The Great Canadian Barrel

Decomposing Ever-Stable Canadian Petroleum Supply in a Sea of Oily Volatility

This Canadian liquids supply overview mirrors the recent Disunited Liquids Producers of America, and both datasets—and much more related work–will be included in my upcoming monthly North American Oil Data Deck. Like the Global Oil Data Deck, this chart-forward report will provide a far deeper dive into developments in the North American oil & gas industry.

If you’re already subscribed and/or like the free headline chart and bullets, hitting the LIKE button is one of the best ways of supporting my research.

Canada is the world’s fourth-largest oil producer and one of the few countries that holds desperately needed supply growth potential in the face of more disciplined US shale producers, Russia’s post-invasion pariah-status, and OPEC capacity constraints.

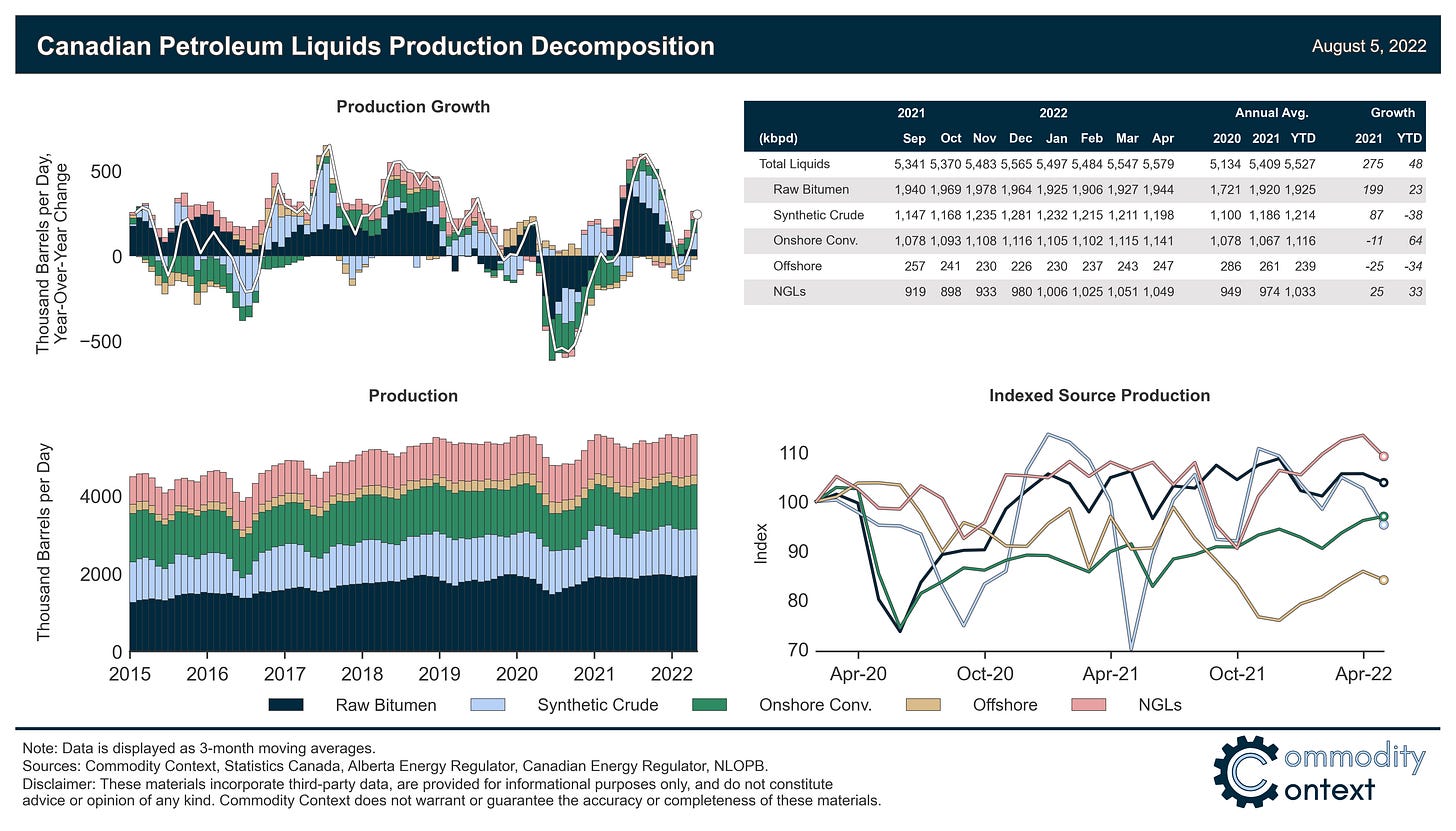

While many global production regions still have yet to recover to their pre-COVID levels, Canadian total liquids output is up 186 kbpd year-to-date vs the same period in 2019.

Bitumen mining output has moved more-or-less sideways since the COVID shock, up a mere 16 kbpd in the first half of 2022 vs the same period in 2019.

In-situ oil sands bitumen output reached fresh all-time highs in 2021, but is running 168 kbpd above 2019 levels in 2022 on the back of slowing project development.

Conventional well drilling continues across Alberta and Saskatchewan, but the recovery is still in progress: only heavy conventional crude oil is up vs. 2019 levels (and only marginally), while light-medium and condensate are both down.

Offshore Newfoundland and Labrador oil production remains down 13 kbpd year-to-date vs the same period in 2019, and will need more than just the near-term boost from Terra Nova re-entering service to sustain growth in the region (with Bay du Nord as a potential answer).

Natural gas liquids output has recovered, with growth heavily tilted toward pentanes plus and buttressed by minor gains in propane and butane; ethane output fell back notably with the historic boom in price of North American natural gas.

Overall, Canadian production has demonstrated exceptional resilience in the face of historic oil market volatility; however, that stability comes at the price of speed—and material growth faces well-known political hurdles.

Canada is the world’s 4th largest oil producer, behind only the three industry titans of Saudi Arabia, Russia, and the US. What’s more, the bulk of Canada’s productive asset base is far more stable—dare I say reliable—than virtually any other major producing nation, a feature that assumes especially high regard in the current era of energy insecurity.

Indicatively, Canadian total liquids supply has bounced right back from the pandemic shock—up 186 kbpd through the first four months of 2022 relative to the same period in 2019—whereas US production still has yet to fully recover. Canada is one of the few countries that holds material [practical] supply growth potential, desperately needed in a world where US shale producers are far less sensitive to price, Russia is a global pariah, and OPEC is running up against capacity constraints.