Oil Context Weekly (W9)

Crude ends week nearly $3/bbl higher on China optimism and the first quasi-bullish round of inventory data so far this year; WSJ report briefly sunk prices before they rebounded on official denials.

Happy Friday, all!

Every week, I summarize the developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data and then provide a taste of the themes I’m thinking about or following closely.

The results of last week’s poll were mildly bullish with 36% of you anticipating weekly crude price gains of $1-5/bbl—and you absolutely nailed it. Let’s see if we can do it again. VOTE!

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

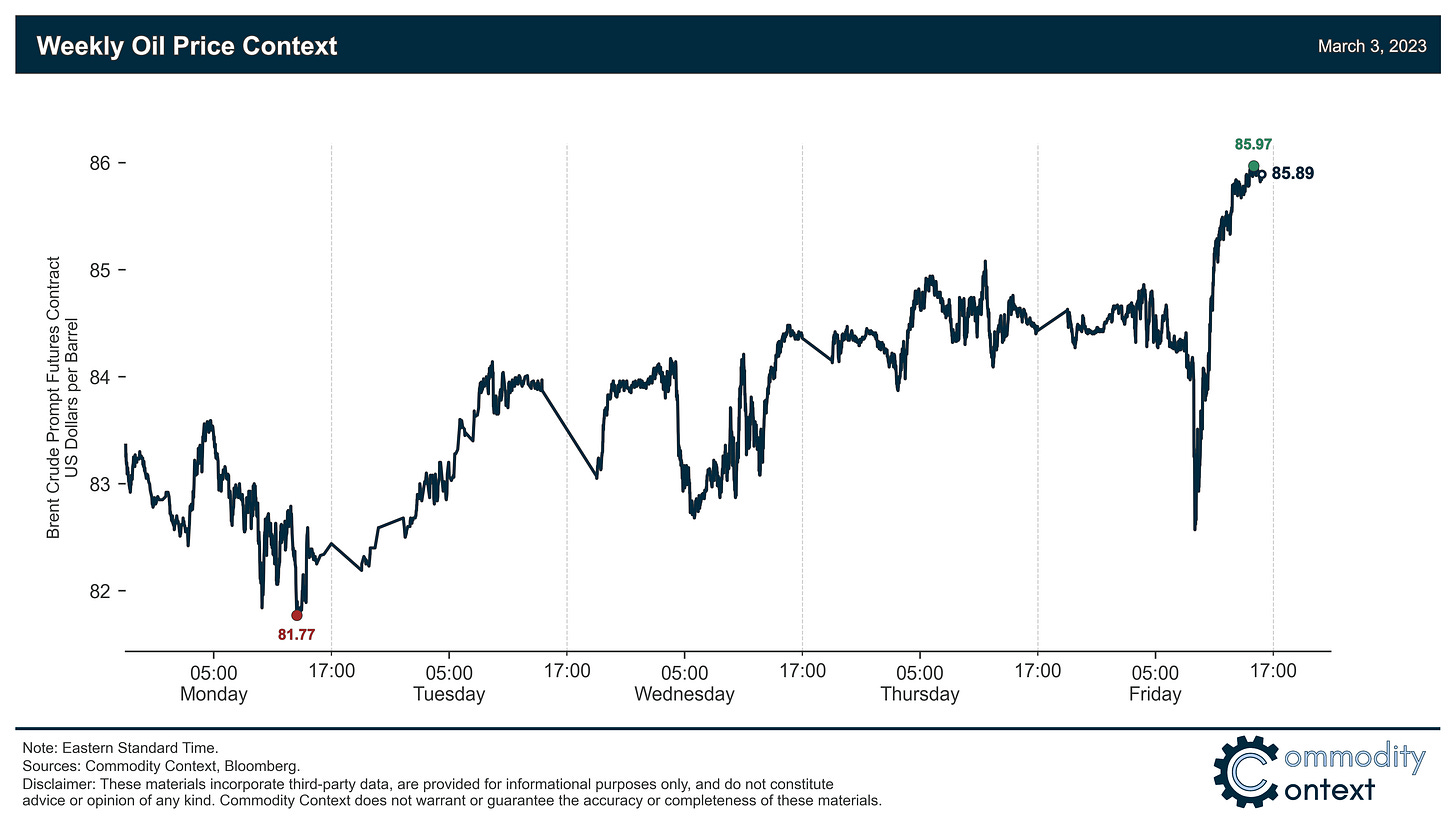

Flat Prices rose nearly $3/bbl to close the week at $86/bbl (Brent); light choppy trading through Thursday saw contracts drift higher on China optimism until that WSJ report (discussed below) tanked prices by more than $2/bbl on Friday morning only for them to rebound back to week-to-date highs.

Calendar Spreads widened over the week but with less of a bang vs. flat prices; there was some interesting divergence on Friday between prompt and further-dated spreads, with the latter rebounding alongside flat contracts while prompt spreads were not able to lift back far off their lows.

Inventories printed the first bullish week of the year, indicating that commercial petroleum stocks fell across all major hubs after a year of voracious builds, especially for crude in the US.

Refined Products saw crack spreads widen modestly over the past week, rising by $2.50/bbl for diesel and $4/bbl for gasoline in New York Harbor.

Positioning in Brent future and options contracts (WTI data releases still haven’t caught up from the hack) indicated that speculators were net buyers to the tune of 9.4 MMbbl on the back of 2.8 MMbbl in new gross longs and a 6.6 MMbbl short-covering; net-spec is now sitting at 10.7%, which, excluding the slightly higher reading two weeks ago is the highest level since summer 2021.

OPEC Headline Headfake roiled prices briefly on Friday morning following a WSJ article about deteriorating relations between Saudi Arabia and the UAE that included comments about the latter considering a departure from OPEC in the pursuit of higher production levels; the report initially dropped prices by more than $2/bbl before multiple official denials erased those losses within their first hour.