Public Report on Canada-US Oil Relations

Our new public report with the Canadian Global Affairs Institute looks at the Co-Evolution of the Canada-U.S. Oil Industry and Possible Implications of Donald Trump’s Re-election.

Source: Canadian Global Affairs Institute

Hello, Commodity Context subscribers—I’m excited to announce a new public report that we’ve cowritten and published today with the Canadian Global Affairs Institute (CGAI).

The report, cowritten by myself and Joe Calnan, CGAI’s Energy Security Forum Manager, explores the symbiotic evolution and rapid growth of the Canadian and US oil industries, ongoing sectoral interdependencies across the 49th parallel, and the unique vulnerabilities faced by Canadian oil exporters to US trade barriers like the universal tariffs proposed on the campaign trail by the incoming administration of Donald Trump, who will next year begin his second term in the White House. While I have repeatedly stressed that it is highly unlikely that such tariffs will be applied to Canadian energy trade, it remains important to understand the scale of the risk heading into inevitable trade negotiations.

The report was adapted from Stronger Together, published to Commodity Context subscribers last month, as well as a presentation by the same name to the CGAI Ottawa Energy Security Forum Conference on The Future of the Canada-US Energy Relationship. A special thanks to the CGAI team for their ongoing support of Canadian energy market research and I hope you enjoy the report.

Excerpt from report

Introduction

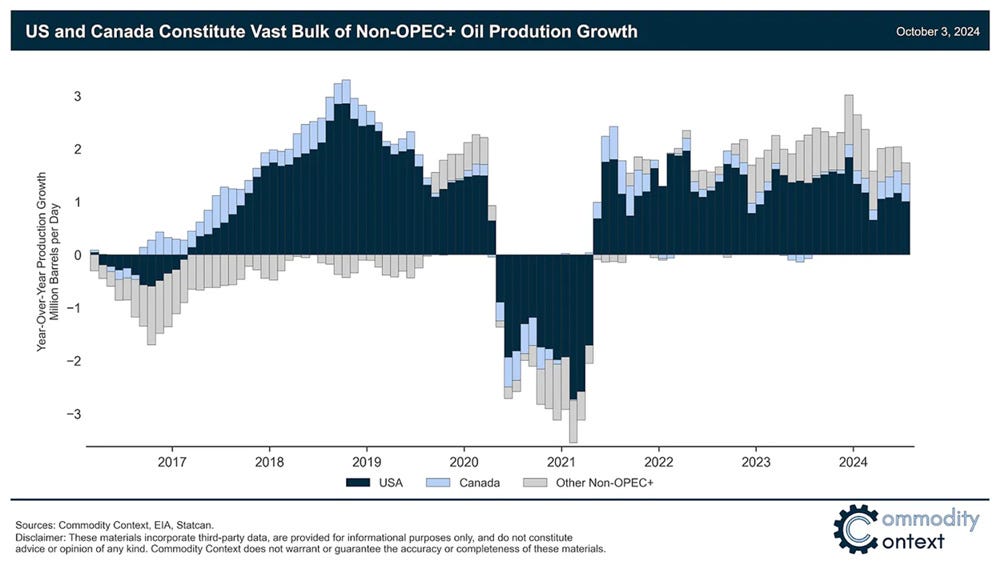

The United States and Canada are the two fastest growing sources of non-OPEC oil production today and, for more than a decade, have made up the bulk of non-OPEC supply growth. While supply from the rest of the world has contracted, combined U.S.-Canada crude output is up by around 1.3 million barrels per day (MMbpd) compared with this time last year. More than that, both the Canadian and U.S. oil industries have grown together, becoming increasingly dependent in both directions across the 49th parallel. This growing mutual dependence has been enabled by the complex of pipelines, oil terminals, and refineries meant to supply the United States with Canadian oil and Canada with American oil.

However, the just-completed U.S. presidential election — and the policy rhetoric throughout the electoral contest — refocuses attention on Canada’s unique vulnerability to U.S. policy risks, both broadly and specific to Canada’s oil and gas sector. Canada and the United States have developed mutually dependent, integrated oil supply systems over decades of stable and friendly relations. In the long decades of declining American oil production, Canadian oil supply was a cornerstone of North American energy security and American refineries adapted to this reality. Today, the Canada-U.S. oil trade relationship is the largest bilateral energy trade relationship in the world. However, it is far from a relationship between equals.

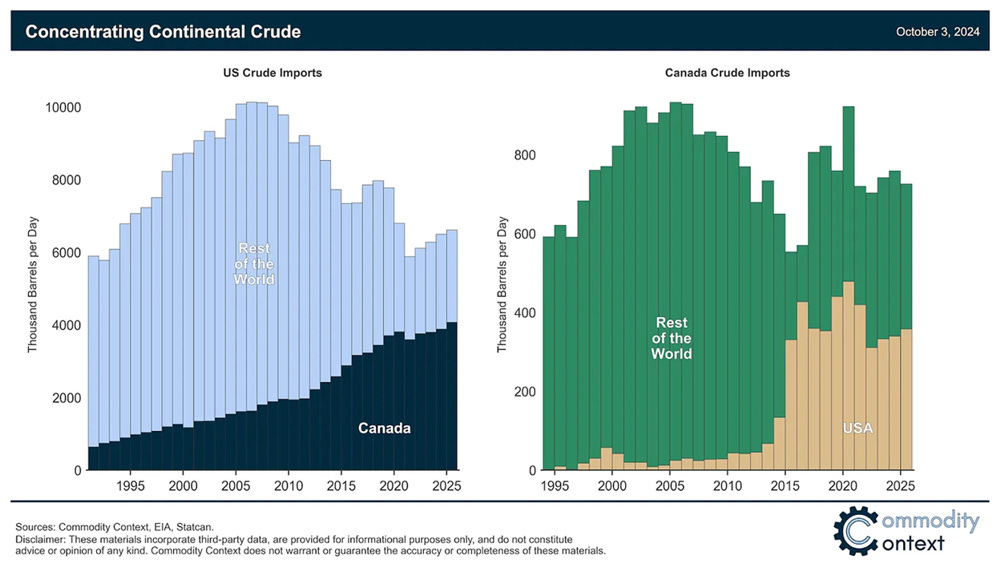

This paper will take stock of the recent strength of Canada-U.S. petroleum production; how each country has displaced overseas imports to now account for more than half of each other’s foreign crude purchases; and the different factors that will drive both producers' trajectory. Owing to the nature of energy trade as both commercial and political, we will then consider the political implications of the victory of Donald Trump on Canadian oil production and export.

Canada-U.S. Co-Dependence

Roughly one-tenth of U.S. crude oil exports flow north to Canada where the U.S. has become the dominant source of Canadian crude imports. Today, U.S. shipments from the Gulf Coast account for more than half of Canada’s imports, replacing what were, historically, barrels from the Middle East and West Africa. But a far larger volume of crude oil flows south; Canada has been the largest source of U.S. crude imports for more than two decades. Over time, Canada has steadily, and then rapidly, consolidated that position, now accounting for more than half of total U.S. foreign crude purchases or nearly 4 million barrels per day.

[Read the rest of the full ~3,000-word report here and in PDF format here.]

Disclaimer: These materials incorporate third-party data, are provided for informational purposes only, and do not constitute advice or opinion of any kind. Commodity Context does not warrant or guarantee the accuracy or completeness of these materials.