Producing Canadian Supply

How barrels produced in Canada are blended and transformed into the hydrocarbon supply mix that actually hits the North American oil market.

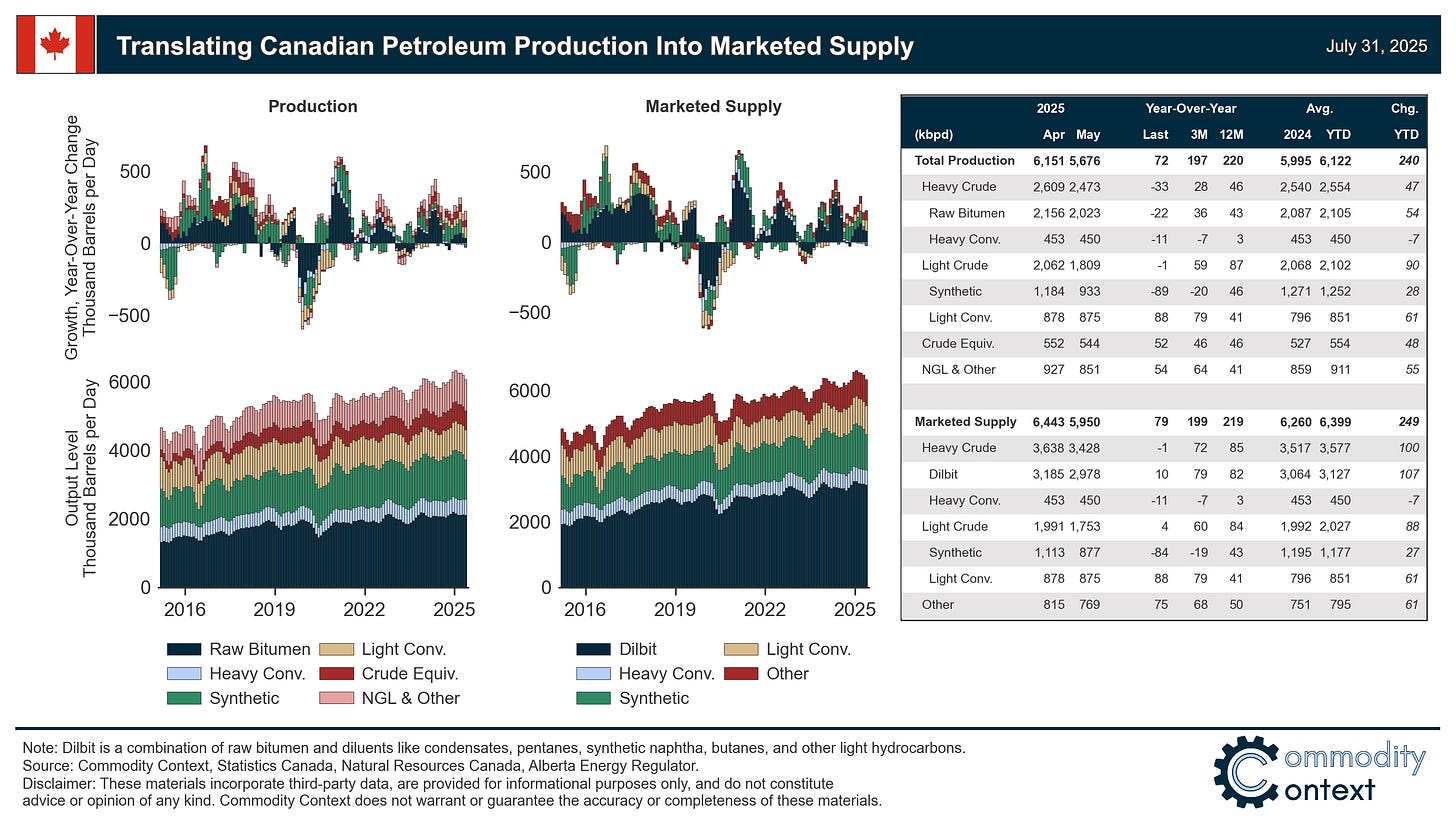

An update of my North American Oil Data Deck is well overdue and this piece is a product of that deeper data work on the transformation of produced Canadian barrels into marketed blends, which changes the North American and Global balances of light and heavy crudes. These updated exhibits will be included in the North American Oil Data Deck (exclusive to paid subscribers) and will be updated going forward.

If you’re already subscribed and/or appreciate the free summary, hitting the LIKE button is one of the best ways to support my ongoing research.

There’s an important difference between Canadian oil production and marketed Canadian supply, with the latter revealing a more accurate picture of the true light-heavy crude balance in the North American market.

Bitumen is Canada’s largest produced primary hydrocarbon and typically requires upgrading or diluting in order to sell to end-users, with the dilution stage driving the lion’s share of differences between the composition of Canadian production and marketed supply.

The transmutation of production into marketed supply has two main effects:

Lighter hydrocarbons (“diluents”) used to dilute ultra-heavy raw bitumen inflate the volume of heavy supply at the expense of lighter oils, with the heavy share of total liquids supply rising to 56% compared to the 43% share in the primary production pool.

The incorporation of imported US diluents inflates total Canadian supply (6.4 MMbpd) by ~300 kbpd relative to production (6.1 MMbpd) as imported diluents are shipped, round trip, back to US refineries.

Over the past year supply growth has averaged ~220 kbpd y/y, and while heavy dilbit remains the single largest marketed product category the majority of gains over the past year has actually come from lighter liquids.

Supply, production, output: these words are often used interchangeably but barrel-counting pedants, like myself, will stress their differences. This is, arguably, most true in Canada where there is a unique structure of differentiated production (mining vs in-situ), upstream processing (upgrading), blending (diluting raw bitumen), and marketing (e.g., WCS). In fact, the world’s 4th-largest oil producing country had a ~300 kbpd difference between total production and marketed supply and, even more materially, there’s a more than 1 MMbpd reclassification of produced light oils as diluents in the heavy crude stream.

The most important reason to adjust Canadian production to marketed Canadian supply is to reveal a more accurate picture of North American flows. Specifically, the balance of light vs. heavy crudes that flow to export markets via pipeline and are, typically, consumed by refineries. Indicatively, the Canadian Energy Regulator (CER) estimated that Canadian heavy crude exports averaged more than 3.2 MMbpd in 2024; but, total heavy crude production only stood at ~2.5 MMbpd.

Canada’s complex series of upstream flows means that there are considerable differences between production, as reported in government statistics, and the actual cocktail of blended barrels supplied to the largely North American market. This isn’t to say that the data is wrong, per se, in either case; rather, they are each measuring something specific and fundamentally different from the other. Accordingly, it is necessary to first understand the marketed supply of Canadian barrels if one hopes to fully understand and track the flow of hydrocarbons through the complex interconnections of the North American oil and gas industry—let’s dig in.