Strategic Oil Reserves Aren’t “Inventory”

They’re potential discretionary supply and demand!

🎙️ I’m excited to share that this post includes an audio voiceover for paid Commodity Context subscribers (link below the paywall). This is a feature I plan to include with most of my research going forward—since becoming a father during COVID, my consumption of audiobooks and podcasts has increased markedly and I hope that this narrated option will provide similar utility to subscribers.

If you’re already subscribed and/or like the free headline chart and bullets, hitting the LIKE button is one of the best ways to support my ongoing research.

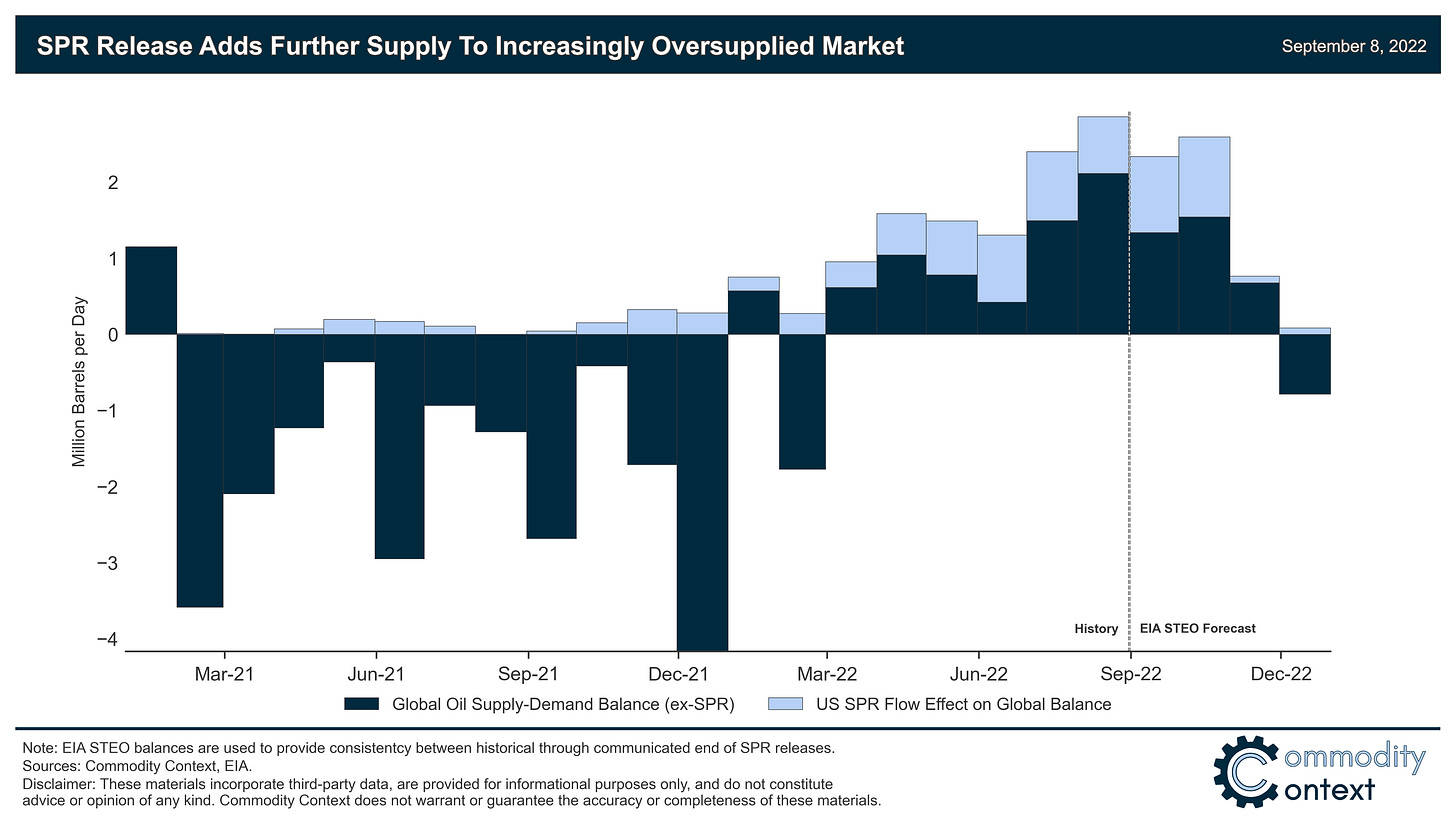

Never before has the SPR played such a material role in oil markets, and the uniqueness of the situation leaves many of us unfamiliar with how to think about the knock-on effects of the SPR release.

Specifically, there is an important, albeit persnickety, definitional issue at hand: the barrels released from the SPR represent additional supply, not simply a drawdown in inventories—a critical distinction for properly understanding the current market.

While the SPR may be a stock of crude, it doesn’t behave like inventory; the “strategic” aspect of the reserves means that decisions to buy and sell crude are decoupled from spot market machinations and typical market incentives provided by the futures curve.

Still, the volume of crude in the reserve does matter, of course, for assessing the potential future impact of the SPR on the broader market; in fact, its knowably finite character makes it decidedly different from other flexible sources of supply.

Ultimately, the SPR release may be a considerable weight around the neck of current spot prices but it’s inherently temporary and will fall away in November, reducing spot market supply by the equivalent of Oman’s entire oil production base overnight—surely a price-positive development.

The Biden Administration’s decision to embark upon the largest-ever emergency release of oil from the Strategic Petroleum Reserve (SPR) is a massive factor driving current oil prices, not to mention unique in the history of the market. But, that uniqueness leaves many of us relatively unfamiliar with how to think about the knock-on effects of the SPR release—and there is a persnickety definitional issue causing persistent confusion.

You see, the barrels released from the SPR represent additional supply, not simply a drawdown in inventories. This might sound like silly pedantry, if not outright lunacy: surely a stockpile of crude is “inventory”? So, let’s talk definitions and why this distinction is critical for understanding current market conditions.