North American Oil Data Deck (August 2025)

Continental production fell in May on Canadian oil sands maintenance and wildfire shut-ins, while US gasoline demand weakness—compared to very strong 2024 levels—weighed on North American consumption.

This 41-page August 2025 edition of my monthly data-dense, visualization-heavy North American Oil Data Deck is exclusive to paid Commodity Context subscribers (attached PDF below paywall). The deck contains detailed and decomposed accounting for US, Canadian, and Mexican upstream (i.e., production) and downstream (i.e., refining) oil activity as well as end-user demand.

This edition of the report includes additional exhibits tracking developments in Canadian upstream production, blending, and marketed supply as explored in Producing Canadian Supply, as well as some updates to the main national production exhibits.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

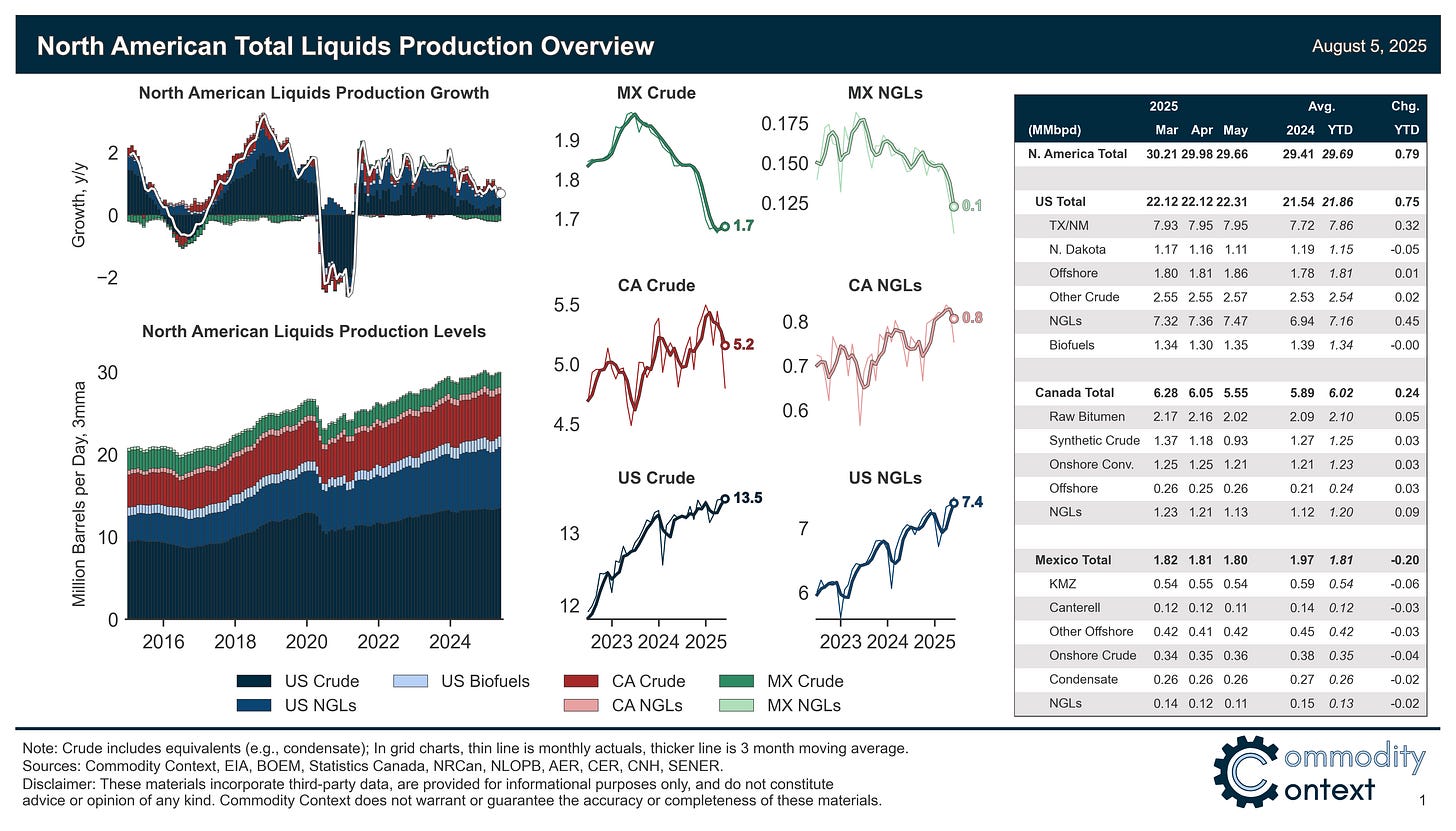

North American petroleum liquids production fell back by 324 kbpd m/m to 29,659 kbpd in May, driven by a combination of seasonal oilsands maintenance and wildfire shut-ins in Canada and blunted by continued gains across all major US liquids. Continental liquids production was up 600 kbpd compared to May 2024, with the ~200 kbpd deceleration from the trailing annual average pace weighed down by both Canada’s temporary slowdown and, more structurally, by decelerating US crude production growth and the chronic outright contractions in Mexico’s upstream sector.

While American output supported continental supplies in May, a steep contraction in US petroleum product consumption weighed on North American demand, which slipped 40 kbpd m/m and was down 459 kbpd on the year; however, that US demand print, while undoubtedly weak at first glance, was itself a vast improvement over higher-frequency data and much of the weakness stems from abnormally high gasoline demand this time last year.

[Full PDF Deck and Country-Level Analysis Below Paywall]