Barreling Ahead

“Consensus” oil market forecast comparison: looser 2022, tighter 2023, but disagreements lurk below the surface

The data and analytical exhibits in this post will be incorporated into my Global Oil Data Deck series, which will be updated later this week, for continued comparative forecast tracking.

🎙️ Be sure to check out my conversation with Demetri Kofinas on the Hidden Forces podcast from a few weeks ago, which is now available for all to listen here.

If you’re already subscribed and/or like the free headline chart/gif and bullets, hitting the LIKE button is one of the best ways to support my research.

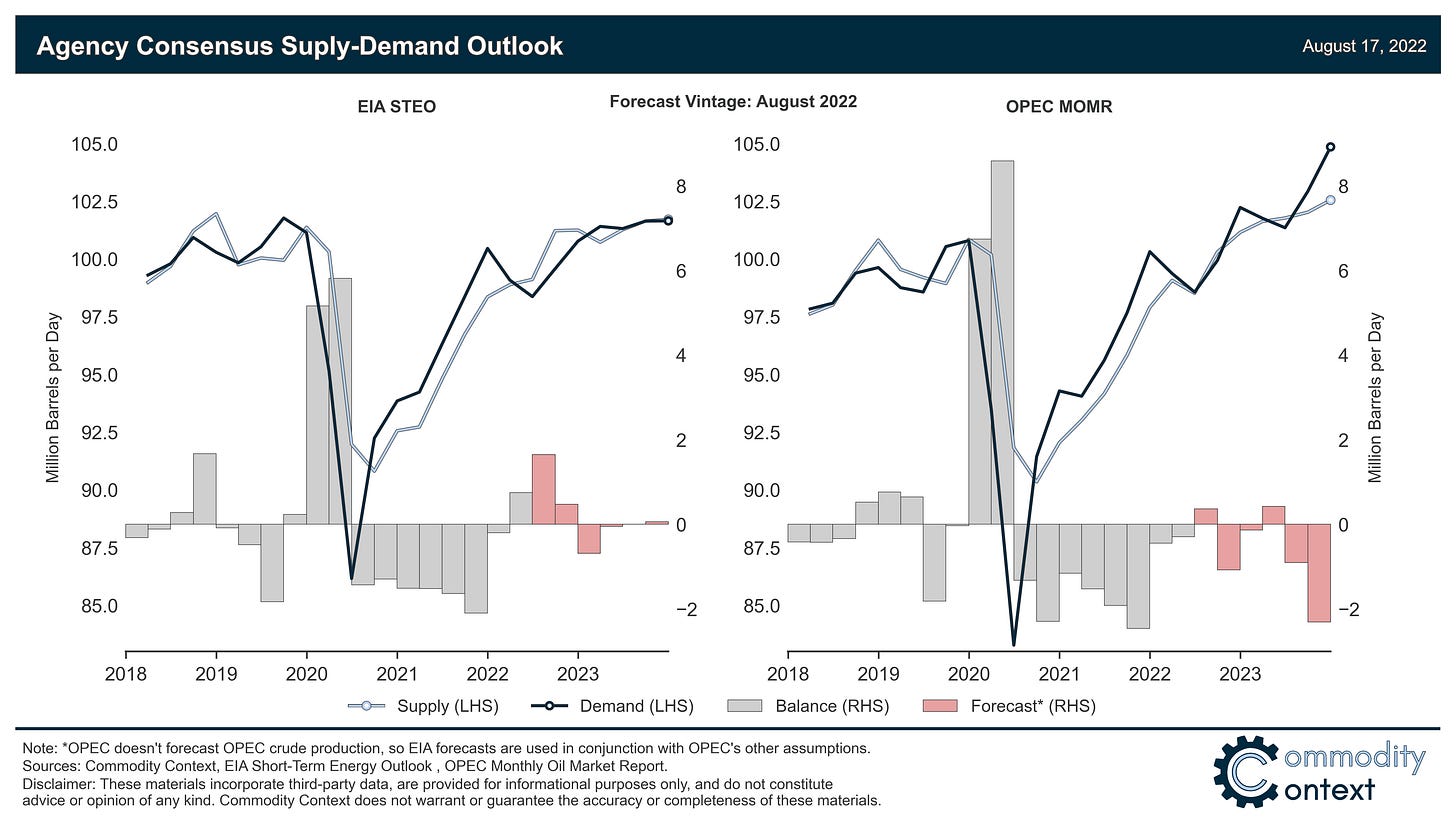

Both the EIA and OPEC agree that the oil market is currently experiencing its weakest quarter (3Q22) since the initial emergence of the pandemic, and both organizations expect the market to tighten materially through the end of 2023—with OPEC holding a more bullish (i.e., tighter market) view over the entire forecast horizon.

But while the both organizations broadly agree on market trajectory, they differ considerably on the means of getting there.

On the supply side of the market, the EIA expects nearly 4-fold larger Russian supply losses next year relative to OPEC (-1.5 vs -0.4 MMbpd) while OPEC holds a considerably more optimistic outlook for global demand growth that more than offsets its expectation of higher Russian supplies.

The EIA’s outlook for OPEC crude output (OPEC itself does not publish one) sees modest gains through the end of 2022 as the OPEC+ deal winds officially winds down, but then production more or less flatlines through the end of 2023, shifting more and more of the burden of incremental supply growth onto non-OPEC and specifically US producers.

Both organizations expect roughly 1.2 MMbpd of US supply growth next year, which is both likely above some industry participants’ more pessimistic outlooks for US production but still only about half the growth witnessed in 2018 despite crude prices averaging nearly double 2018 levels year-to-date.

Beyond the biggest supply-side players of the US, Russia, and OPEC, both organizations expect a smattering of smaller producers—namely Canada, Brazil, Guyana, and Norway—to round out the rest of the gains.

Static version of headline gif above—latest (August) forecast vintage:

Crude prices are at their weakest level since before Russia invaded Ukraine—and it’s been roughly as long since I last did a round-up of what I call the “agency consensus outlook” (see: Oil Bullish on the Streets, Bearish in the Forecast Sheets). Both the Energy Information Administration’s (EIA) Short-Term Energy Outlook (STEO) and the Organization of Petroleum Exporting Countries’ (OPEC) Monthly Oil Market Report (MOMR) forecasts share the view that the oil market is experiencing the weakest quarter currently (3Q22) since the initial arrival of the pandemic in the second quarter of 2020, and that the market will get tighter from here into 2023. But, unlike the broad agency alignment that I outlined in February, today OPEC is forecasting a notably tighter market than is the EIA—in other words, higher prices—on the back of its materially larger implied inventory draws in an already-low inventory market.

OPEC sees a tighter market is virtually all periods across the forecast horizon, both in terms of the extent of the oversupply today in 3Q22 (OPEC at 0.6 MMbpd vs EIA at 1.65 MMbpd) as well as the extent of the annualized deficit in 2023 (0.4 MMbpd deficit vs balanced market). To get to this tighter market, OPEC assumes substantially stronger demand albeit somewhat balanced by smaller Russian production losses—ultimately yielding a growing (albeit bumpy) supply deficit. Meanwhile, the EIA sees a larger Russian supply loss and middling demand growth, yielding a very minorly undersupplied but generally balanced market next year.

Data Note: the modeled assumptions discussed in this post are taken from the publicly available EIA STEO and the OPEC MOMR. As noted in the charts, the MOMR does not officially forecast OPEC crude production.

The International Energy Agency’s (IEA) Oil Market Report (OMR) is another major source of oil supply/demand forecasts, but, alas, the OMR is still behind a paywall and thus not accessible to many. If the IEA manages to bring down their paywall as planned (see here), the OMR forecasts will be added to the comparisons going forward.