Oil Context Weekly (W36)

Crude prices fall and futures curves sink as OPEC mulls further production hikes faster than expected while refined product market fortunes improve on a slew of lost processing capacity.

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

At the end of this report you’ll also find my weekly, 40-page Oil Market Positioning Data Deck, tracking and contextualizing shifts across the most important paper petroleum contracts.

🎙️ In the latest episode of the Oil Ground Up podcast, I spoke with Brett Gibbs of Bloomberg Intelligence about the recent growth in renewable diesel production and consumption in the US, the policy backdrop for the biofuels sector, and where the Biden/Trump administrations have directed this incredibly policy-driven market.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

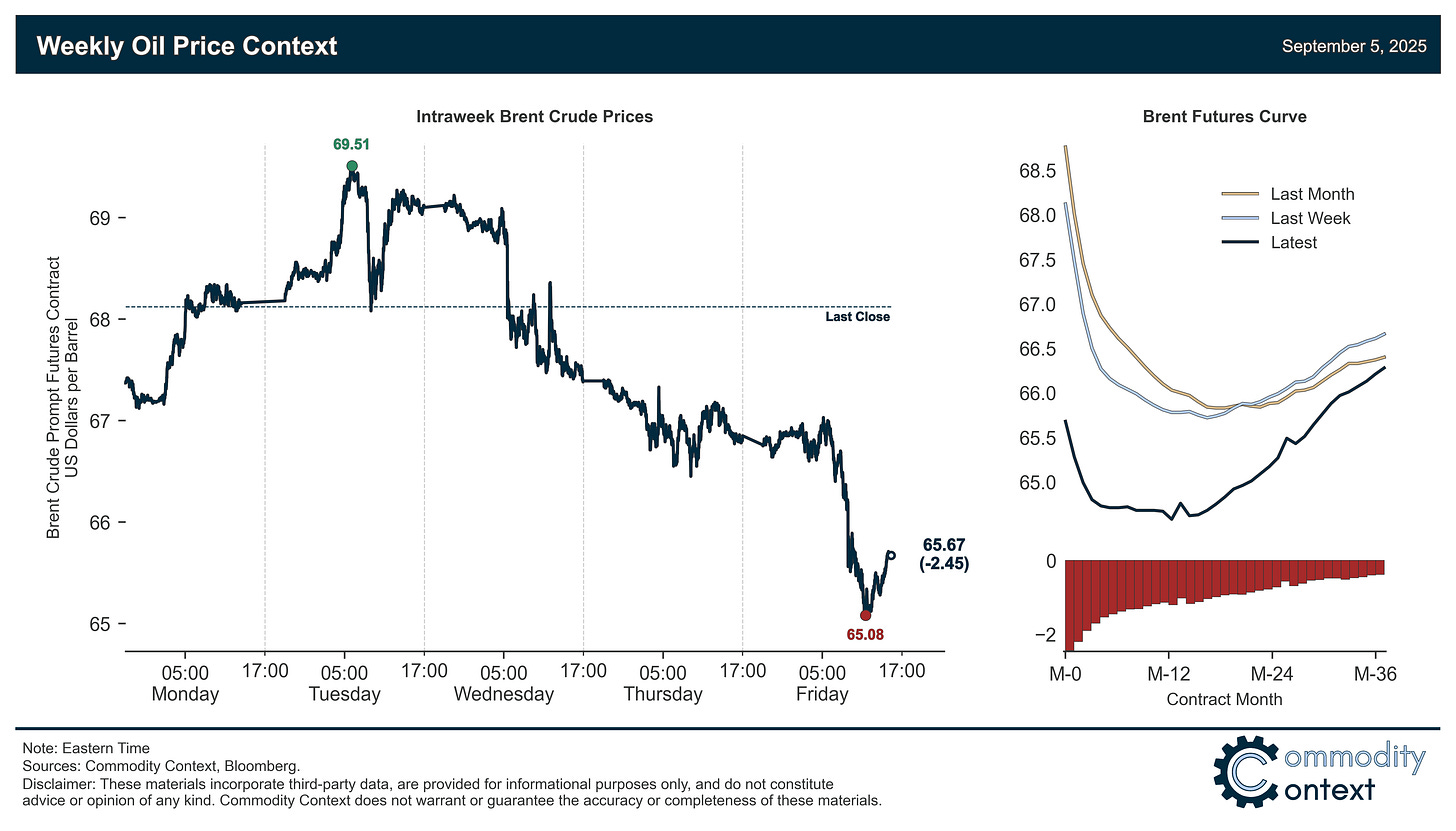

Flat Prices fell $2.50/bbl on the week on the back of rumours that OPEC+ would march ahead on further production increases faster than expected and refining outages keep pressure on crude demand.

Timespreads are weakening once again; the front of the Brent futures curve slipped to the weakest backwardation since early May and the already-depressed belly of the curve slipping deeper still, erasing what was more than a year of priced [if modest] backwardation to barely 4 months of remaining backwardation today before contango takes hold early next year.

Inventories data confirmed notably builds across all major tracked hubs, with US stocks building at a time of year when they’d normally be drawing; diesel stocks remain low-ish but far healthier than a few months ago while gasoline stocks are beginning to tighten more aggressively than usual through the end of driving season.

Refined Products markets strengthened on the back of numerous refinery outages including upped Ukrainian attacks against Russia’s refining fleet, the likely months-long loss of Dangote’s gasoline producing unit, as well as Europe’s largest refinery confirmed heavy maintenance.

Market Positioning data confirmed that speculators were notable buyers of crude contracts through the end of Tuesday, though the post-OPEC+ rumour selloff likely reversed much if not all of this recent buying effort.

As Well As OPEC+ reportedly eyeing yet more production hikes, and why Gabon is [likely] excluded from the next OPEC+ cut tranche unwind and what it says about OPEC+’s political structure.