Russian Fuel Autarky

Why did Russia ban diesel and gasoline exports, and what’s the risk to already-strained global refined product markets?

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

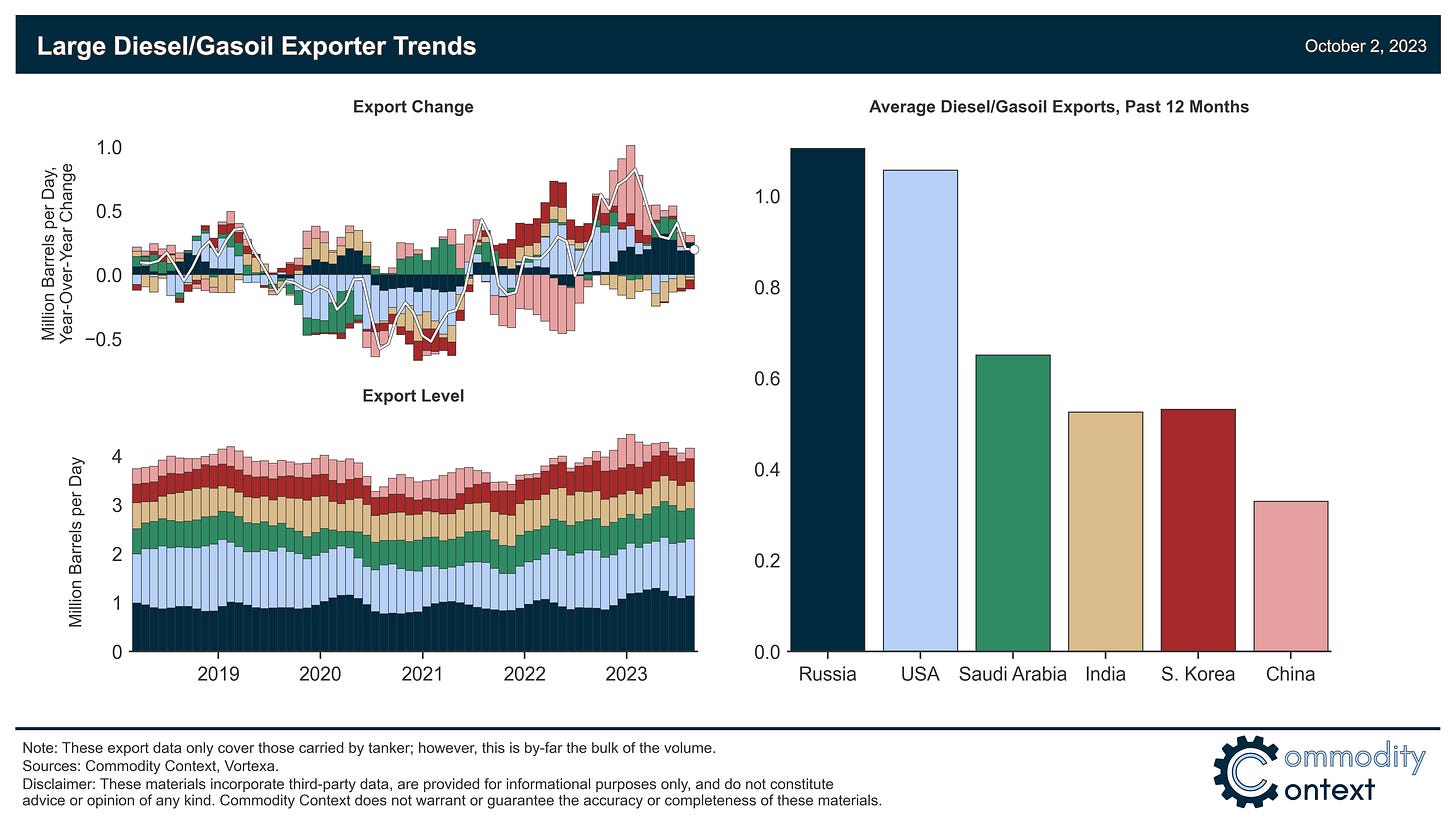

The world’s second-largest diesel exporter, Russia, recently announced a ban on diesel exports, which comes at a time when the middle distillates market is already exceptionally tight as evidenced by crisis-level crack spreads.

Moscow’s stated rationale for the ban is shoring up domestic shortages but Russia is a structural diesel exporter, so strict longer-lasting enforcement of such a ban would actually end up tightening domestic markets with forced refining run cuts.

Some have invoked the Energy Weapon™ to explain Moscow’s actions; however, I believe the evidence points to more or less what Moscow admitted in the announcement: that it’s a desperate attempt to address domestic issues—a sign of weakness, not a flex of strength.

Prices jumped following the news but have been relatively unremarkable since, likely a sign that the market, too, expects this to be a reasonably short-lived affair; still, this is a major disruption to follow over the coming month and even if the ban is reversed we now know that Russian diesel supplies are decided less secure going forward.

It would appear that Russia is intent on remaining at the center of the oil market calculus. Moscow’s latest move to ban the export of both gasoline and—much more critically—diesel threatens to further inflame the already acutely strained refined product markets. As the world’s largest exporter of diesel and gasoil, Russia holds the power to create a monumental shock with the dead stop of flows, especially in a moment where diesel crack spreads (i.e., margins) are at exceptionally high levels.

Now, Moscow claims that this is a “temporary” measure to preserve fuel for its increasingly tight domestic market; but, the announcement makes no mention of an end date beyond the vague “when the domestic fuel market stabilizes”. So, what is the most likely explanation? While some analysts point to mounting evidence of domestic concerns that would, indeed, support a short-lived stoppage to shore up domestic stocks and remind refiners of domestic responsibilities, others more skeptically argue that this is just another instance of Moscow leveraging its so-called energy weapon.

Let’s add some context to these conflicting narratives concerning Russia’s motivations—and thus timeline—as well as try to quantify the impact of this export stoppage for the already-strained global diesel market. This post will focus on the diesel side of the equation given the comparatively small volumes of gasoline at play and the extremely soft gasoline market conditions at present (crack spreads at COVID-era lows).