Oil Context Weekly (W24)

Israeli strike on Iran upends crude market, shifts focus from gradually and organically improving fundamentals to geopolitical tail risk.

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

This week, prior to literally everything in the oil market becoming a question of Israel and Iran, I published Oil’s Wrinkle in Time on the recently bizarre structure of the crude oil futures curve.

I also had the opportunity to talk about that work, as well as the broader physical and oil market realities in which said structure is occurring, on the latest episode of the Macro Voices podcast as well as on BNN Bloomberg.

I also spoke with both Axios and Reuters about the EIA’s latest forecast revision, which now shows US crude production peaking this year before declining for the first time since COVID, as well as with Bloomberg about Canada’s newfound pipeline ambitions.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

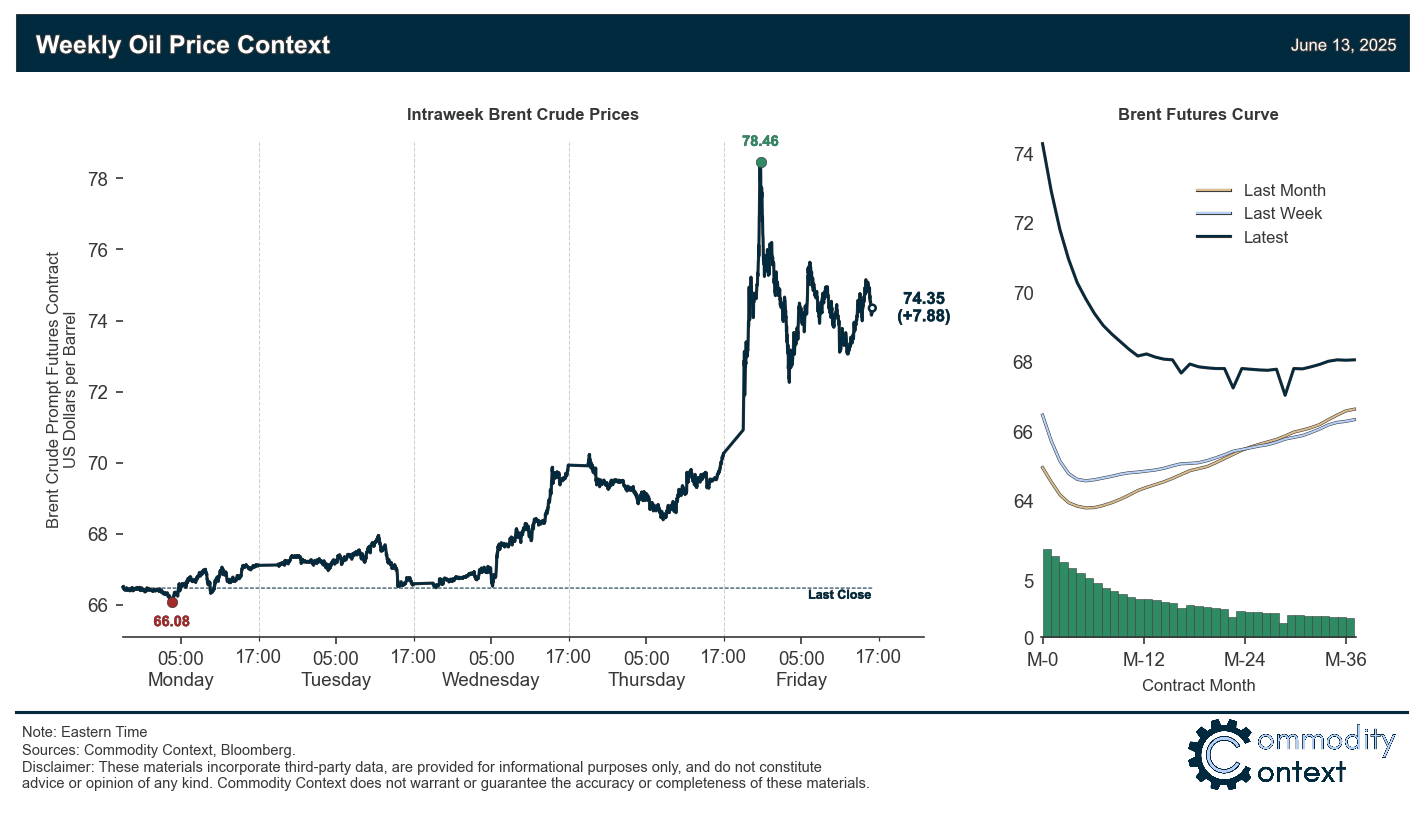

Flat Prices rose steadily through the week alongside firming term structure before rocketing nearly $10/bbl higher in the immediate aftermath of Israel’s attack on Iran, with prices finishing nearly $8/bbl higher on the week.

Timespreads rocketed higher and prompt Brent spreads briefly hit their highest level since Russia’s 2022 invasion of Ukraine before settling down, but remain up more than double the levels that they started the week following steady gradual strengthening over the past five days.

Inventories data were mixed this past week but leaned toward seasonally normal builds, with stocks up in the US and Singapore and down in ARA Europe; US crude stocks began drawing earlier than seasonally normal while road fuel inventories are rebuilding more rapidly than usual coming off depressed levels.

Refined Products parted ways, with gasoline crack spreads falling $2/bbl, as feedstock prices rose without any offsetting boost to demand prospects, and diesel climbing $3/bbl as already tight heavier sour crude markets grapple with the prospect of supply losses from the Middle East, the world’s largest source of that type of crude.

Market Positioning data revealed that speculators were once again net buyers of crude contracts over the past week through Tuesday, bringing us back to the rough middle ground between the recent extremes of positioning levels; however, that was before the Israeli strikes on Iran, and today we are almost certainly back into overbought territory. That may well be entirely justified given the current geopolitical backdrop, but it also opens the door to predictably sharp pullbacks if any of this calms down over the coming week.

As Well As Israel strikes Iran and stokes renewed fears of Middle Eastern supply losses, the EU proposes even stricter import ban on fuels derived from Russian crude, and the EIA’s latest forecast now sees US crude production peaking this year.