nameplate capacity, but more on that later).