Oil’s Off-Balance-Sheet Glut

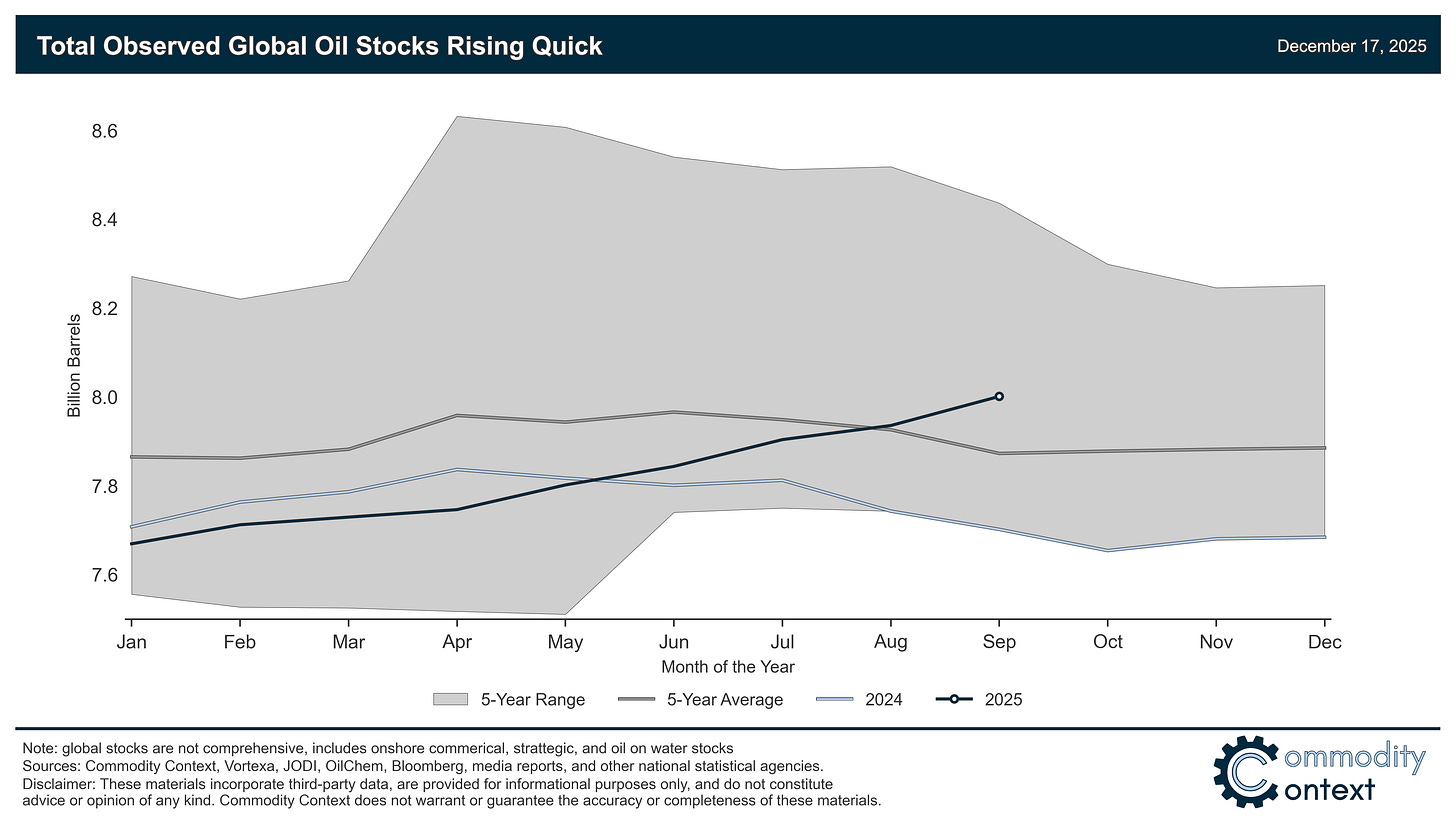

Global petroleum stocks in 2025 have risen at their fastest pace since 2020, but the product mix, geography, and stage many of these barrels occupy in the supply chain has thus far spared crude prices

If you’re already subscribed and/or appreciate the free summary, hitting the LIKE button is one of the best ways to support my ongoing research.

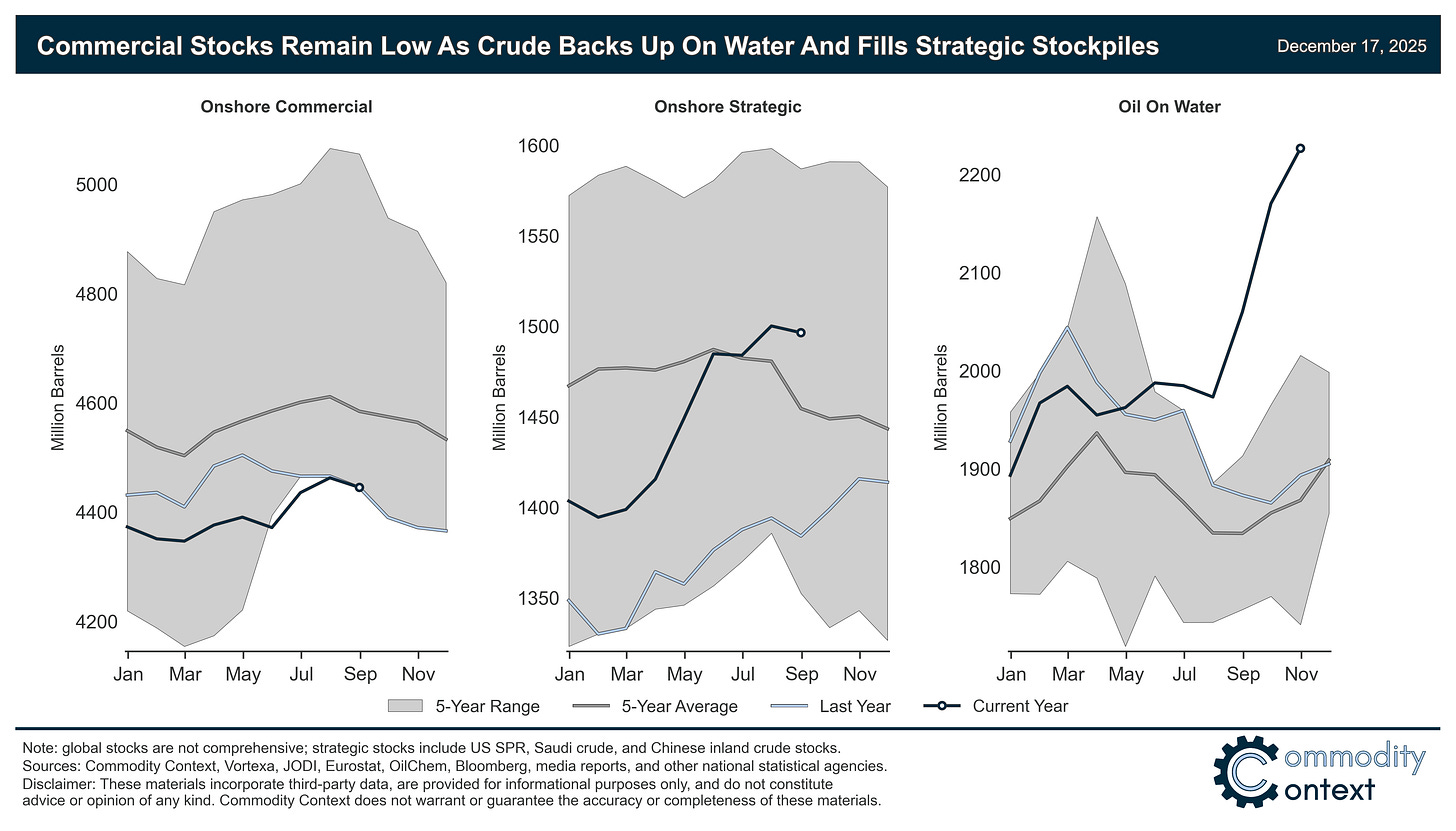

Despite ever-worsening outlooks for a forthcoming supply glut, oil markets have remained tighter than expected through the end of 2025. While we’re heading into 2026 with crude prices under pressure and the majority of the futures curve in broad contango, the front of the curve remains in stubborn—albeit diminishing—backwardation and the most visible commercial stocks remain achingly low.

However, the most widely anticipated supply surplus is, indeed, already arriving; it’s just being held off the oil market’s primary, price-setting balance sheet. The surplus has materialized, instead, in three main places: an acute accumulation of oil on water thanks to rising production and also sanctions; a massive build-up in Chinese strategic stockpiling; and a steady backdrop of growing US NGL inventories.

Let’s go through each in turn.