Barreling Ahead: Realizing—or Denying?—The Glut

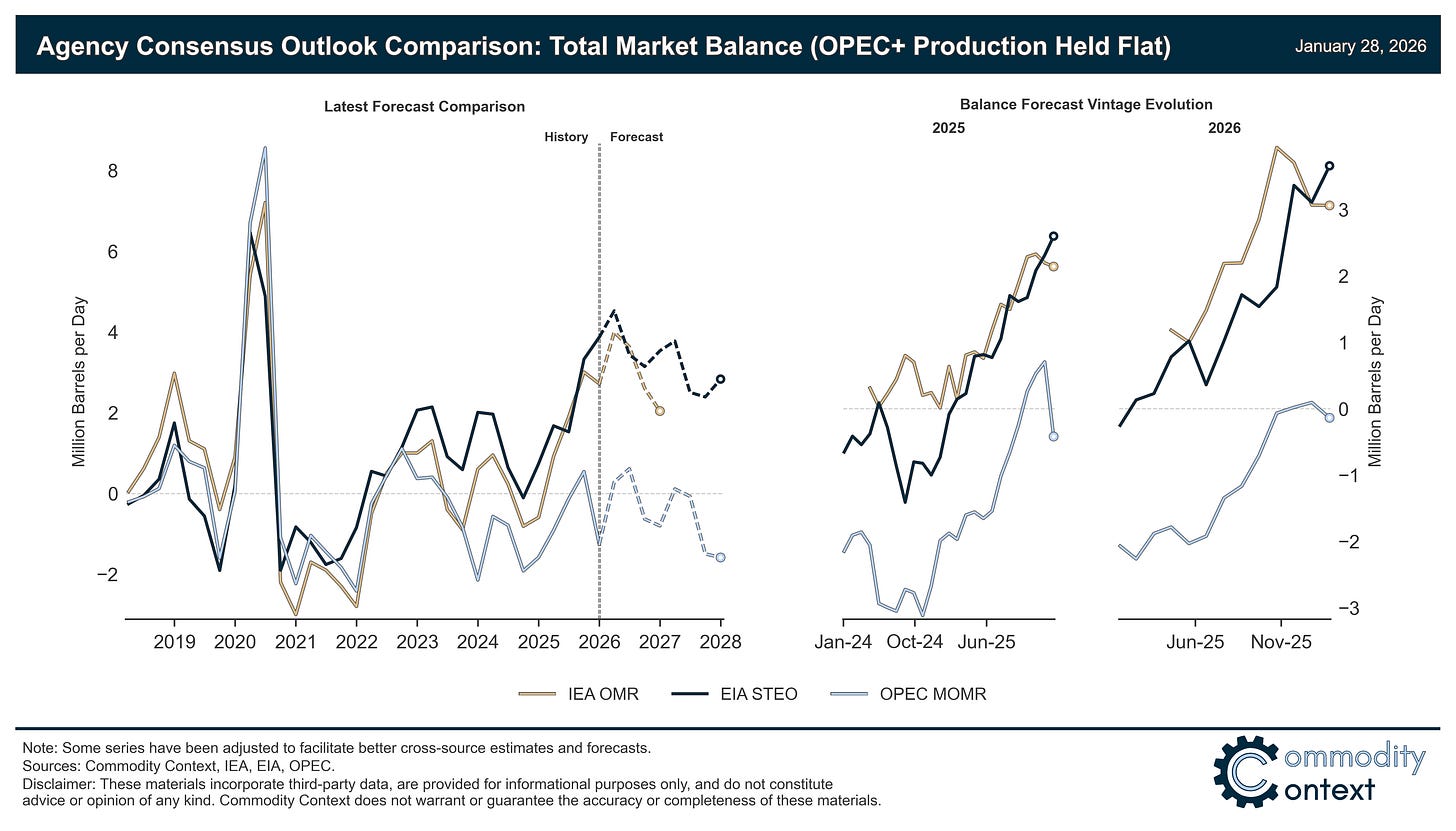

The oil market in 2025 ended up much looser than anyone expected and expectations for 2026 balances are beginning to tighten after nearly a year of ever-weaker outlooks.

If you’re already subscribed and/or appreciate the free summary, hitting the LIKE button is one of the best ways to support my ongoing research.

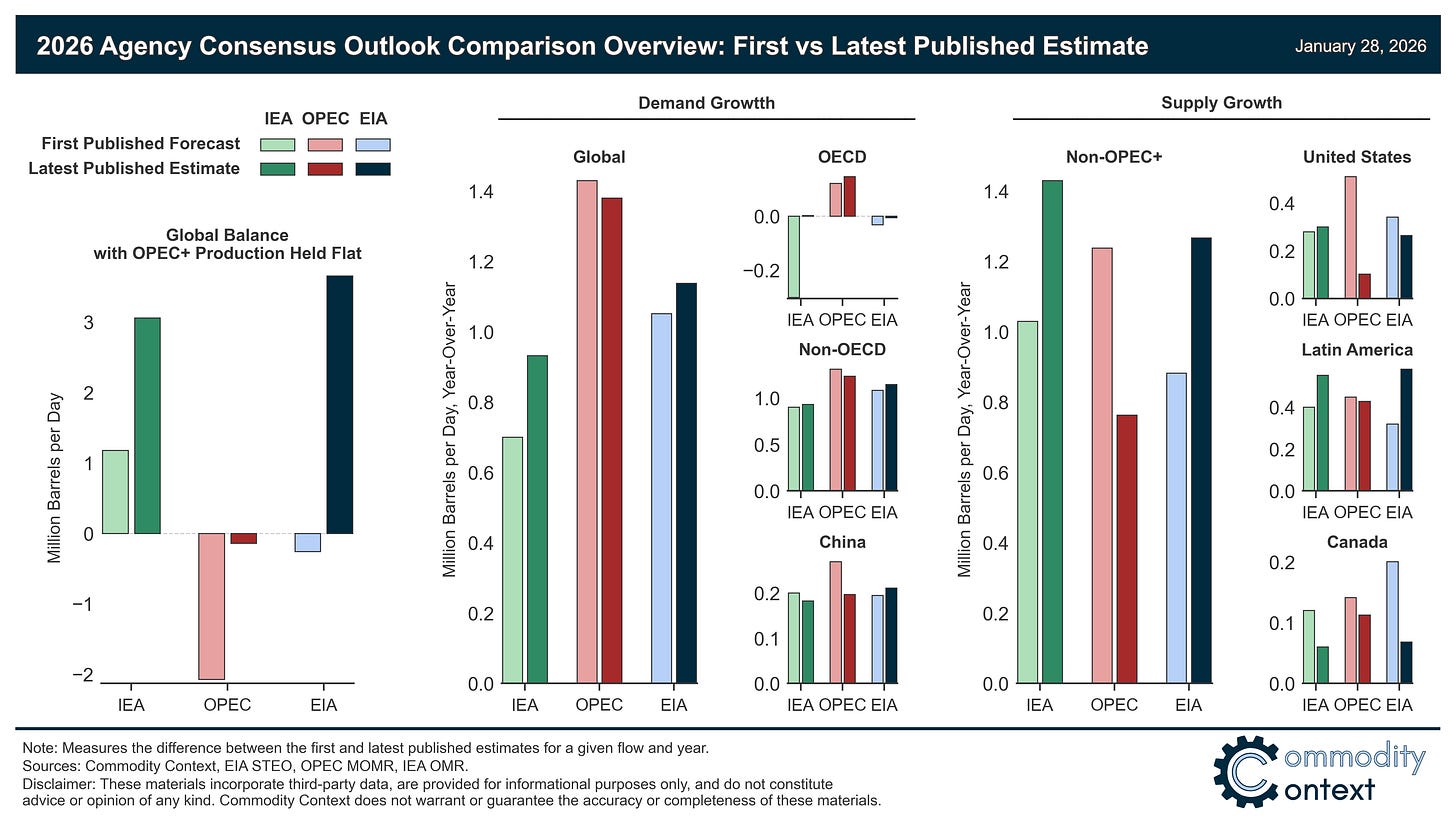

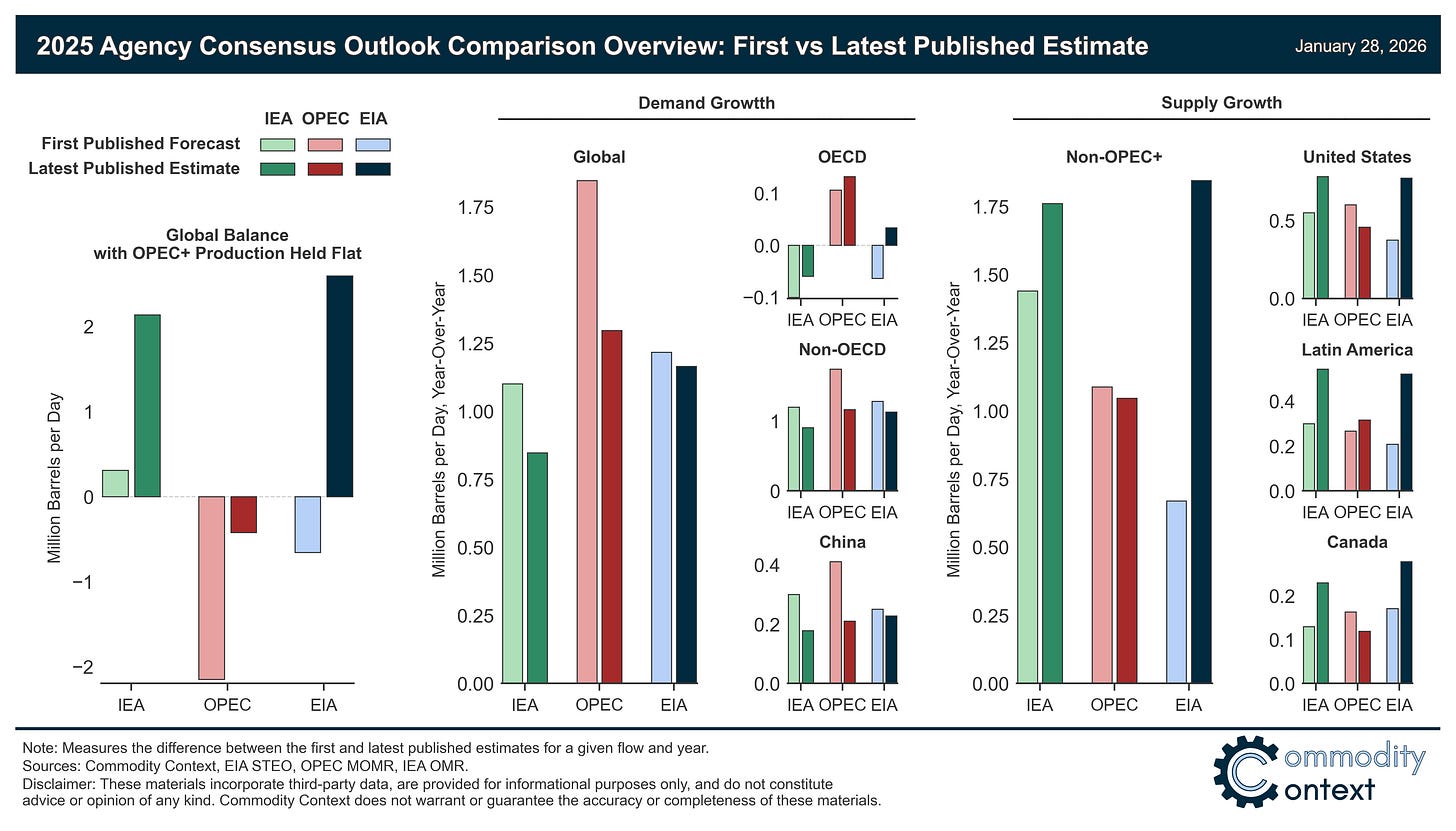

Balances: After steadily mounting over the past year, the supply glut outlooks are finally beginning to roll over; IEA and OPEC outlooks are re-strengthening even while the EIA’s outlook continues to loosen.

Demand : 2025 demand growth underperformed initial expectations, but outperformed the depths of despair following the tariff shock; each of the IEA (weak), EIA (medium), and OPEC (strong) maintain steadily different views on both 2025 and 2026 demand, widening an already pronounced gap.

Supply: OPEC supply statistics have under-accounted for outperformance gains in non-OPEC+ production; all agencies agree that US and Canadian growth will decelerate in 2026 while only the IEA and EIA are building in ever-greater expectations of Latin American production growth.

Over the past year, the dominant theme of the oil market has been that the world is staring down an ever-larger glut of surplus supply. This surplus is driven by the rapid return of withheld OPEC+ crude production together with robust non-OPEC+ production growth across the Americas running up against meagre global demand growth. Now, according to the data published by both the International Energy Agency (IEA) and the US’ Energy Information Administration (EIA), that glut is upon us—even if the surplus has yet to have the expectedly negative effect on pricing (see: Oil’s Off-Balance-Sheet Glut).

The extent of that glut is, obviously, a fiercely debated topic driven, in large part, by vastly different fundamental oil market data published by the IEA, EIA, and OPEC. While some of the largest differences in forecasted global oil market balances have been closed, plenty remain; OPEC is forecasting an oil market roughly in balance but the IEA and EIA have implied acute 3+ MMbpd surpluses in the current period. And, as can be seen above, those differing surplus views are anchored in material differences in demand estimates and a growing split in expectations and realized 2025 estimates of non-OPEC+ supply growth.

So, let’s again unpack what’s driving the differences in both past and future oil market fundamentals data today to better understand how 2025 ended, where we stand today, and where we’re headed over the coming year.