NEW: Oil Market Positioning Data Deck

A new report decomposing and contextualizing petroleum market positioning highlights, adding further texture to paper market realities beyond oil's physical fundamentals.

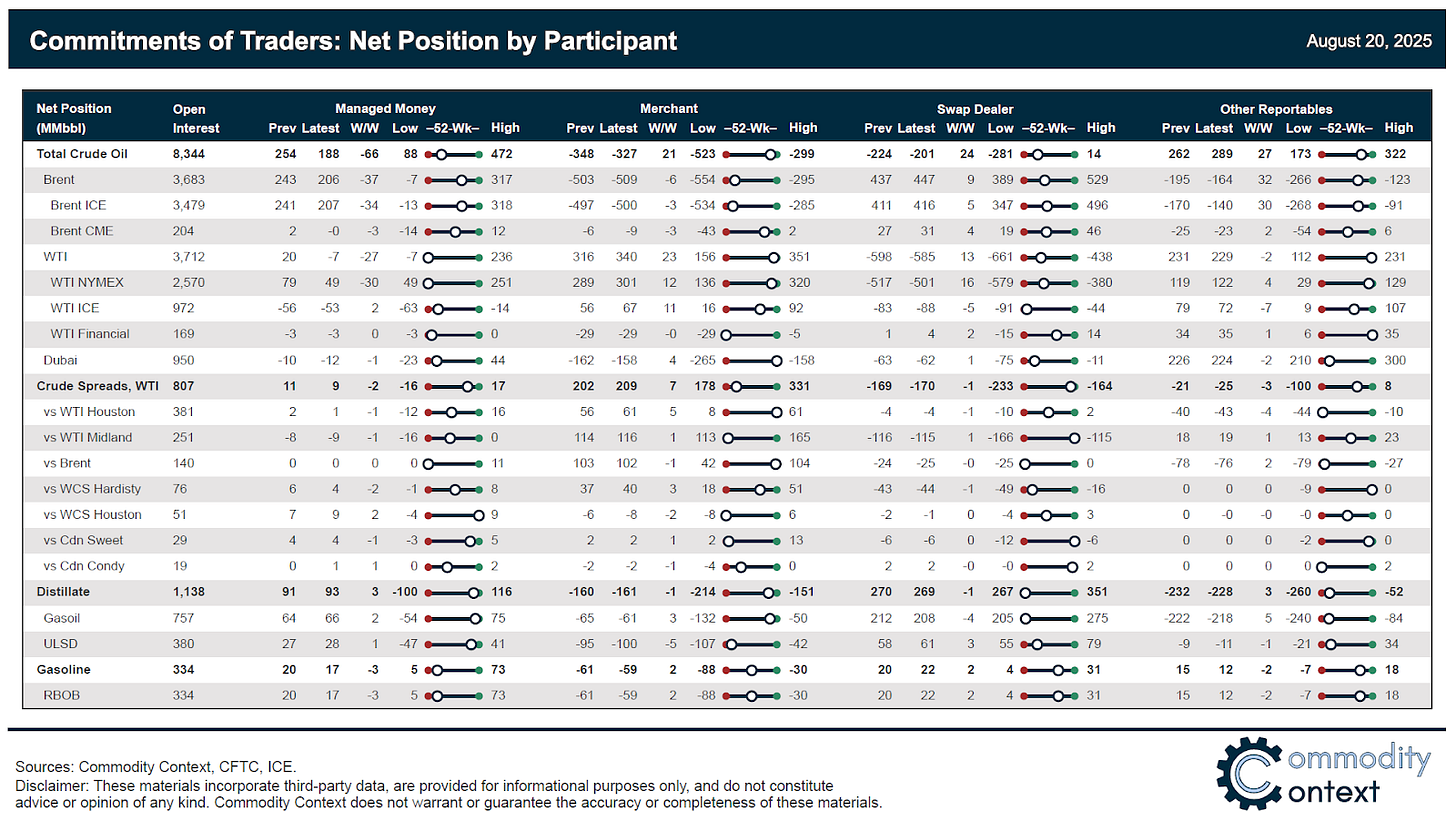

This post contains the inaugural edition of what will now be our fourth regular—and first weekly—Data Deck. This 40-page weekly Oil Market Positioning Data Deck will track and analyze data published by the CFTC and ICE in each organization’s Commitments of Traders (CoT) report, and will grow with the analytical tools that we continue to develop in our thematic research.

From the very beginning of Oil Context Weekly, we have dedicated a section to the coverage of changes in speculative positioning—and the 4pm ET Friday publication target was even initially chosen to immediately follow the publication of the CFTC’s CoT report at 3:30pm ET. The new CoT report will extend this coverage and highlight recent developments in CoT data, and it will be updated every Friday in Oil Context Weekly.

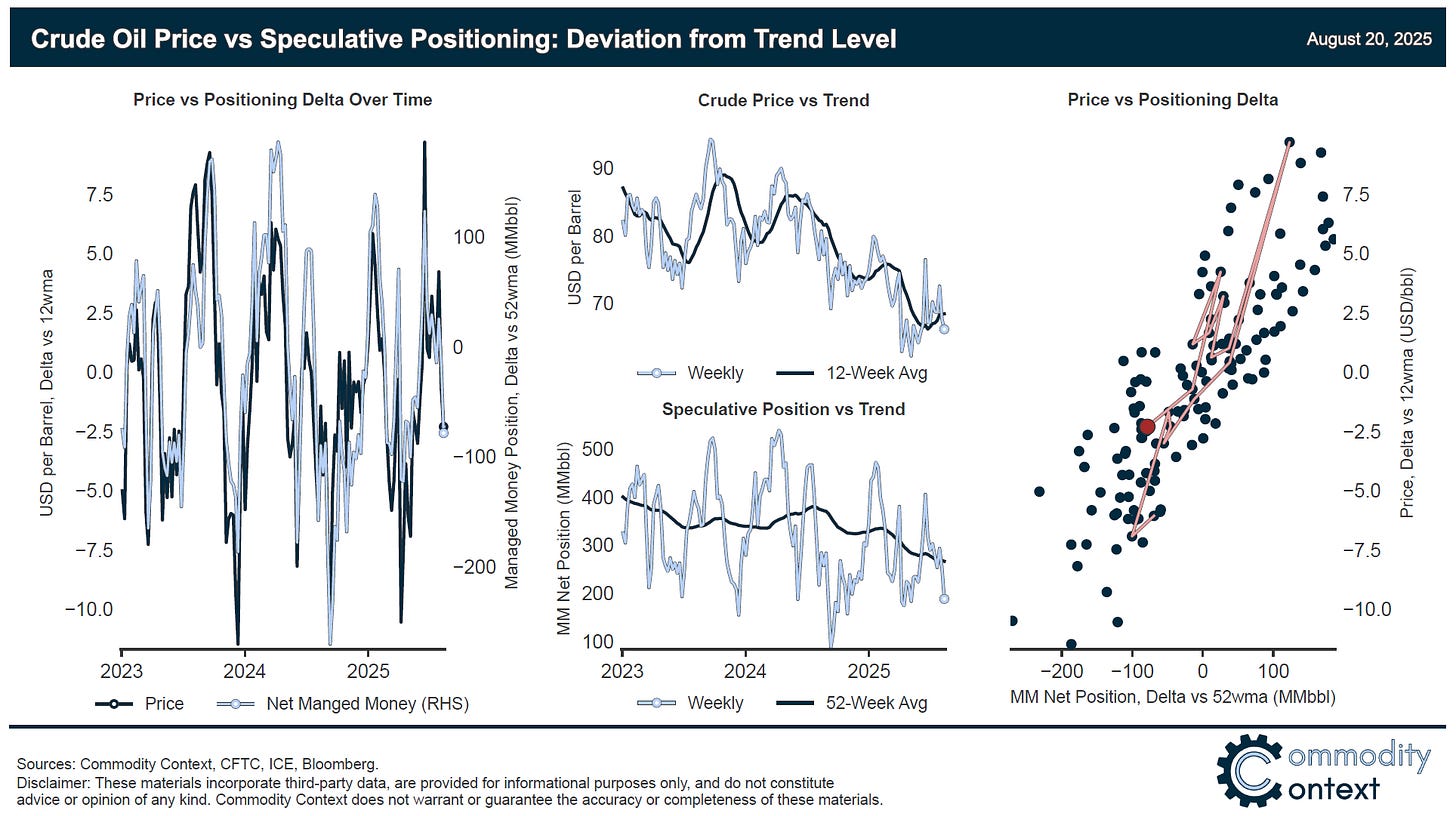

As regular readers know, I spend a lot of time looking at and writing about speculative positioning in crude markets as revealed in Commitments of Traders Report data published by both the CFTC in the US and ICE in Europe. These financial flows play an outsized role in short-term price formation given that many, many more paper barrels are traded daily compared to the actual volume of physical barrels produced, shipped, and consumed.

For the past decade, I have closely tracked net speculative flows—only one of five participant categories—in the two largest crude futures contracts: ICE Brent and NYMEX WTI. But there are many other participant categories representing producers, major consumers, banks managed hedging flows, and so forth. And there are also many other oil-related futures contracts than just the two big crude contracts that I mentioned. Both Brent and WTI are traded on other exchanges (i.e., ICE WTI and CME Brent), and there is growing interest in Dubai, cross-grade differential contracts (e.g., WTI Midland, WTI Houston, and WCS), and refined products—most notably ICE Gasoil. This report covers each in detail.

Spec Positioning Flows Drive Short-Term Crude Prices

[Full New Weekly Oil Market Positioning PDF Deck and Further Analysis Below Paywall]