OPEC+'s BasedLines & Lollipops

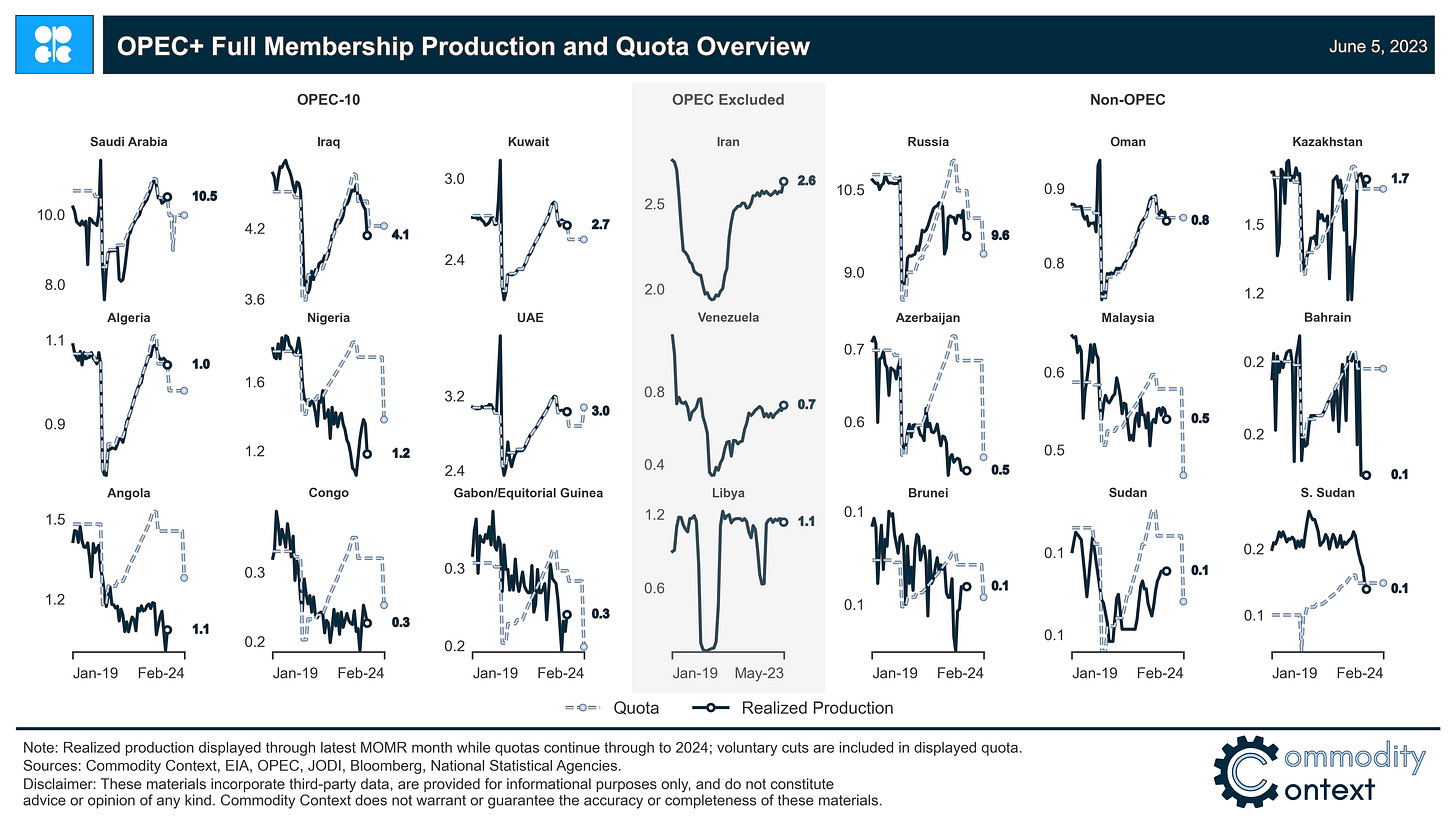

Quick Context: a BIG unilateral Saudi cut of still-uncertain duration, production baseline revisions, and a lot of lip service to unity; nobody knows what it means, but it’s provocative.

If you’re already subscribed and/or appreciate the free charts and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Saudi Arabia is unilaterally and voluntarily cutting production by 1 MMbpd effective July 1st and, as yet, in force for only one month, subject to extension.

Formal OPEC+ cuts from late-2022 and voluntary commitments made in early April will roll over into 2024.

Baseline revisions have begun: 9 countries will see their production reference levels reduced by a collective 1,593 kbpd, while the UAE will have its reference level increased by 200 kbpd, all effective January 2024.

Ministers were at pains to present an image of unity, but clear conflict remains—from reports of African member anger at baseline revisions, to Russia’s notable absence from the press conference, to the very fact that Saudi Arabia is now shouldering this entire cut alone.

The immediate price reaction of ~$2/bbl was paltry, reflecting a market that had already partially priced in some form of production and that remains skeptical of the producer group’s capacity to manage this market.

Despite two large OPEC+ cuts, crude prices are still lingering in the mid-70s—and even a few bucks below early-April pre-surprise cut levels. The market is not cooperating with the whims of OPEC+.

OPEC+ ministers met in Vienna over the weekend, ultimately culminating in a large 1 MMbpd, unilateral, and voluntary production cut from Saudi Arabia as well as material changes to production baselines effective January 2024. It was apparent that the producer group was trying to present a united front and to finally corral an uncooperative crude market; it was also clear that relations were, in actuality, growing increasingly contentious, even if compromises were eventually reached. Overall, the meetings were shrouded in dramatic overtones, between the banning of major news organizations from the building; reports of disgruntled baseline-reduced African members; and the conspicuous absence of key members like Russia from the press conference.

The market reacted, in Asian trading, with a ~$2/bbl price spike: a pretty paltry post-meeting rally in the scheme of OPEC price responses.

But, as always with OPEC+ watching, the real devil is in the details—so let’s dig in.