Barreling Ahead: 2023 Forecast Comparison

Comparing the outlooks and material forecast assumptions for the oil market in 2023 between major public forecasting agencies

This post dives deep into the weeds of the comparative forecasts published by both the EIA and OPEC and is, relative to most of my other thematic research, heavier on charts (11 in total). The last time I did a post like this I titled it Barreling Ahead and I liked it so much that I’ve decided to turn it into an ongoing series where I periodically (every quarter or so) revisit these data to see where the different agencies are forecasting different regional supply/demand heading will trend over the coming year and how that expectation has shifted over time.

If you’re already subscribed and/or like the free headline chart/gif and bullets, hitting the LIKE button is one of the best ways to support my research.

There is a wide range of possible futures for the oil market this year given still-heightened policy risks across a number of large-barrel categories including, most notably, the performance of sanctions-battered Russian supply and demand growth in a reopening China.

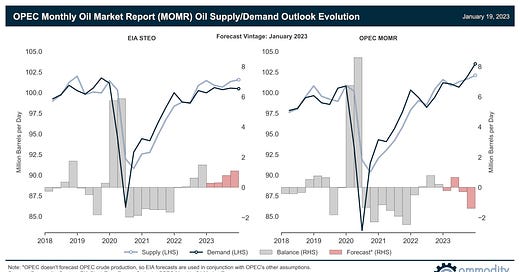

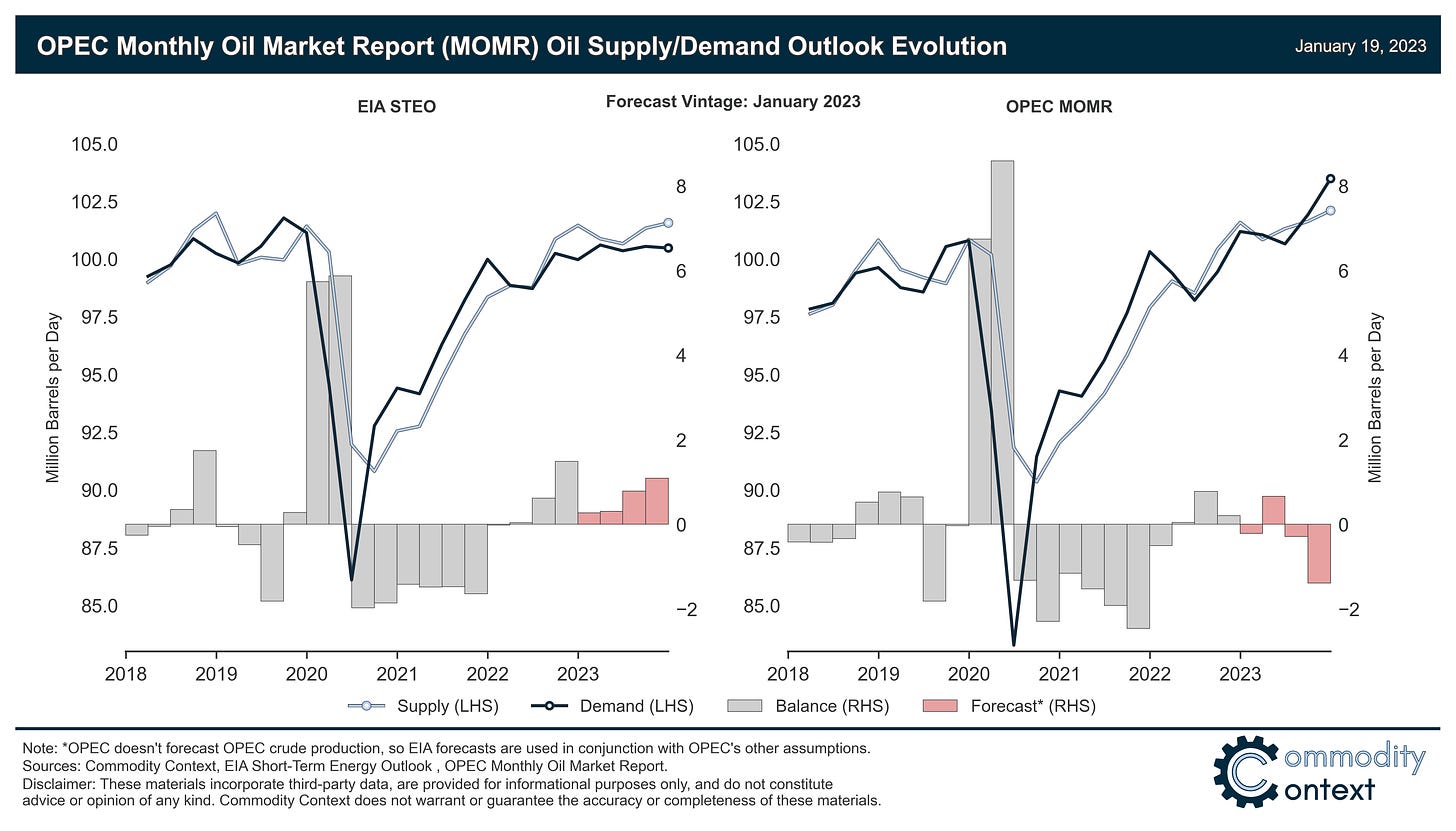

The EIA expects markets to remain moderately oversupplied, on average, in 2023 on weaker demand growth while OPEC’s robust demand expectations push its forecast into mild deficit territory.

This post disaggregates the core underlying assumptions between the EIA and OPEC to make these forecasts more explicit and provide informed readers with the opportunity to make your own decisions about what are often binary policy decisions—in a market like that in which we find ourselves today, outlooks are less base case exercise and more choose your own adventure.

Static version of headline gif above—latest (January ‘23) forecast vintage:

Welcome to a whole new year; where do you see oil markets heading?

Last year was a truly wild ride: consensus expectations were torqued from tight to tighter before ultimately reverting to oversupply on a cacophony of policy-driven developments—from Russian supply upsets to gargantuan SPR releases to draconian Chinese COVID policy. As a result of the policy tumult, the forecasting agencies’ supply/demand models swung wildly by millions of barrels per day, fundamentally justifying 2022’s price volatility beyond simple speculative machinations.

This post will break down the current outlooks of major [publicly accessible] oil market forecasting agencies (i.e., the EIA and OPEC) in what I’ve decided to maintain as a regular series called Barreling Ahead (see previous updates: February 2022, August 2022). Specifically, I will untangle the forecast assumptions that underpin each agency’s market balance outlook, giving special attention to the forecast assumptions that dominate ongoing market debates like Russian production, the trajectory of US shale, and the degree to which Chinese demand bounces back from its COVID-lockdown doldrums.