Quick Context: SPR 2.0

A new era of more active strategic petroleum inventory management—maybe

I recently announced the formal launch of Commodity Context, a new kind of commodity market data and analysis service that delivers numbers, narrative, and nuance straight to your inbox. If you like the content in this post, please consider subscribing to continue reading.

Today the Biden administration announced that it is taking two groundbreaking measures in the management of the US’ Strategic Petroleum Reserve (SPR).

First, a first-of-its-kind commitment to—and a rough timeline for—refilling at least part of the SPR following the current emergency sale.

Second, the opening of a rulemaking proceeding by the DOE to consider broadening buyback regulations to facilitate fixed-price bids.

The devil is still in the details—but, at the very least, this announcement is a step in the right direction toward more effective future strategic inventory management.

Just over a month ago, the Biden administration announced the largest-ever sale of oil from the US Strategic Petroleum Reserve (SPR), a whopping 180 million barrels over six months. As I outlined in this Quick Context, “the SPR release risks falling into bad policy territory—an election-year pump-price pander” absent a clearly communicated, ideally forward-purchased plan to refill the SPR. I hoped to see a more explicit plan to leverage the SPR’s buying power today to refill the SPR in the coming years, which would enhance the price signal to producers by pulling up the back of the crude futures curve and thereby facilitate more profitable corporate hedging.

Well, funny story—they more or less did just that.

This morning the US Department of Energy (DOE) announced two big things regarding the US SPR. The first is a commitment to purchase 60 million barrels to refill part of the SPR, with the call for bids taking place “in the fall of 2022 to secure delivery in future years.” Second, the DOE will “begin a rulemaking proceeding to consider broadening DOE’s buyback regulations to allow for a competitive, fixed-price bid process as an alternative to the index-pricing that is traditionally used.” (The prior index-pricing system adjusted the contracted purchase price to nearer the ultimate spot price at the time of delivery—the opposite of what we would want here.)

So, what does that mean, exactly?

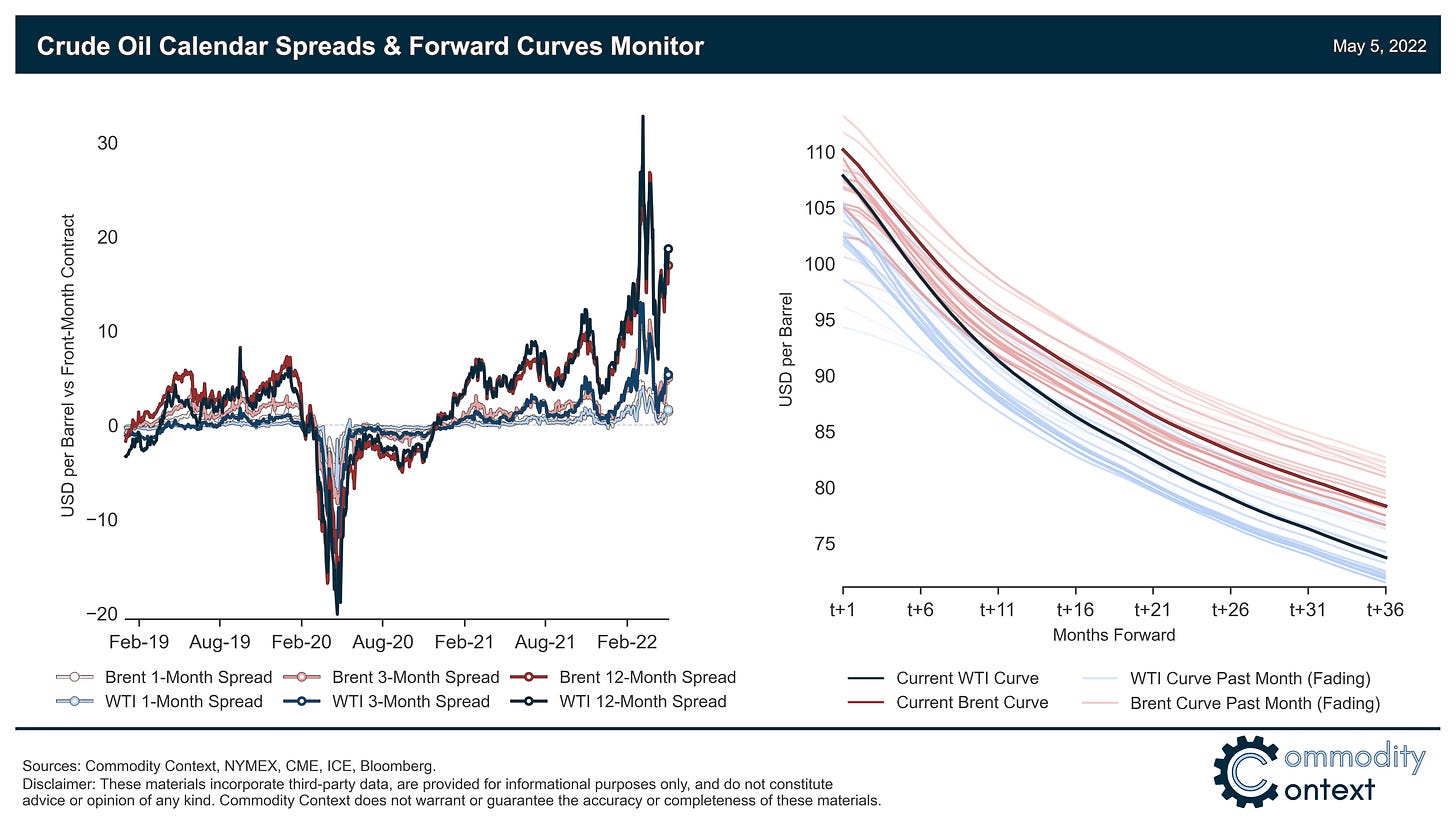

While the devil remains in the details, together these announcements—if the rulemaking proceeding concludes in time—effectively mimic a direct purchase of futures contracts to lock-in currently-lower prices further down the curve. By purchasing for future delivery and then using a bidding process to create competition amongst those selling those future-dated barrels, the DOE will naturally press sale prices to converge around the futures curve for the given time period (i.e., at prices well below their lofty current levels, as seen in the chart above).

In addition to the obligatory tilt towards the traditional energy security agenda, the press release added that “this replenishment structure also will help encourage the production we need to lower prices this year by guaranteeing this demand in the future.” This intertemporal demand shifting is an innovative policy solution to current market woes, effectively transferring acute prompt price pressure (i.e., superbackwardation) to a more diffuse price signal further down the futures curve—which also happens to be more useful for corporate hedging purposes.

I outlined a very similar policy structure on a recent podcast (26:40 minute-mark) and hat-tip to Employ America’s white paper early in the energy crisis on policy options for the Biden admin that made this kind of mechanism a central pillar.

Caution: Mostly good, but some worrying words absent further context

A word of caution on my generally positive tone: two words in the press release gave me pause (emphasis mine): “The future delivery window will be based on anticipated market conditions factoring in when future oil prices and demand are expected to be significantly lower.” “Expected”, taken in isolation, would suggest that the DOE is not going to lock in lower prices now; this makes little sense to me, so instead I’m taking it as a lawyerly, rather than an economic, hedge. The other is the word “demand” in said lower expectation, which must be a mistake because it would be deeply unexpected if demand fell outright over the coming years.

Finally, an important point for clarity: The repurchase plan will be executed at the same time as the congressionally mandated sales of SPR oil—33.5 and 42.5 million barrels in 2023 and 2024, respectively. While simultaneously buying and selling crude may sound completely ludicrous (and I’d prefer no mandated sales), the purchases will ideally be made at the lower prices that are currently reflected in the crude futures curve and the mandated sales will be executed nearer a spot price. That spot price will either be higher—and thus a winning trade from the perspective of the SPR—or lower, in which case the White House gets its easing affordability outcome and slightly lower future-contracted sales aren’t a deal breaker.

Conclusion

This is a landmark announcement from the DOE, with the Biden administration effectively reimagining the role of the SPR. While only time will determine the ultimate success of this policy approach, I view this announcement as admirable in its pragmatic creativity and believe it will open the door to a more actively-managed strategic reserve going forward.

Becoming a paying Commodity Context subscriber and clicking the LIKE button are two of the best ways to support my research.

Great commentary. Very helpful for broader understanding of the mechanics involved. Thanks

Spot on analysis!