Waiting for the Glut: Oil Market 2025, Wrapped

The year was defined by the emergence—and avoidance—of the oil market’s largest glut since 2020, driven by an OPEC pivot and thus far absorbed by strategic stock builds and sanctioned tankers on water

Happy New Years Eve, oil watchers, and congratulations on making it through another year in the petroleum market!

Below you’ll find my reflections on the past year, and, oh, what a year it was. 2025 may very well be the strangest, most head-fake-y year in memory following a stretch of truly historic years in the oil market.

If you’re already subscribed and/or appreciate the free summary, sharing my research and hitting the LIKE button is one of the best ways to support my ongoing work.

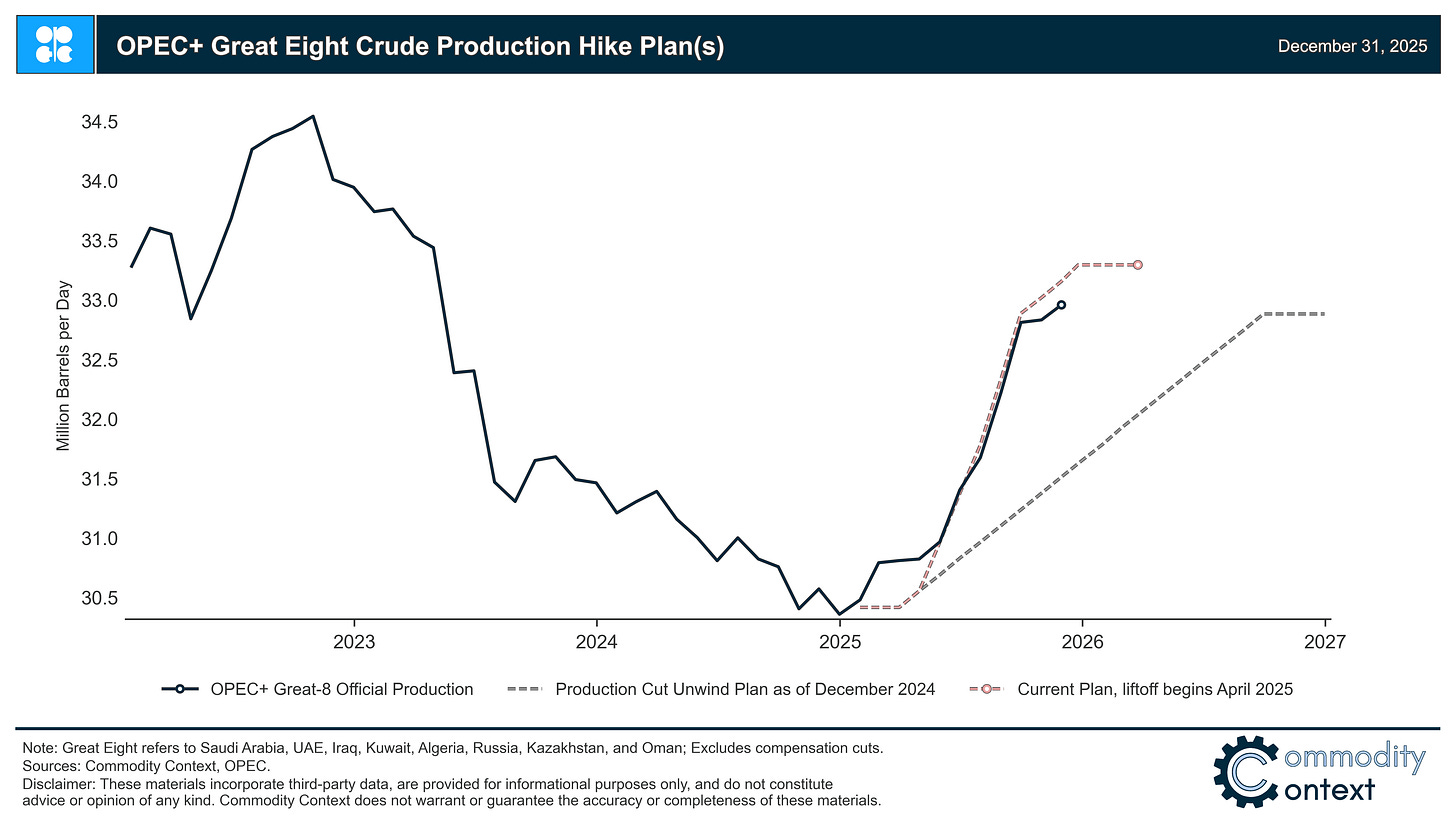

2025 was, of course, a year defined by Donald Trump’s return to the White House but no one could have quite expected the ensuing cacophony of tariffs, sanctions, geopolitical shocks, OPEC+’s about face, and Chinese strategic stock building that came to dominate headlines. This year’s market weirdness is most representatively crystalized in the smiley-faced futures curve—a year that can be best described as waiting, Waiting for the Glut. The overwhelming consensus view was that the combination of meagre demand growth, impressive supply growth in the Americas, and a rapid unwind of OPEC+ production cuts would precipitate a monumental supply glut of 3-4+ MMbpd in 2026 (assuming OPEC+ kept 2026 production unchanged from current levels). While a supply surplus accumulated rapidly through the second half of the year in analyst balance estimates (ours included), the effect on price was comparatively muted thanks to the “surplus sinks” of China’s SPR and sanctioned crude on water (read Oil’s Off-Balance-Sheet-Glut).

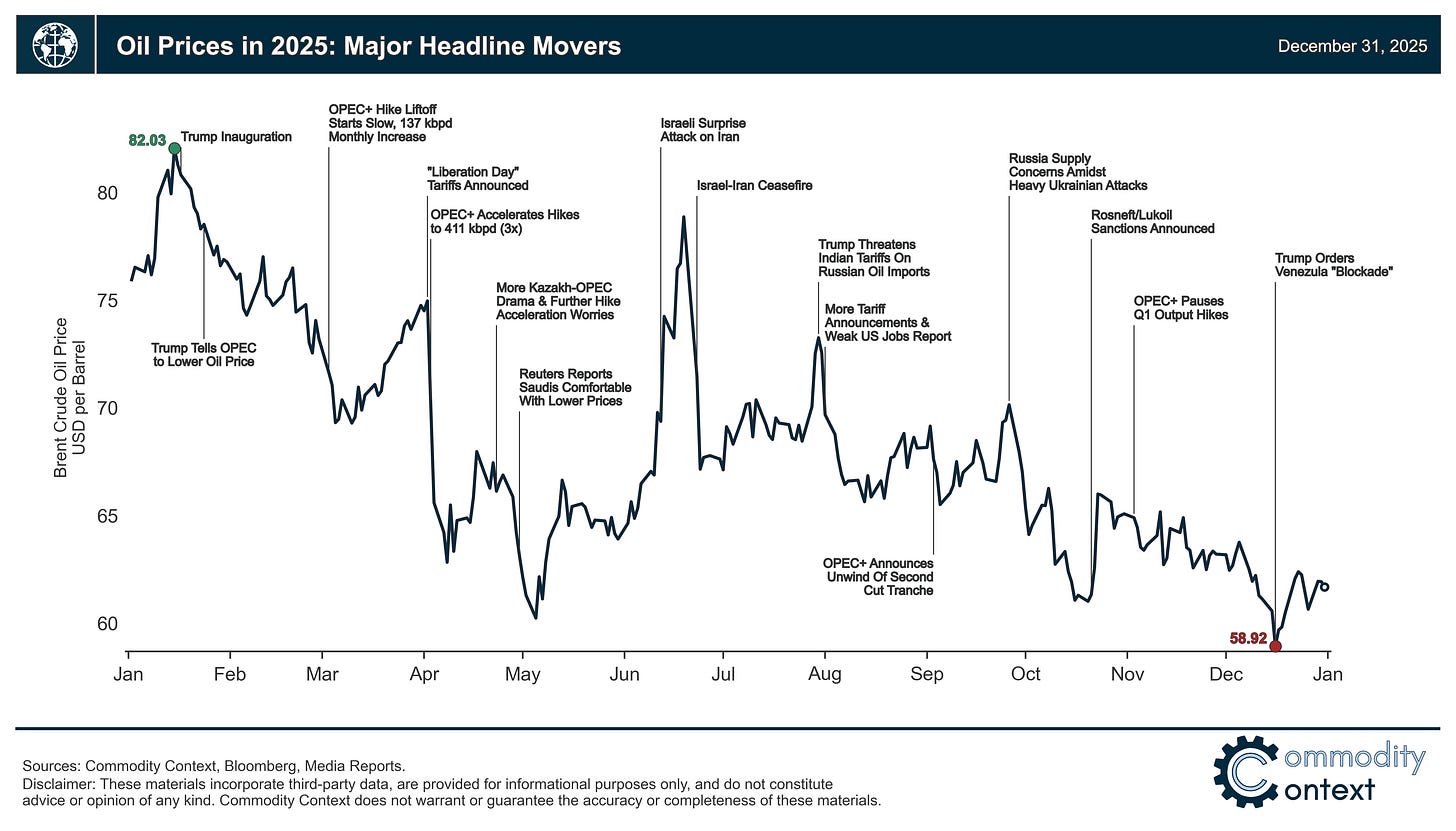

More tangibly, crude prices fell roughly $13/bbl in 2025, with a barrel of Brent ending the year just below $62/bbl. From a January kickoff just above $74/bbl, crude prices hit a high-water mark of $82/bbl on January 15th and then experienced a steep collapse over the next 3-4 months. Crude got double hammered by Trump Liberation Day tariffs and OPEC+’s decision to triple the pace of monthly production hikes, which dragged the barrel to $60/bbl by early May. Then, the Israel-Iran war spiralled into full-blown drone and missile attacks and briefly spiked the market back to around $80/bbl in mid-June. Crude prices continued declining through the latter half of the year, by roughly the same amount, to a more than 4-year low of $59 (Brent) in mid-December, though they did recover into the low $60s to end the year.

Donald Trump and OPEC+ exercised the greatest influence over the oil market in 2025. OPEC+ increased production quotas by a staggering 2.9 MMbpd, and rapidly accelerated the timeline for the first tranche of production cut unwinding from 18 months to 6 months—and all indications are that the group plans to continue to increase production through 2026. The White House ramped up sanctions across three major pariah oil exporters, which strained supply chains and throttled back effective supply availability. Of course, tariffs dominated the headlines for the first half of the year; but, thankfully the bark was far worse than the bite of this file. The futures curve took on a bizarre smiley-faced shape, which reflected the truth that the broad market expectations of mounting supply surpluses were not being realized as quickly as anticipated.

Let’s take a walk back through 2025.