Beijing’s Long-Term Oil Problem

Perceptions of China’s structural foreign fuel dependence are driving both the oil market’s biggest support (SPR buying) and heaviest drag (from world-leading to flatlining Chinese demand growth)

If you’re already subscribed and/or appreciate the free summary, hitting the LIKE button is one of the best ways to support my ongoing research.

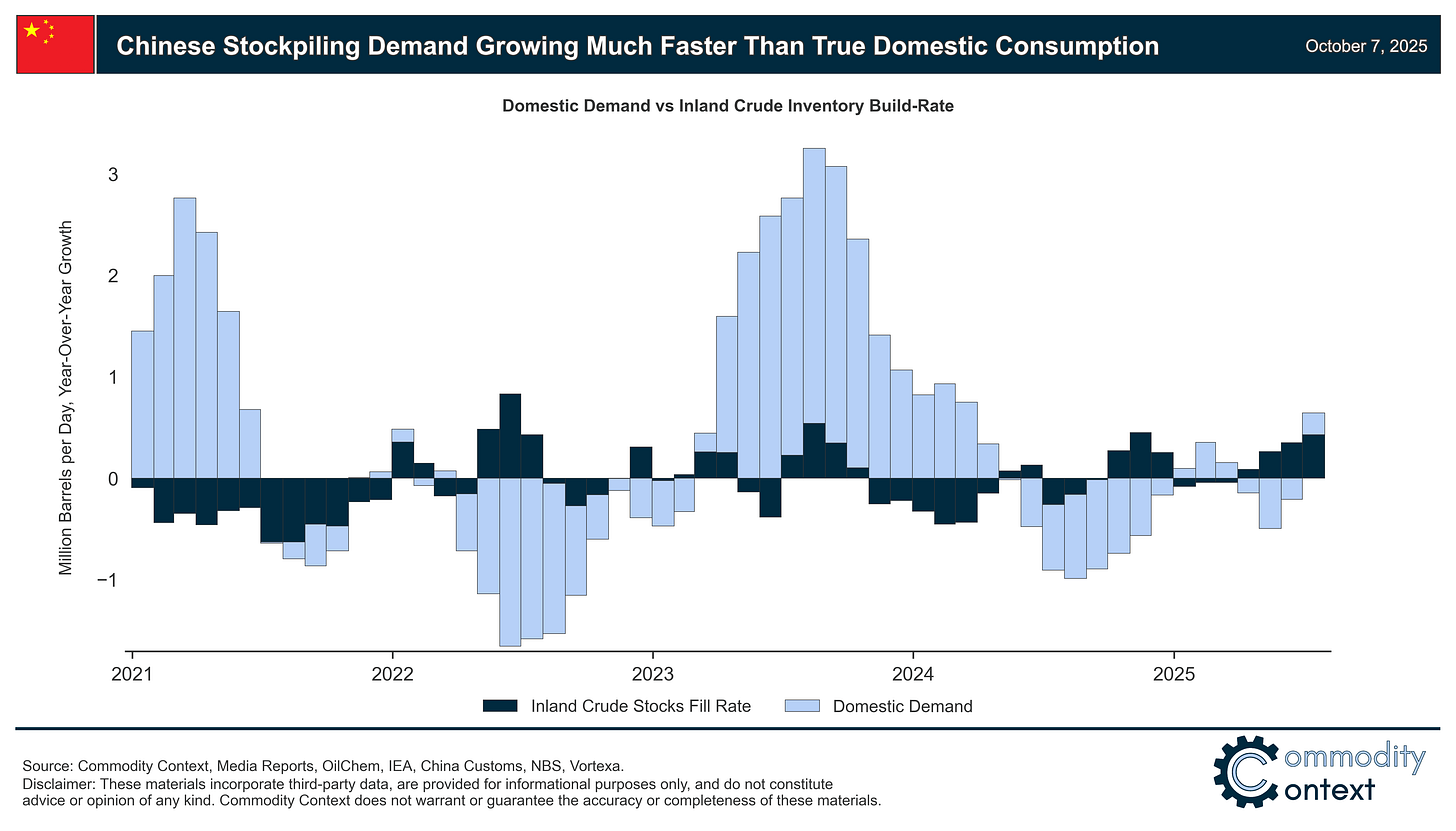

The entirety of effective Chinese demand stimulus over the past year has been demonstrably driven by stock-building (and not domestic consumption), which vacuumed up nearly 1 MMbpd, on average, through the second quarter of 2025.

It is an acute sense of energy insecurity that is driving Chinese policymakers to invest in domestic production, incentivize the electrification of transportation, and—most notably—build out sizable strategic reserves (circa US-policymaking in the 1970s).

This short-term bullish market support is also the propellant of oil’s most bearish structural drags: contracting Chinese petroleum product demand growth as transportation fuels are hit by the substitution effect of China’s world-leading electric vehicle penetration.

Ultimately, the bearish drag of domestic petroleum consumption substitution will be more durable than the inherently finite build-up in strategic stockpiles, no matter how much longer these China SPR-building efforts continue in the short-term.

Much of the resilience in recent global crude pricing is reliant on China’s seemingly voracious appetite to build its strategic crude stocks (read: Why Aren’t Oil Prices Weaker?). This hoarding—driven by policy rather than by explicit economic incentive—vacuumed up nearly 1 MMbpd, on average, through the second quarter of 2025. While this pace slowed somewhat through Q3, we’re continuing to see a steady climb in Chinese crude stocks and despite prompt-backwardated markets.

Given China’s importance to the current oil market, the key question is how much longer can this discretionary demand stimulus last, exactly? By definition, China can’t continue building stocks forever; however, Chinese crude stocks are at only 60-65% of estimated storage capacity and Beijing has plans for the construction of yet more explicit strategic reserve facilities. Thus, it’s more important to understand why Beijing is building strategic stocks so aggressively in the first place.

While there are many potential drivers of this strategic stock-building appetite, the underlying genesis is an acute sense of energy insecurity among Chinese policymakers. And China’s energy security agenda is pulling the global oil market in both directions. On one hand, China’s SPR-building has been a critical support for today’s market and, on the other hand, this suite of energy security policies puts the brakes on more durable domestic Chinese petroleum product demand growth. In fact, the entirety of effective year-over-year Chinese “demand” growth impulse for global barrels over the past year has been driven by stock-building and not true domestic Chinese consumption.

Let’s dig in.