OPEC+ Data Deck (September 2025)

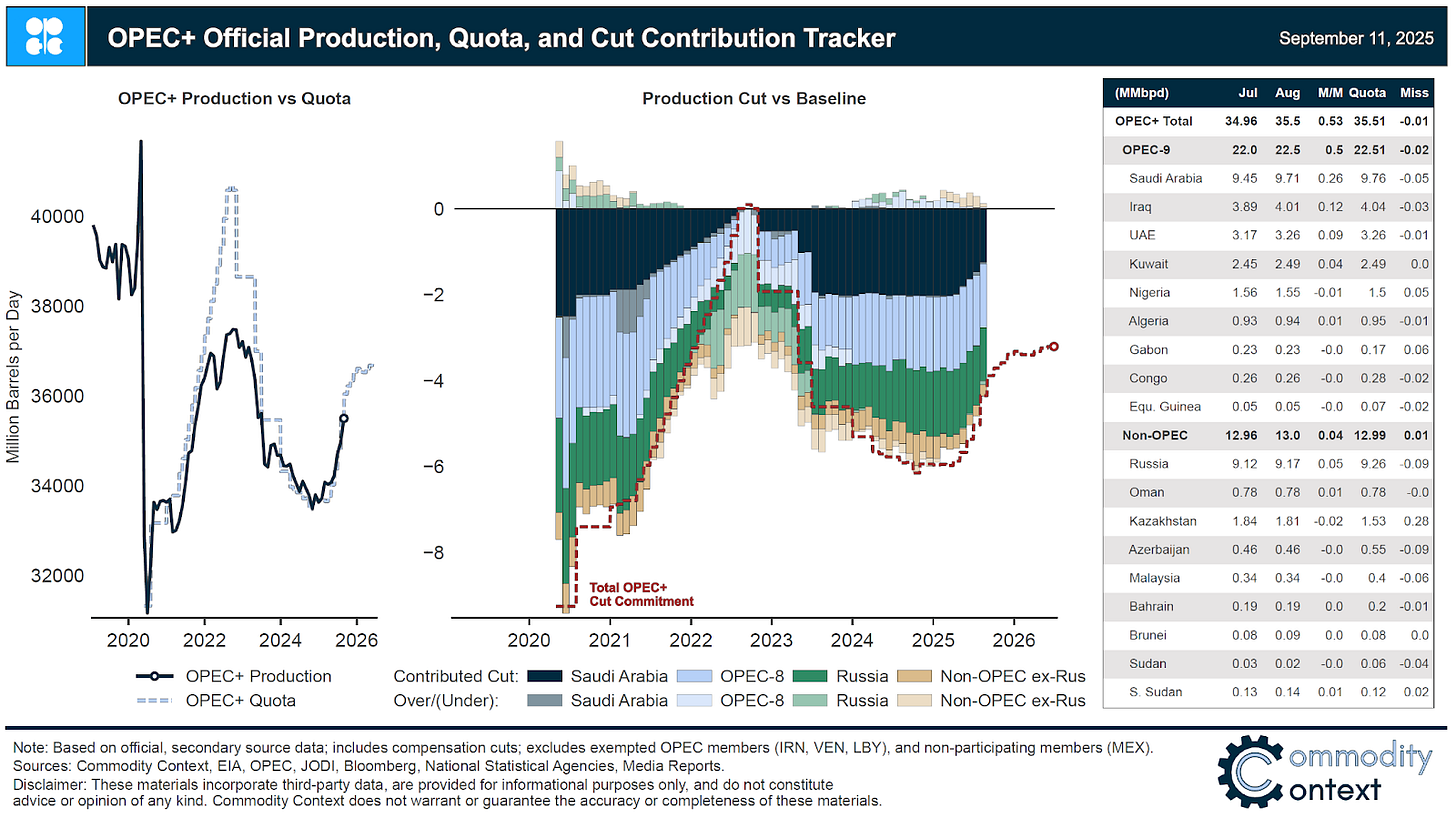

Official OPEC production data indicates further output increases in line with accelerated cut unwind—though implied production estimates marked a slowdown—and group agrees to further hikes into 2026.

Below the paywall you will find the latest monthly edition of the Commodity Context OPEC+ Data Deck (50-page PDF), tracking groupwide and member-level official production estimates, quotas, compliance, exports, and official production data reconciliation vs output implied by visible movements.

If you’re already subscribed and/or like the free summary bullets, hitting the LIKE button is one of the best ways to support my research.

Summary

Quota participating OPEC+ cut production rose +514 kbpd m/m to 35,497 kbpd in August, according to official OPEC secondary source estimates; gains were driven largely by core Great 8 members continuing their accelerated cut unwind through the end of September.

However, flows-implied Great 8 production was near flat on the month, which shrunk the spread between implied and official production data to its narrowest level thus far in 2025.

New deal keeps the production hikes coming: without skipping a beat following the completion of its 6-month, 2.5 MMbpd production hike in September, the producer group, at its meeting this past weekend, immediately rolled into another phased unwinding of its next 1.65 MMbpd production cut tranche.

Updated compensation cut plan offsets, on its face, some of the 2026 implications of further production hikes but relies almost entirely on unrealistically large—and ever-deferred—pledges from Kazakhstan.