OPEC’s Price

It’ll take even higher oil prices to derail OPEC+ from its current production plans.

If you’re already subscribed and/or appreciate the free summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Oil markets are tight, prices are surging, and all forecasts for the year hinge on the question of whether, and how soon, OPEC+ might ease its production cuts to address clear market shortages.

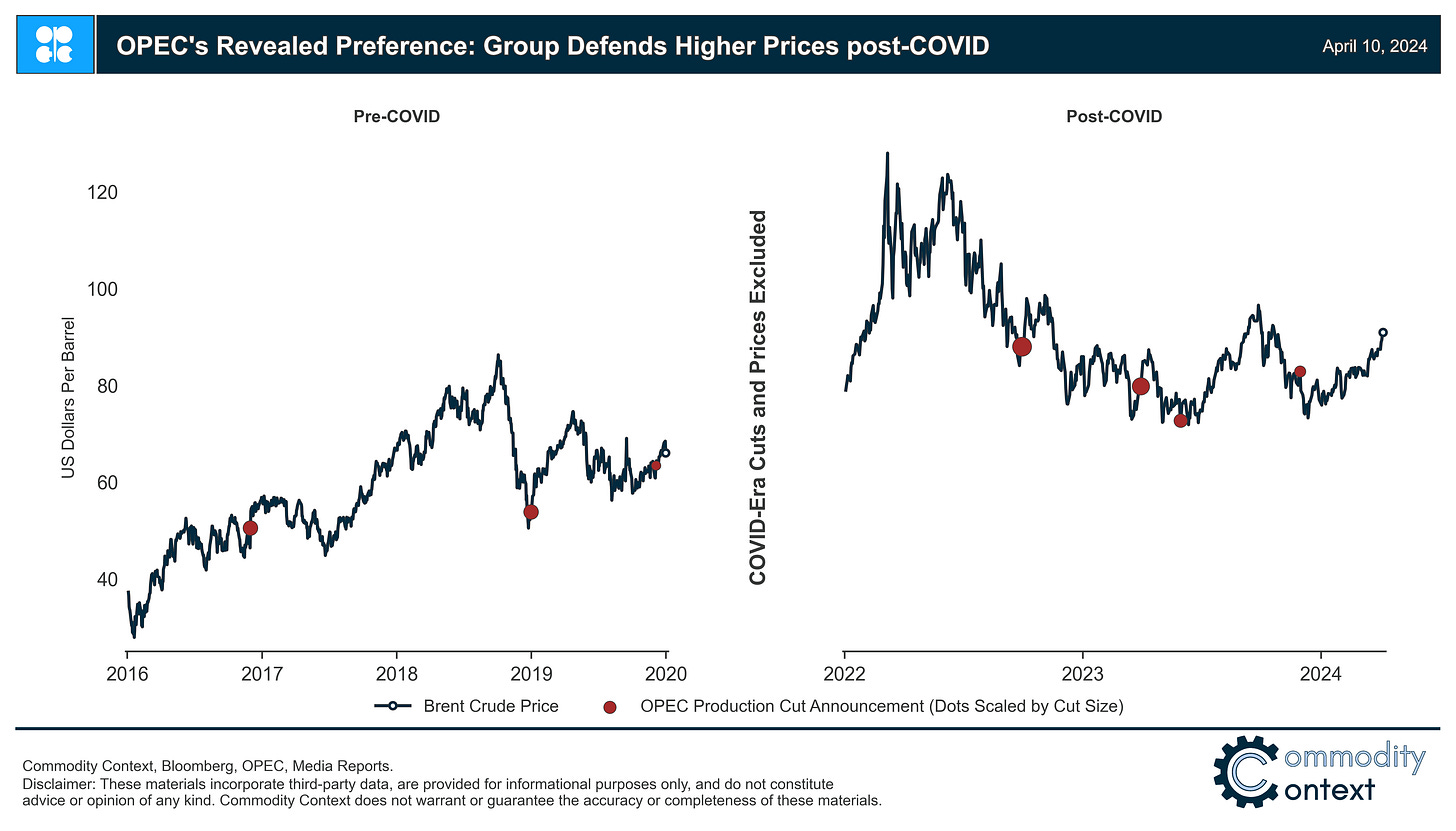

OPEC+’s revealed price preference has risen notably from the pre-COVID norm and the present-day cutting cycle was prompted by Brent prices roughly where they stand today.

An assortment of factors influence the (implicit) price preference underpinning OPEC’s production management decisions, including but not limited to:

Short-term income maximization;

Potential supply competition, especially from US shale;

The depressive effect higher oil prices on the global economy;

Political blowback from consuming countries—whether from the White House or from Indian PM Modi; and

Faltering compliance within OPEC+’s own ranks given the length and depth of cuts.

Oil prices are at their highest level in half a year, but OPEC+ isn’t feeling the heat—at least not yet. Crude prices have raced nearly $10/bbl higher over the past month on the back of upgraded demand expectations and extended OPEC+ cuts. But that’s just it: it’s critical to remember that the market is artificially tight thanks to substantial OPEC+ support in the form of the largest production cuts [excluding the COVID intervention] since the Great Financial Crisis in 2008.

OPEC+ holds the power to determine how much further this rally has to run. Of course, it’s always been a given that OPEC+ would eventually need to ease its production cuts; but, even as the producer group embarked on its fourth wave of production cuts late last year, it still wasn’t obvious when there would be an opportunity to ease cuts amidst still-flagging prices. Now, Brent crude is above $90/bbl and the market can clearly absorb more OPEC+ barrels—but at the same time both supply and demand in the market can handle higher prices than the pre-pandemic norm.

Most recently, OPEC+’s Joint Ministerial Monitoring Committee (JMMC) recommended that the group keep its policy unchanged at its latest meeting last week, confirming that prices aren’t yet enough to prompt the producer group to revise its plan to have production cuts continue until at least the end of June. So, how high can the price go before OPEC+ finally begins to ease back on the substantial volume of supply it’s holding off the market? In the near-term, I think prices can go well into the $90s, if not the low triple digits, before OPEC+ would consider revising its current timeline; but, prices holding in the mid-$90s (i.e., $5+/bbl higher than today) through the end of June would likely be enough to trigger a cautious easing process.

With discretionary power now firmly in the hands of OPEC+ ministers, it’s important to consider the full range of factors influencing OPEC+’s price preference.