OPEC+ Data Deck (August 2025)

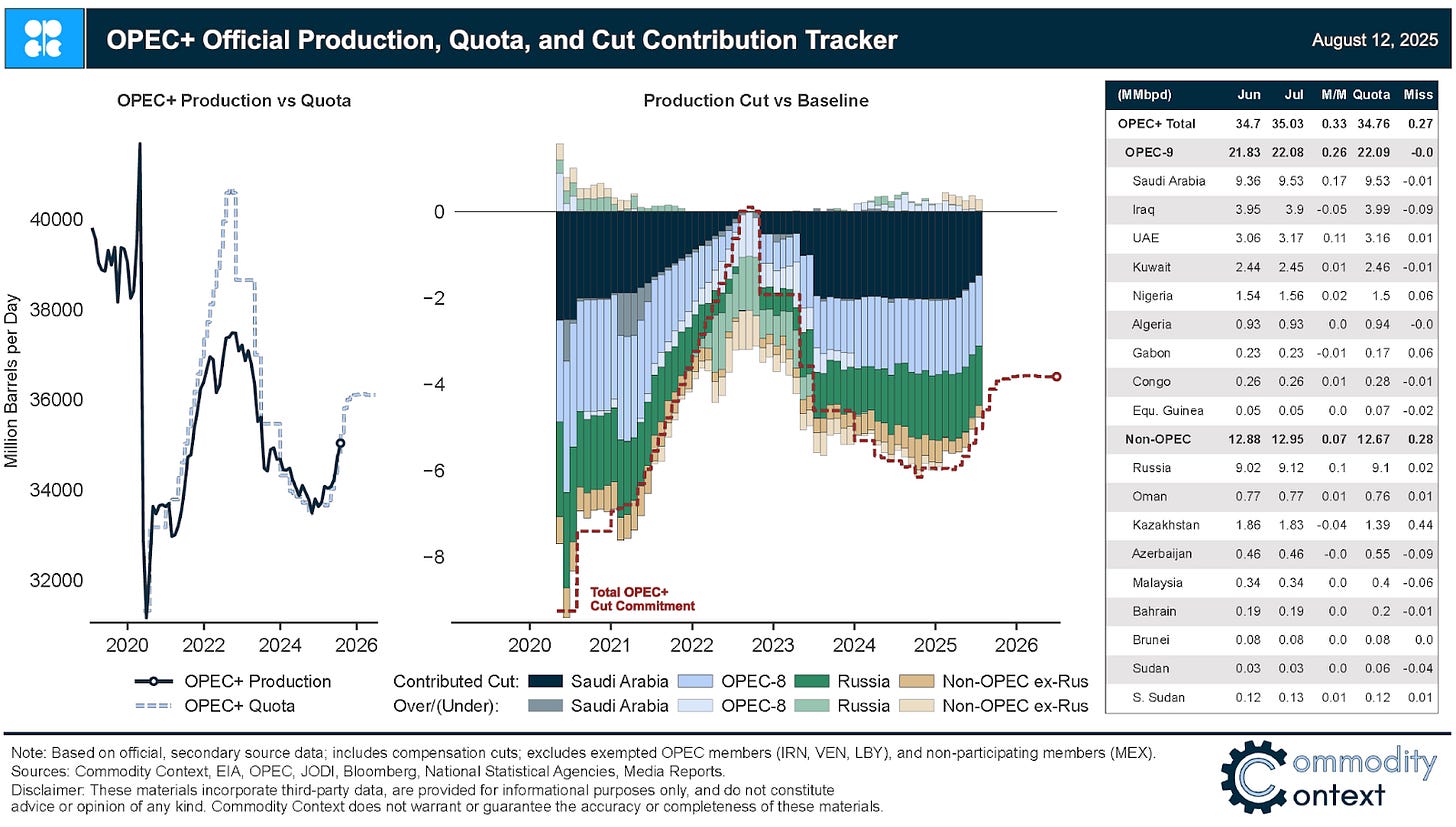

OPEC+ crude output continued to rise in July, though gains continue to accumulate more slowly than do quota hikes.

Below the paywall you will find the latest monthly edition of the Commodity Context OPEC+ Data Deck (50-page PDF), tracking groupwide and member-level official production estimates, quotas, compliance, exports, and official production data reconciliation vs output implied by visible movements.

If you’re already subscribed and/or like the free summary bullets, hitting the LIKE button is one of the best ways to support my research.

Quota participating OPEC+ crude production rose +331 kbpd m/m to 35,033 kbpd in July, according to official OPEC secondary source estimates; most of the gains, unsurprisingly, came from Saudi Arabia, the UAE, and Russia, which together constitute the lion’s share of incremental quota hikes.

Officially recognized overproduction fell to 273 kbpd in July but Kazakhstan continued to pump 441 kbpd above its all-in quota in July; Iraqi official output fell notably below its target in July, though flows-implied production data continues to indicate notable—and largely unchanged—overproduction.

Flows-implied crude production out of the Great-8 tracked official increases in aggregate output (+323 kbpd vs. +308 kbpd); however, the composition of those gains was markedly different and showed larger increases from Russia compared to a pullback in Saudi output.

[Further analysis and full OPEC+ Data Deck PDF report below paywall]