OPEC+ Data Deck (February 2026)

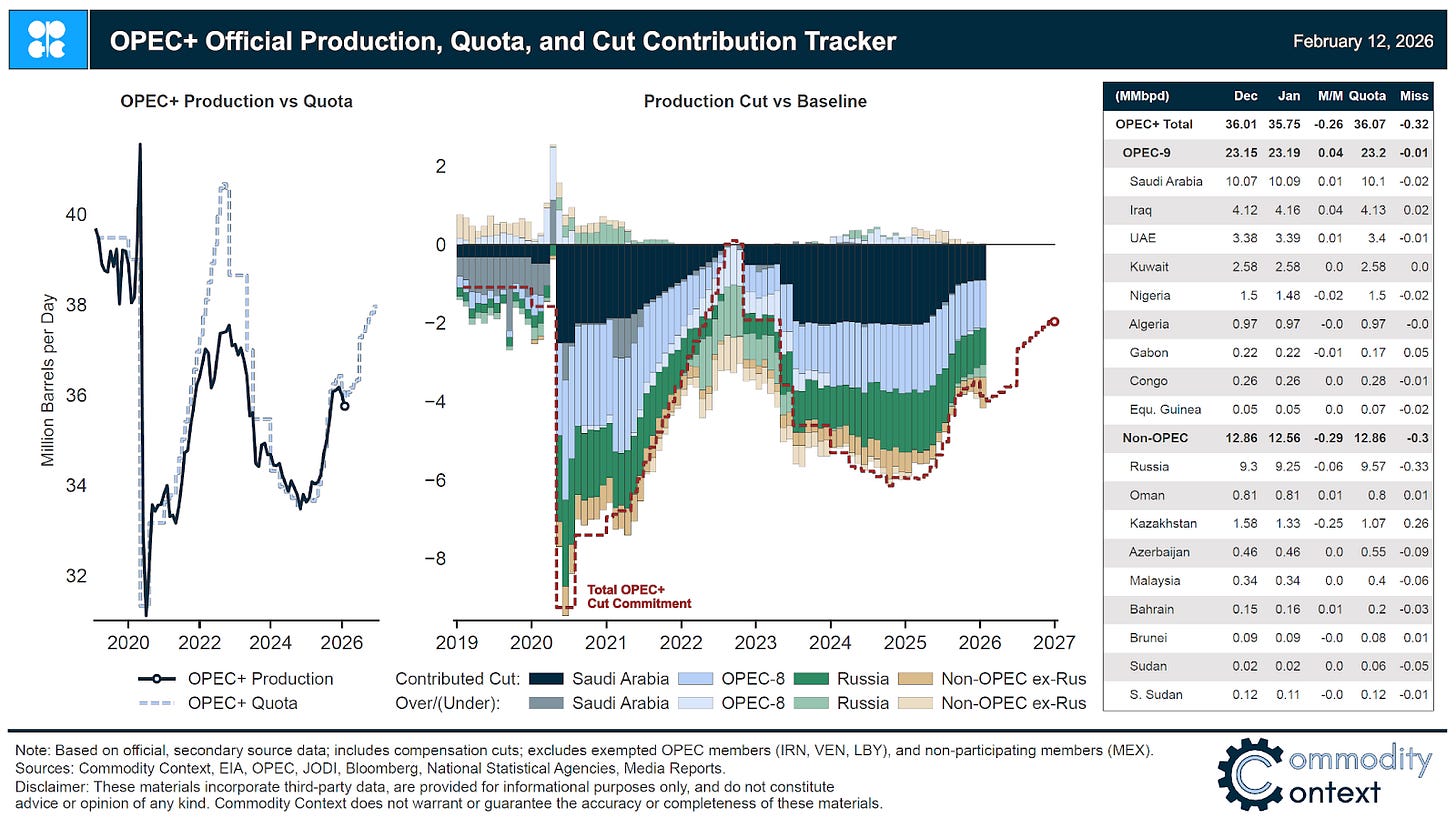

Official OPEC+ quota-bound production fell again in January given more bad luck in Kazakhstan, though, even with this decline, a mountain of Kazakh quota overproduction “debt” remains.

Below the paywall you will find the latest monthly edition of the Commodity Context OPEC+ Data Deck (50-page PDF), tracking groupwide and member-level official production estimates, quotas, compliance, exports, and official production data reconciliation vs output implied by visible movements.

If you’re already subscribed and/or like the free summary bullets, hitting the LIKE button is one of the best ways to support my research.

Quota-participating OPEC+ crude production fell another -255 kbpd to 35,751 kbpd in January, according to official OPEC+ secondary source aggregate statistics, continuing December’s production pullback for a second month; declines continue to be overwhelmingly driven by cratered Kazakh crude production thanks to both CPC Marine Terminal disruptions and a major power outage at Kazakhstan’s largest producing oilfield.

While this helps “pay back” some of Kazakhstan’s chronic quota overproduction, Kazakh overproduction technically rose in January thanks to an attempted frontloading of compensation cuts that reduced Kazakhstan’s quota faster than production faltered.

Implied production declined even more quickly than official tallies, which hastened the convergence between official and implied production levels to almost perfectly equal in January.

[Full PDF Deck and additional analysis below paywall]