Why Aren’t Oil Prices Weaker?

Chinese counter-economic stock-building and sanctions-related seaborne logistical woes are absorbing the arrival of surplus supply—at least for now.

If you’re already subscribed and/or appreciate the free summary, hitting the LIKE button is one of the best ways to support my ongoing research.

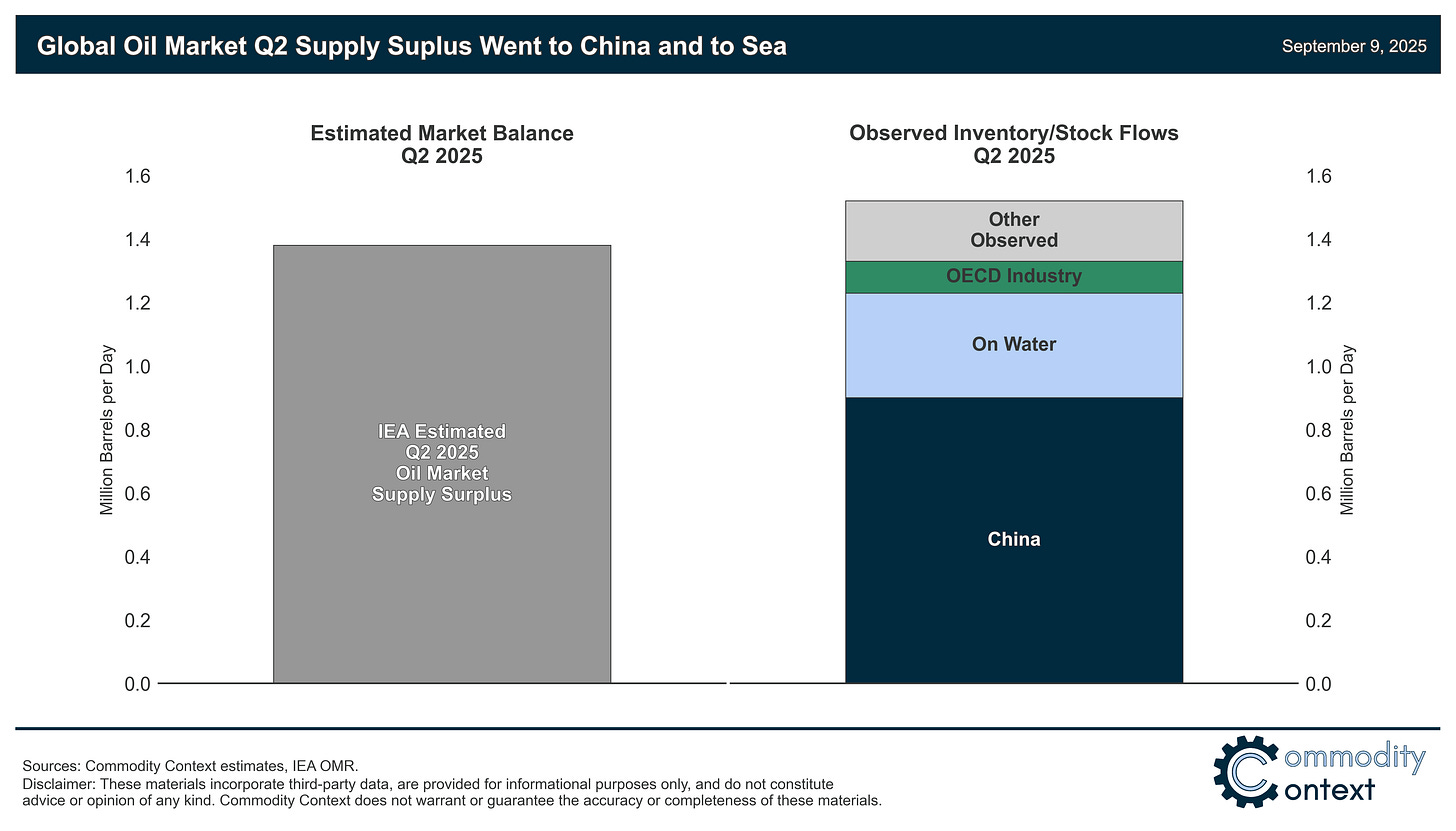

Global oil stocks are objectively rising—by ~1.5 MMbpd on average in Q2, according to the IEA—but there hasn’t been a commensurate impact on crude prices or prevailing term structure (i.e., shape of the futures curve).

The market should be flipping into contango, which effectively “pays” for storage, but that hasn’t yet been realized because China—and not the broader market— is, largely, paying for the storage by building stocks outside of an explicit economic incentive.

Nearly 60% of the observed stock-builds in Q2 ended up in China and another ~20% inflated the volume of oil on water. Only 5% of the surplus flowed into the most visible OECD commercial tank farms, the fill level of which remains well below the trailing 5-year average as well as year-ago levels.

Crude prices will not truly begin to fall until both Chinese buying and builds of oil on water end, if not reverse; but, estimating the exact timing of already-shadowy Chinese policy pressure is, at best, a speculative venture.

Global oil markets are softening, transitioning from a multi-year run of tight balances to a broadly-expected rough[er] stretch for prices thanks to an emerging surplus of supply. But while the IEA, for example, estimates a ~1.4 MMbpd supply surplus in Q2 and reports that global visible stocks have built by ~1.5 MMbpd on average over the same period, futures curves remain broadly backwardated (at least at the front, where it really matters) and much-watched OECD commercial petroleum stocks remain notably low.

OPEC+ members had cut millions of barrels of supply from global markets in an attempt to maintain the extremely tight balances and lofty pricing that we experienced through 2021-22. After years of cut-extensions, OPEC+ has now already eased many of those withheld barrels back into the market, and plan to further increase production. This all comes at a time when demand growth is already under strain, a worrisome combination that has, by most estimates, already pushed the global oil market back into surplus. And this surplus was already broadly expected to grow more intense through the year-end before OPEC+ confirmed that it was adding yet more supply than previously expected in the fourth quarter.

So, where’d all those surplus barrels end up and why aren’t prices already weakening? And what will it take for prices to begin to feel the pressure of softer fundamentals?