Oil’s Wrinkle In Time

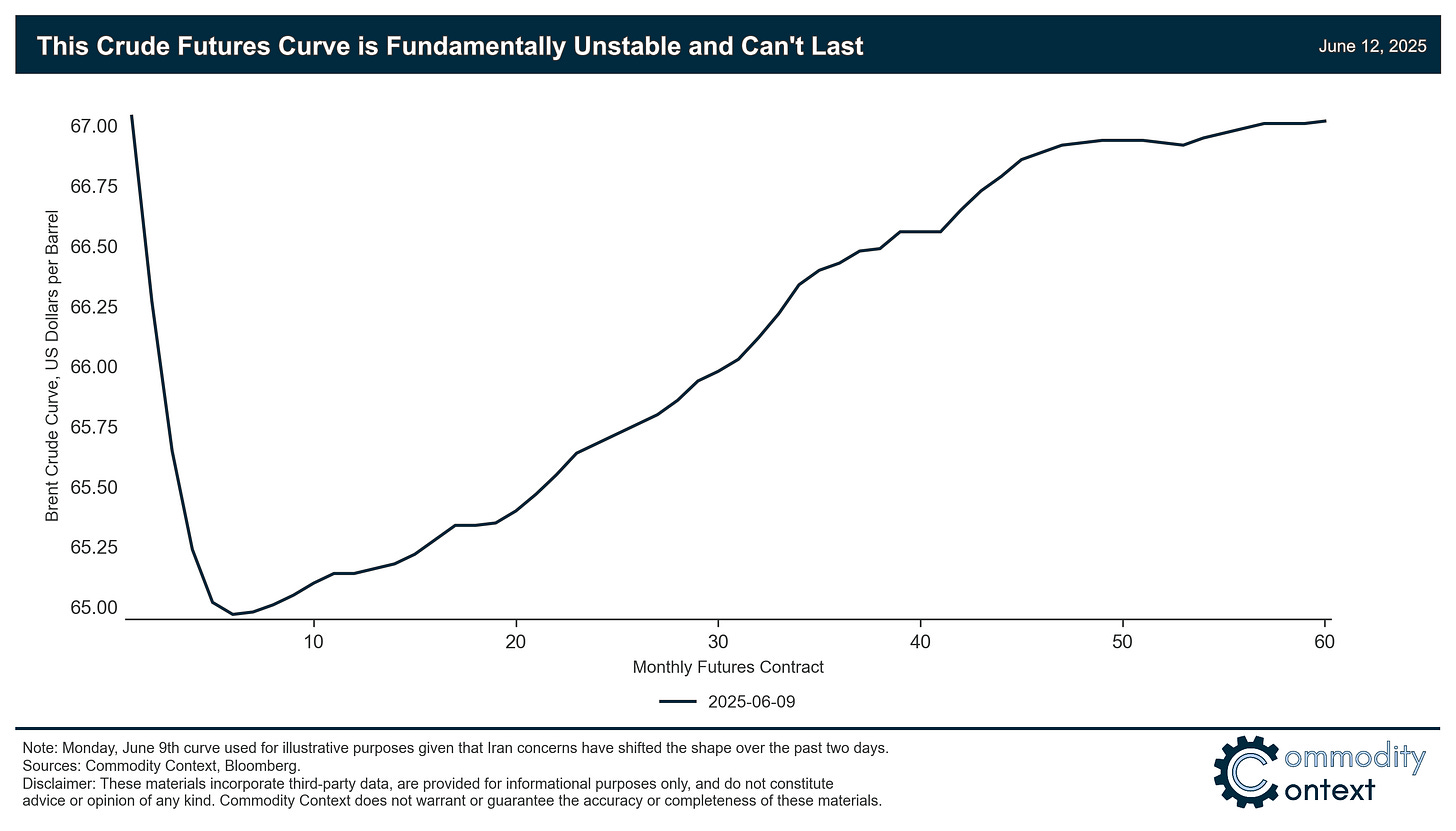

The current shape of the crude oil futures curve is extremely rare and simply cannot last.

If you’re already subscribed and/or appreciate the free summary, hitting the LIKE button is one of the best ways to support my ongoing research.

The current crude oil futures curve is shaped like a smiley face (i.e., a backwardated front with a broadly-contango’ed belly), which is both extremely rare (occurring less than 1% of the time) and inherently unsustainable.

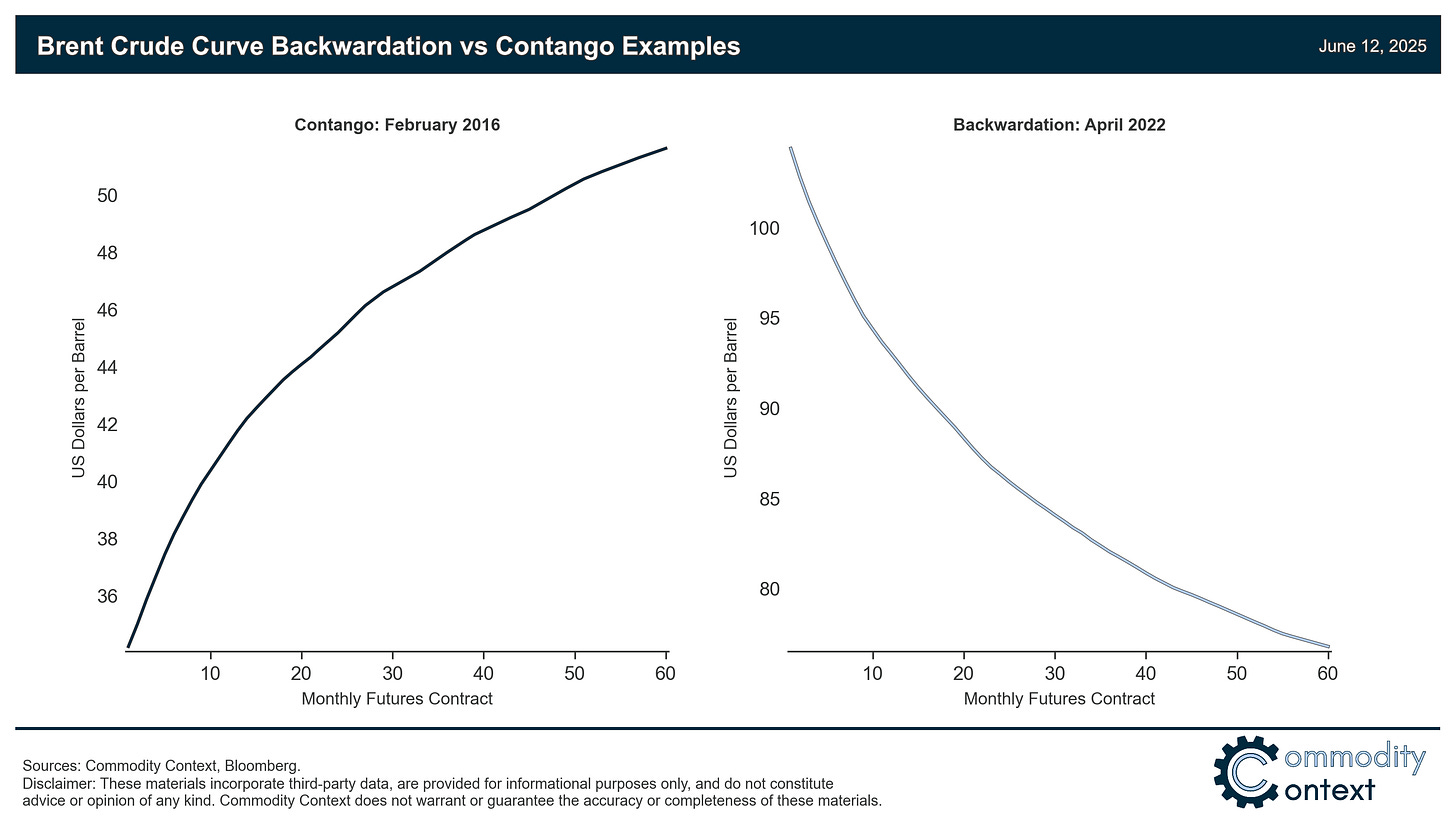

The curve typically exists in one of two states—backwardation of contango—and said state is usually persistent along the curve, strongest at the front and weakest at the back (a reality ripple, if you will).

Today, we’re seeing more of a wrinkle in time emanating from the belly of the curve, which looks to be a rare, implicit market forecast, reflecting the broad consensus of market participants that oil market conditions will weaken materially over the coming months juxtaposed with still-tight current market fundamentals.

Looking across historical precedent, this rare smiley face curve (🙂) appeared in two primary instances: 1) transitions between contango to backwardation (we’re travelling the opposite direction today), and 2) ahead of massive shocks like in 2008 and 2014, kicked off by an initial sharp, sentiment-driven pullback (check…) and then followed immediately by $40-50/bbl price declines (yikes…).

More recently, crude fundamentals have gradually recovered and Iran concerns appear to be triggering material short-covering of the selling pressure that was weighing on the belly of the curve; however, absent realized Iran-related supply losses, it’s likely that the curve sags again until the anticipated surplus arrives or consensus expectations shift bullish.

The current crude oil futures curve looks really strange: a bizarre backwardated front with a broadly-contango’ed belly. We are at a rare crossroads in the oil market given modestly tight (thus far) market balances, the announced rapid return of withheld OPEC+ barrels, and US trade policy-induced economic headwinds. In other words, the curve is caught between stubbornly tight current fundamentals and bearish market consensus about what is soon to come.

We talk a lot about the futures curve here at Commodity Context. The shape of the curve is the best guide to what’s currently happening in the oil market, far more than the prevailing flat price that you see quoted in the business news or, even, our latest supply-demand balances estimates. The crude futures curve typically exists in one of two states—backwardation or contango—but something is deeply abnormal about the current curve. While there are some historical comparisons to draw upon, we’ve literally never seen this particular, smiley-faced Brent crude curve structure before.

Even more importantly, this curve structure simply cannot persist. So, the crude market has to be on the verge of collapsing into contango—as market consensus largely expects—or about to get torqued back into backwardation by a surprisingly-tight reality. Let’s look back through history to explore how the crude futures curve normally works, when we’ve seen this—or similar—structure emerge before, and how that normal pattern has broken down today.