The Ruins of Mexican Oil

Falling production, weak investment, and little near-term turnaround potential

This overview of Mexico’s upstream oil industry is the final in a series covering North American upstream liquids production (see The Great Canadian Barrel and The Disunited Liquid Producers of America), and all this data will be featured and regularly updated in the North America Data Deck launching soon.

If you’re already subscribed and/or like the free headline chart and bullets, hitting the LIKE button is one of the best ways of supporting my research.

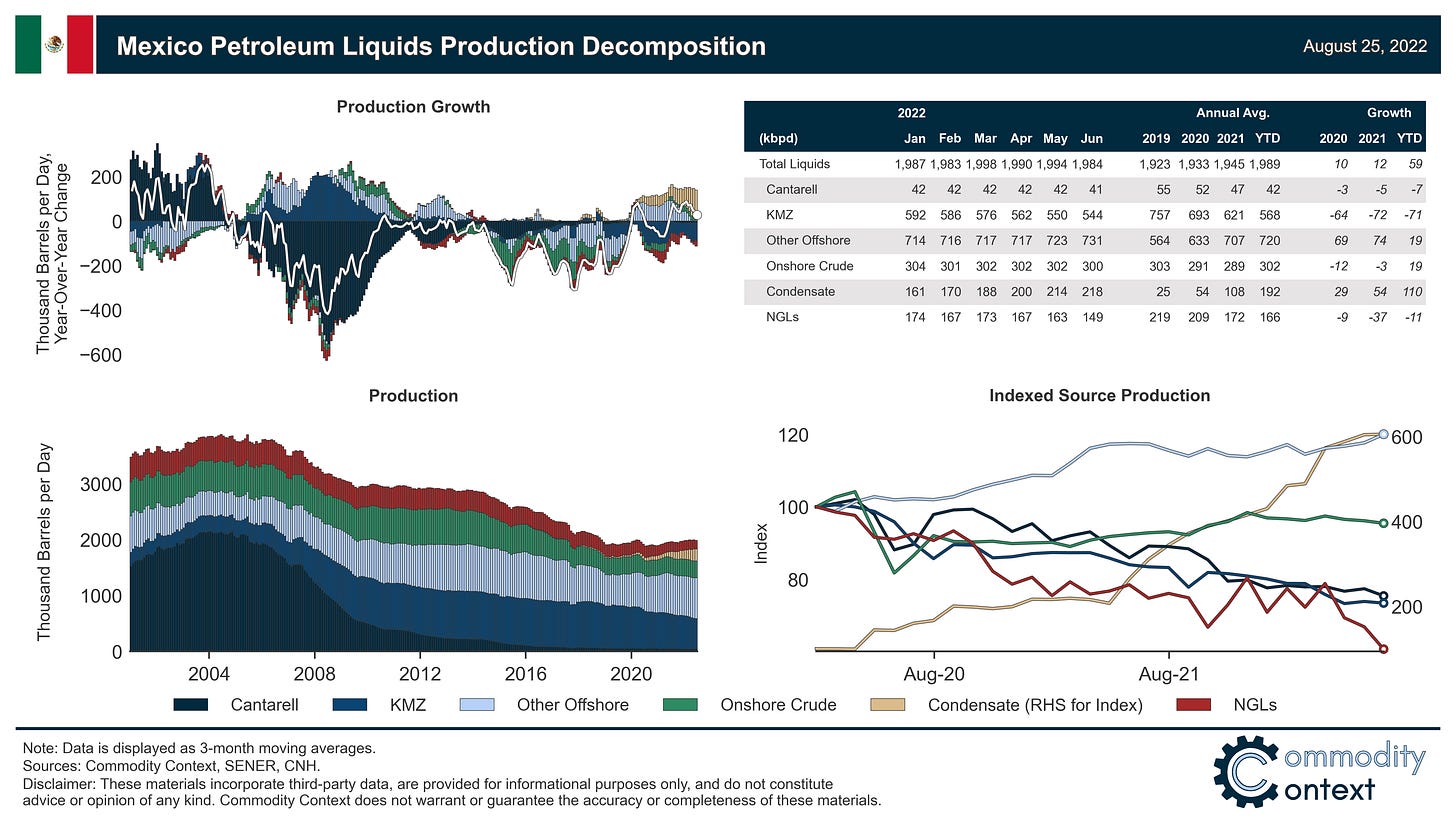

Once a prolific producer and exporter, Mexican oil production has fallen steadily over the past two decades, down by roughly half to around 2 MMbpd today on the back of aging infrastructure and a lack of critically-needed reinvestment.

Offshore crude output has for decades been dominated by mega-fields—with Cantarell representing the world’s second-largest oil field in its heyday–that are now in structural decline, with a dearth of large projects to pick up the slack.

New production, both offshore and onshore, is more heavily tilted toward light crudes and condensates, shifting Mexico’s crude production slate and likely necessitating new export clients; but, this represents yet another hurdle for the steady-as-you-go state-owned petroleum giant, Pemex.

Natural gas liquids output—an area for growth for its northern neighbours—has also collapsed alongside falling domestic natural gas production, further hampering total liquids supplies and kneecapping the domestic petrochemicals sector.

All-in-all, the EIA’s STEO expects Mexico’s total liquids supply to continue to fall to below 1.8 MMbpd by the end of 2023, which seems inevitable absent a material renaissance in Pemex—or, even more importantly, private investment in the country’s capital-starved industry.

Mexico has one of the oldest oil industries in the world, but a history of government-monopolized mismanagement and a lack of reinvestment has led to two decades of declining output and aging production infrastructure.

Through the early 20th century, Mexico was the world’s largest oil exporter and second-largest producer and, as recently as the mid-2000s, boasted the world’s second-largest oil field. These days, Mexico remains a substantial producer—around the size of Norway—but has failed to post growth in recent times. Output currently sits around 2 MMbpd, which is about half of the near 4 MMbpd Mexico produced at its peak in 2004. For reference, that contraction can be compared to the marked gains in the US (+11.5 MMbpd, +167%) and Canada (+2.7 MMbpd, +89%) over the same timeframe.