What’s Driving OPEC’s Dovish Shift?

Accelerating supply hikes into a volatile US tariff-driven economic shock is a stark shift from OPEC+’s previous cautious and hawkish market support.

We’ll have a full OPEC+ data update on Monday, but for the past week I’ve been thinking and talking a lot about the producer group’s recent and highly atypical announcement that it would be tripling the pace of planned production increases in May, signaling a potential and unexpected shift in OPEC+’s production policy bias. Below you’ll find my latest thoughts on this hugely important and increasingly uncertain guardrail for the global oil market.

If you’re already subscribed and/or appreciate the free summary, hitting the LIKE button is one of the best ways to support my ongoing research.

OPEC+ announced a tripling of its planned May production hike—from 135 kbpd to 410 kbpd—just one day after Trump shocked markets with steeper-than-anticipated “Liberation Day” tariffs.

Regardless of reason, it’s undeniable that the producer group is taking a comparatively less cautious stance about potential negative price consequences—and this has supercharged trenchant and diverse opinions across the universe of market participants.

The most likely explanation for OPEC+’s May acceleration is worsening member-level production compliance and, specifically, acute overproduction by Kazakhstan following the recent completion of an expansion of the prolific Tengiz field.

Rumours continue to swirl around other possible reasons for this unexpected announcement, from bullish theories about impending Russian or Iranian supply concerns to bearish theories around OPEC+’s reinvigorated appetite for market share.

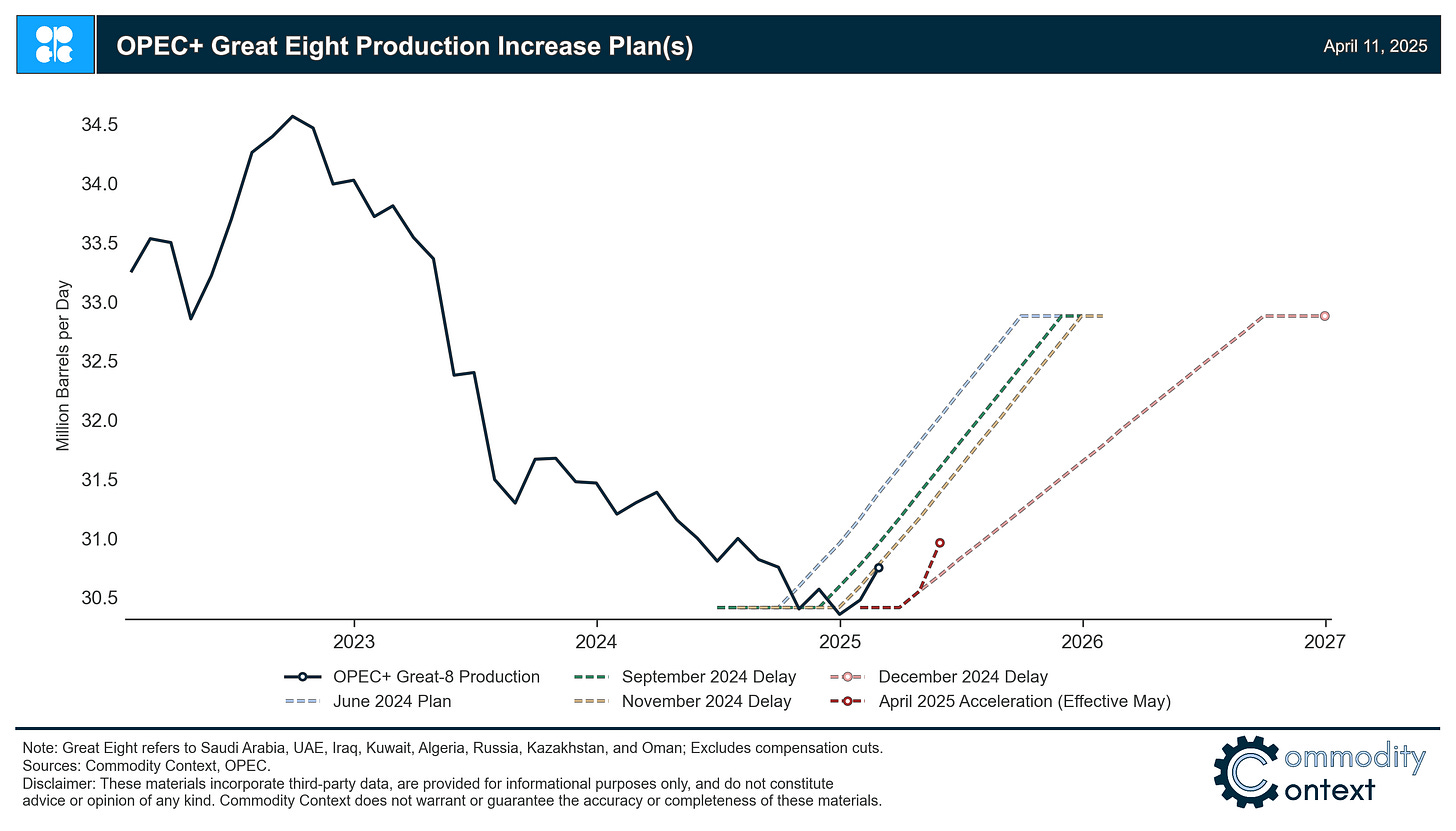

After two and a half years of steadily deepening market support and cautious stick-handling of production policy, OPEC+ made a decidedly incautious announcement last week: the producer group is tripling the planned May production hike from 135 kbpd to 410 kbpd. OPEC+’s previous plan saw steady ~135 kbpd monthly production increases until reaching a cumulative 2.5 MMbpd (2.2 cut unwind, 0.3 UAE baseline upgrade) over 18 months beginning in April, as previously explored in OPEC Back and Relevant Again. But now, OPEC+ has pivoted to three months worth of increases planned for May alone.

This market-depressing change to their much-delayed but well communicated production normalization plan was made, worse still, by announcing the change on Thursday April 3rd, or the morning after Trump shocked markets with steeper-than-anticipated “Liberation Day” tariffs. Of course, OPEC+ itself created and fostered this production overhang risk that now threatens the oil market. The producer group maintained optimism that its massive production cuts accumulated over recent years could eventually be unwound into a strengthening market; instead, OPEC+ is now forced to confront a weakening market—a global economic shock driven by volatile US trade policy. Crude prices fell ~$3.50/bbl following the announcement and crude prices have remained under pressure since.

In doing so, OPEC+ has sowed the seeds of even greater uncertainty in the oil market, shifting from a clearly communicated 18-month plan to a lack of clarity as to what’s even happening in June. It’s unclear whether the producer group will hold steady at those elevated levels for three months through July and then resume the prior plan, continue increasing at a ~135 kbpd monthly pace in June (and, thus, reduce the total return timeline from 18 to 16 months), or even more structurally steepen the pace of go-forward hikes and further reduce the overall timeline. It’s worthwhile to stress just how big a deal this [still tentative] shift in OPEC+ disposition represents for the oil market: a potential loss of the so-called OPEC+ put without a clear sense of what replaces it.

So, what might be driving the current shift in tone and what can this potentially tell us about OPEC+’s next step(s)?