Oil Context Weekly (W52)

Crude prices rise through Christmas only to completely reverse course in a Boxing Day selloff; oil markets closing out 2025 at extremely oversold levels and refining margins have fallen back to earth

Merry Christmas and Happy Holidays, Oil Watchers,

This final Oil Context Weekly of 2025 will be a brief check-in on how crude is closing out the year with some longer, with year-in-review thoughts coming next week.

I’m also happy to report that, after months of US government shutdown induced delays, the CFTC’s Commitment of Traders data has finally caught up and we’ve finally recommenced publication of our weekly Market Positioning Data Deck.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

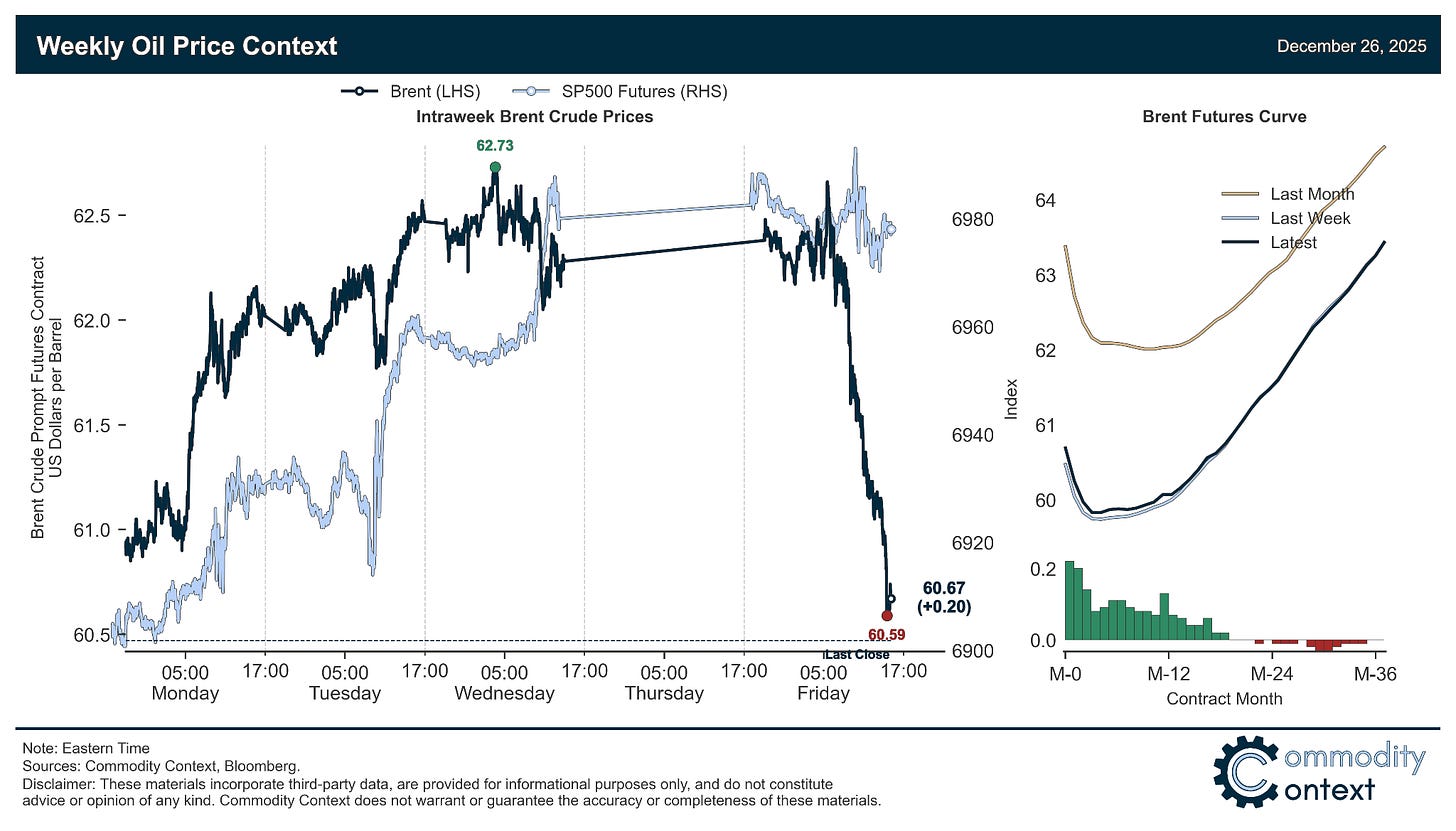

Flat Prices rose ~$2/bbl through Christmas Day before giving back virtually all those gains in a Boxing Day sale selloff; gains through the first half of the week were driven by US hunting of Venezuelan tankers amidst overstretched short spec positioning, while the Friday selloff was most likely triggered by news that Trump and Zelensky would be meeting this weekend to iron out peace deal disagreements.

Timespreads were mixed between financial futures, which were flat to lower, and more physically proximate Brent DFLs, which experienced a robust rally into steep backwardation ahead of next week’s expiry.

Inventories data was largely postponed for the holidays but we know that crude stocks fell in ARA Europe and overall product inventories rose in Singapore on the back of residual bunker fuels.

Refined Products continued to shed their previously-overexuberant crack spreads, with refining margins for both gasoline and diesel closing the gap back to seasonal levels, as overstretched positioning continued to normalize.

Market Positioning data was postponed as well but the CFTC finally caught up after the shutdown-induced lag; we’ve recommenced our Oil Market Positioning Data Deck and, in doing so, gained a far better read of oil sentiment going into year-end.