OPEC+ Data Deck (December 2025)

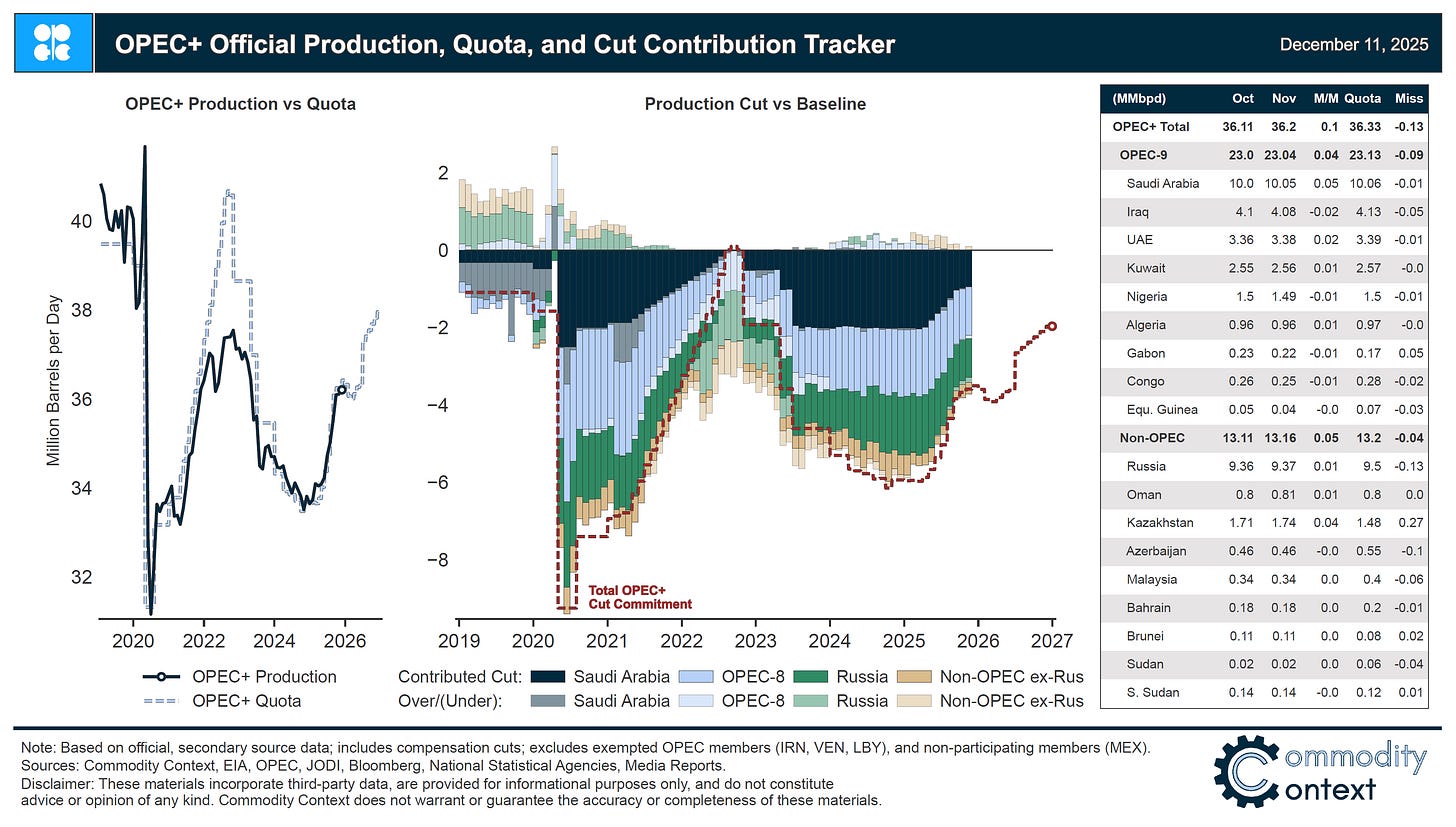

Official OPEC+ crude production figures rose in November alongside quota hike but flows-implied output estimates fell, shrinking the estimate gap that blew out in October.

Below the paywall you will find the latest monthly edition of the Commodity Context OPEC+ Data Deck (50-page PDF), tracking groupwide and member-level official production estimates, quotas, compliance, exports, and official production data reconciliation vs output implied by visible movements.

If you’re already subscribed and/or like the free summary bullets, hitting the LIKE button is one of the best ways to support my research.

Quota-participating OPEC+ crude production rose +96 kbpd to 36,204 kbpd in November, according to official OPEC+ secondary source aggregate statistics, with monthly gains continuing to be driven by output increases across the Great 8 in line with upgraded quotas. Overall group output rose by +53 kbpd, with declines across quota-exempt members blunting the headline gain.

Flows-implied groupwide production pulled back on the month compared to the official headline production print, narrowing the blowout between official and implied estimates that emerged in October.

At its latest meeting, the Great 8 stayed on course for its Q1 2026 production hike pause, but that’s not to say it was an uneventful meeting: at least on paper, OPEC signed off on what is being called a “historic” and “transparent” new member capacity estimation mechanism, but devil is in the [lack of] details.