Stronger, Together

The Co-Evolution of Canada-US Oil Production and Trade

This post is based on my recent presentation to the Energy Security Forum Conference on the Future of the Canada-US Energy Relationship, hosted by the Canadian Global Affairs Institute (where I hold a fellowship) in Ottawa.

If you or your organization are interested in having me present something similar or on other oil-related topics, please get in touch by replying to this email.

If you’re already subscribed and/or appreciate the free summary, hitting the LIKE button is one of the best ways to support my ongoing research.

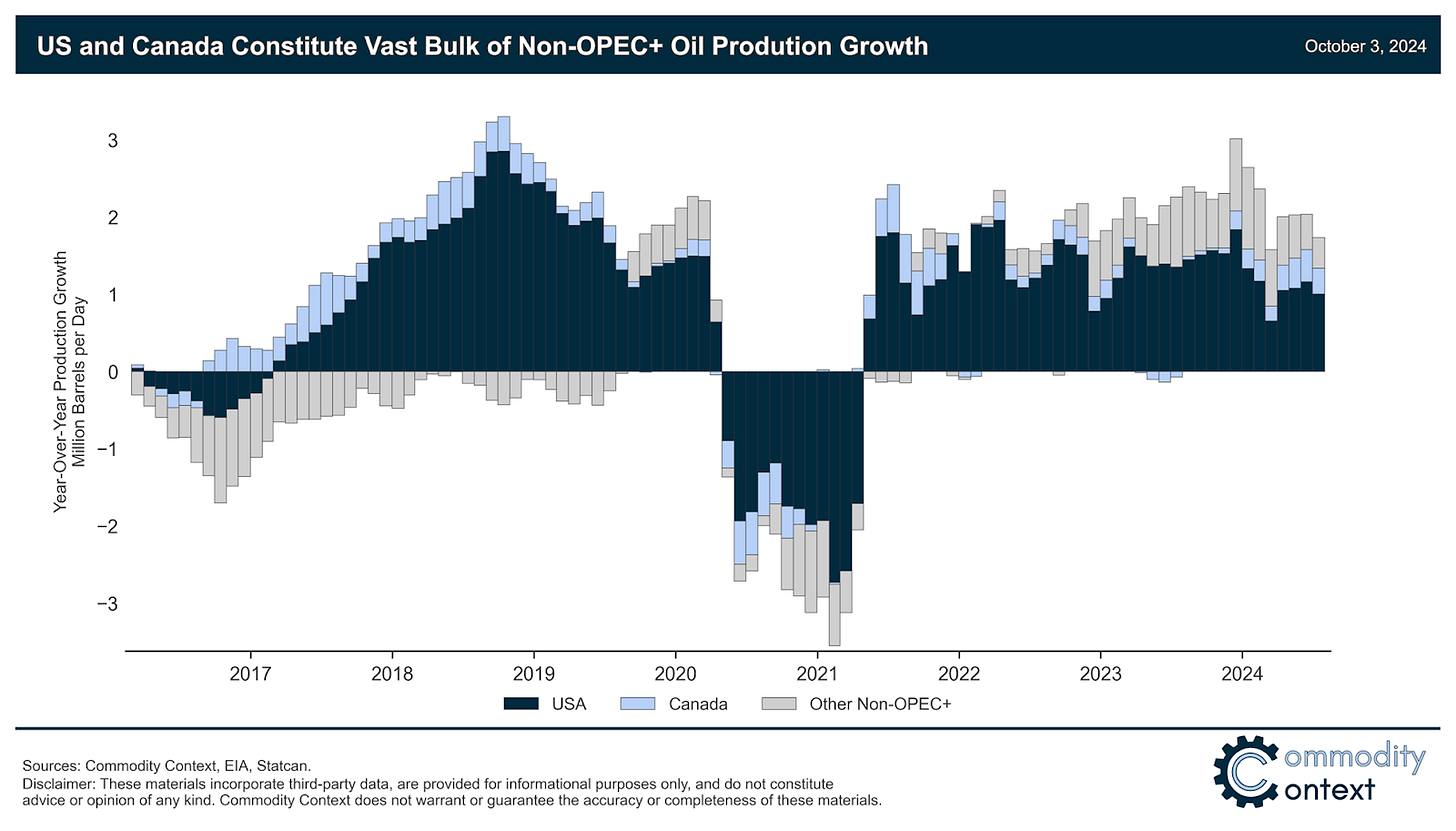

The United States and Canada are currently the two fastest growing sources of non-OPEC oil production in the world; combined US-Canada oil output is up ~1.3 MMbpd y/y over the past three months, while supply from the rest of the world has contracted.

The vast majority of these additionally produced barrels are exported: the US to the world and Canada almost entirely (~98%) to the US.

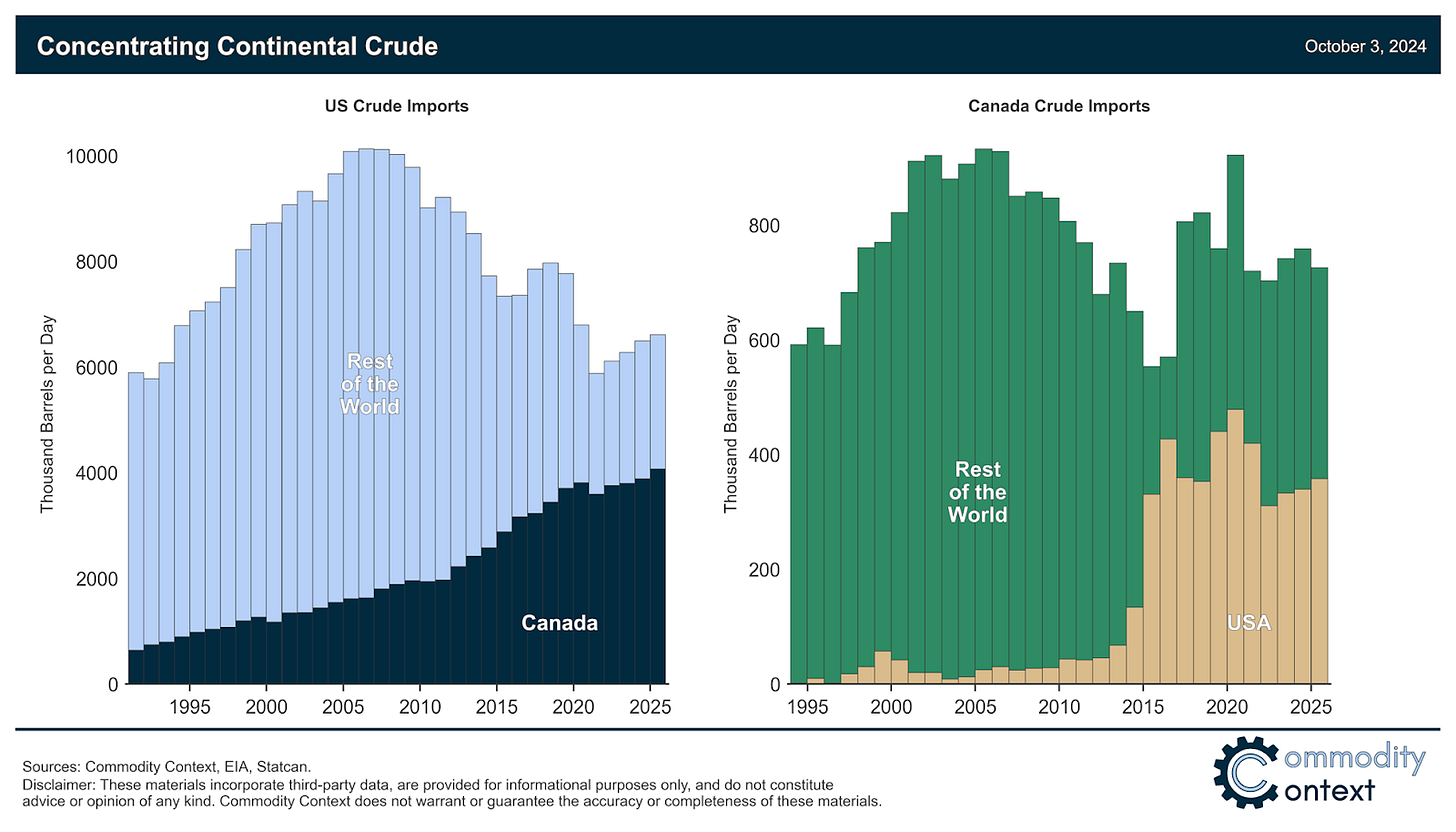

In fact, the US and Canada have become hugely more self-sufficient in crude and have displaced a reliance on overseas crude imports, with both the US and Canada now accounting for more than half of the other’s crude imports.

While US production growth is easing as prices fall back, the start-up of TMX has uncorked substantial pent-up growth in Canada and gains have accelerated to levels last seen in the booming early-2010s.

The United States and Canada are currently the two fastest growing sources of non-OPEC oil production and, for more than a decade, have made up the vast bulk of non-OPEC supply growth. Over the past three months, combined US-Canada oil output is up 1.3 MMbpd on average compared to the same period last year (1.0 from the US, 0.3 from Canada). Supply from the rest of the world, meanwhile, contracted by 0.4 MMbpd over the same period.

The steady growth of American and Canadian output is particularly stark in comparison to the capriciousness of recent OPEC+ production policy. With the still-planned easing of 2.2 MMbpd of OPEC+’s production cuts through 2025, we should expect downward pressure on prices which in turn should further slow the pace of US shale growth. But it’s not the shale-dominated 2010s anymore and there’s plenty of other non-OPEC+ growth potential across the Western Hemisphere. While US production growth is starting to ease as prices fall back, the start-up of Canada’s Trans Mountain Expansion pipeline (TMX) has uncorked substantial pent-up growth in Canada and gains have accelerated to levels last seen in the booming early-2010s.

So, let’s take a closer look at the recent strength of Canada-US petroleum production, how each displaced overseas imports to now account for more than half the other’s foreign crude purchases, and the different factors that will drive both producers' go-forward trajectory.