OPEC+ Data Deck (October 2025)

Official OPEC crude production data tracked announced production hikes while implied output estimates rose even faster; the producer group agreed to another gradual output increase in November.

Below the paywall you will find the latest monthly edition of the Commodity Context OPEC+ Data Deck (50-page PDF), tracking groupwide and member-level official production estimates, quotas, compliance, exports, and official production data reconciliation vs output implied by visible movements.

If you’re already subscribed and/or like the free summary bullets, hitting the LIKE button is one of the best ways to support my research.

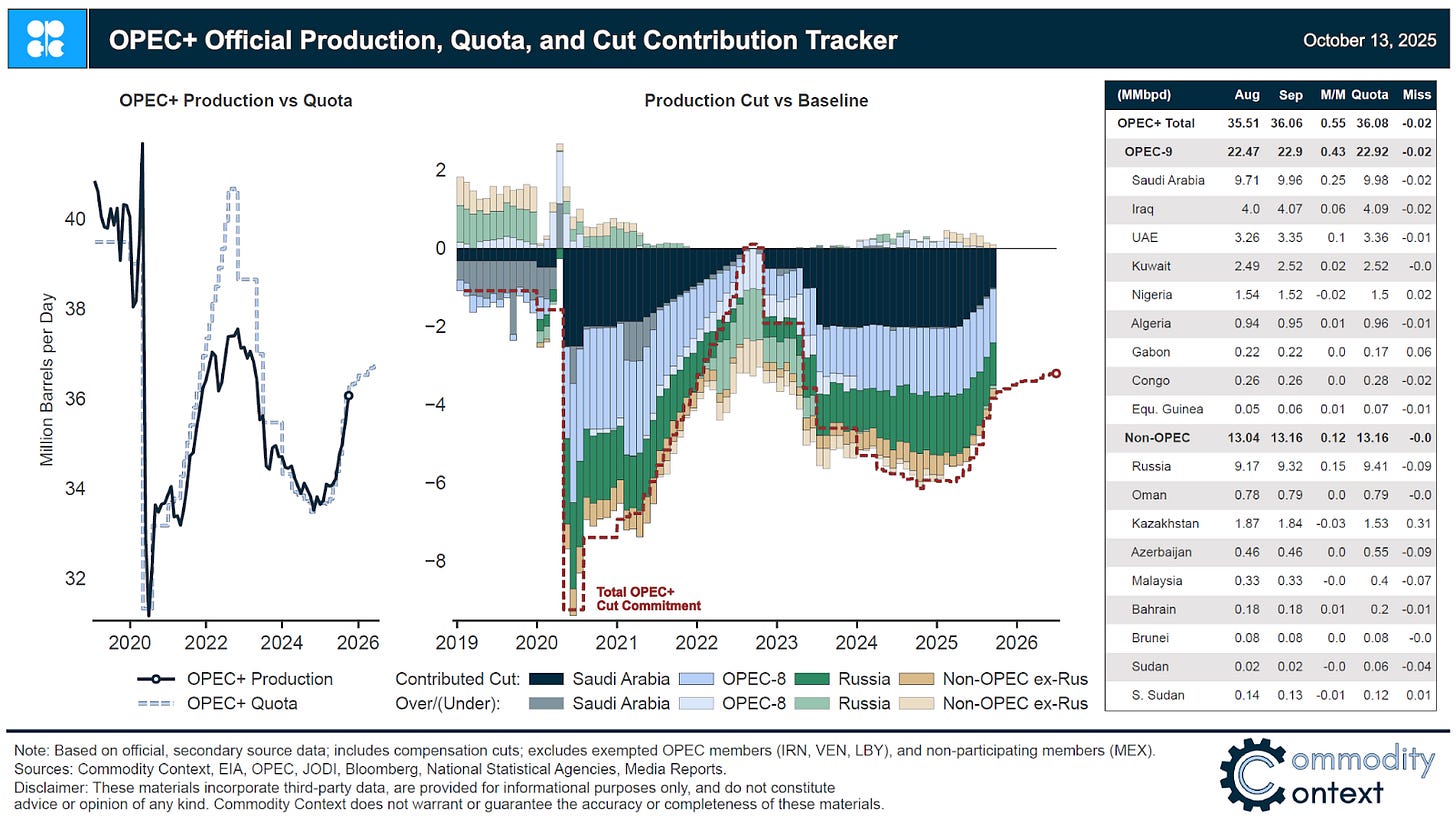

Quota participating OPEC+ cut production rose +553 kbpd m/m to 36,062 kbpd in September, according to “official” OPEC secondary source estimates; gains continue to be driven by core Great 8 members, with Saudi Arabia and Russia leading the pack higher.

However, implied Great 8 production rose even faster, which shrunk the spread between implied and official production data to its narrowest level thus far in 2025.

The Great 8 announced another 137 kbpd production hike for November, bucking earlier rumours that the group was mulling a vastly-accelerated ~500 kbpd hike.

Updated compensation cut pledges saw Russian commitments fall thanks to recent production struggles while Kazakh commitments continue to rise as production remains stubbornly and chronically well above quota.