OPEC+ Data Deck (November 2025)

Official OPEC crude production slowed, according to official statistics, in line with the deceleration in monthly Great 8 quota increases, while flows-implied output continues to advance more quickly.

Below the paywall you will find the latest monthly edition of the Commodity Context OPEC+ Data Deck (50-page PDF), tracking groupwide and member-level official production estimates, quotas, compliance, exports, and official production data reconciliation vs output implied by visible movements.

If you’re already subscribed and/or like the free summary bullets, hitting the LIKE button is one of the best ways to support my research.

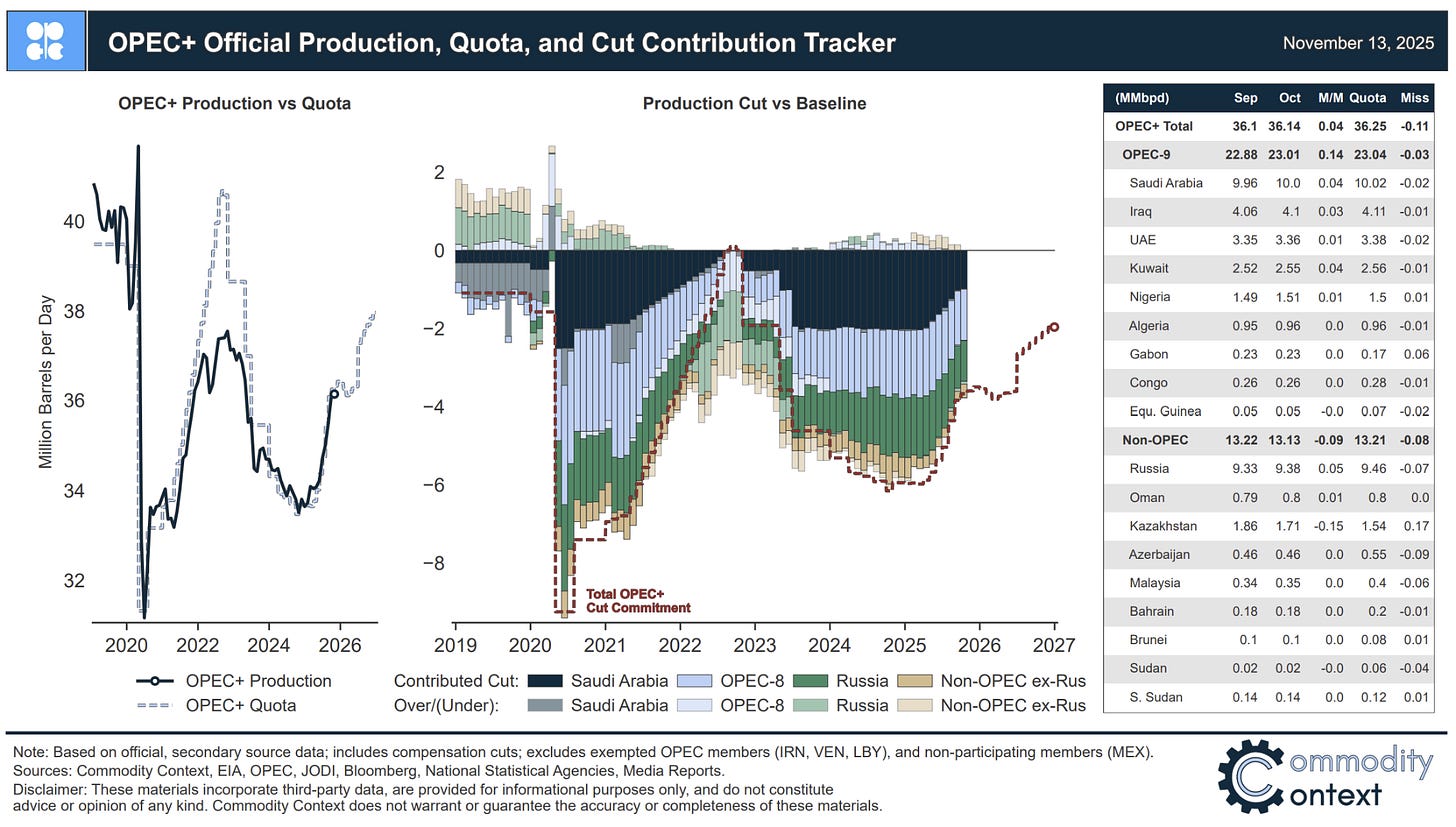

Quota participating OPEC+ crude production rose only 42 kbpd m/m to 36,139 kbpd in October, according to official OPEC+ statistics, with monthly gains slowing in line with the deceleration in monthly Great 8 quota increases from 547 kbpd in September to only 137 kbpd in October. Flows-implied production across the Great 8 membership continues to rise faster than indicated by official OPEC statistics.

At the latest meeting of Great 8 OPEC+ members, the group announced increased output quotas (+137 kbpd) for December but, “due to seasonality”, further output increases would be paused through the first quarter of 2026. This is the first real sign of hesitation from OPEC—in its ongoing effort to normalize production quotas—and an important signal about comfort levels vis-a-vis current prices.