OPEC+ Controls the Oil Market for Better or Worse

OPEC and its allies saved the oil market but continued salvation is far from assured.

OPEC+ saved the market by cutting production in April 2020 and has since been gradually easing those cuts; a broadly, but not unanimously, accepted plan would have seen the group further ease these cuts through end-2021 and extend the deal through end-2022.

The UAE unexpectedly opposed the extension of the deal, demanding a higher baseline against which the cuts should be calculated. Saudi Arabia chose to draw a line in the sand.

The collapse of OPEC+ negotiations has boosted prices but is ultimately a pyrrhic victory for oil bulls; OPEC+ still needs to eventually rationalize its spare capacity and soon: it risks reawakening US shale investment and damaging the global economic recovery.

Prices will remain volatile until a deal is finalized, and while my base case remains that parties will find compromise, it could still take weeks to reach an agreement.

It’s no exaggeration to say that OPEC and its allies (OPEC+) saved the oil market in May 2020 when they collectively cut crude production by 9.7 million barrels per day (MMbpd) to offset the initial wave of COVID-induced demand destruction. Even if said salvation came only after a market share conflagration that contributed to WTI oil prices trading negative for the first time in history, the emergency supply management surely spared the market from months of destabilizingly low prices that would have done lasting damage to the industry’s productive capacity.

Now OPEC+ is in near-total control of oil prices, with the producer group arguably holding the highest degree of market power in decades. But its power rests on a market that remains fundamentally weak and critically reliant on continued OPEC+ life support (see my last newsletter). This all makes the assumed path of OPEC+ production over the coming 18 months the single most important price determinant—and biggest risk—to anyone’s outlook. And they’re not making it easy on us.

OPEC+’s No-Good, Really-Long Meetings

As a consensus-driven alliance, OPEC+ needed to find agreement on two resolutions at a series of meetings beginning Thursday, July 1st. First, members acknowledged that both current prices and physical market signals justified a production hike, with a consensus quickly emerging that they would ease cuts by an additional 2 MMbpd between August and December at a pace of 400 kbpd each month. Second, members widely accepted that the current agreement, scheduled to conclude April 2022, should be extended through end-2022—widely accepted, but not unanimous.

Instead, the UAE emerged as a spoiler, refusing to support an extension of the current deal without changes to the baseline against which the cuts are measured. The UAE has invested substantially in its industry since the current baseline was established in October 2018 and now wants an alternative baseline reflecting April 2020 production, a time when members pumped unrestrained amidst the battle for market share and therefore is arguably more representative of current production capacities.

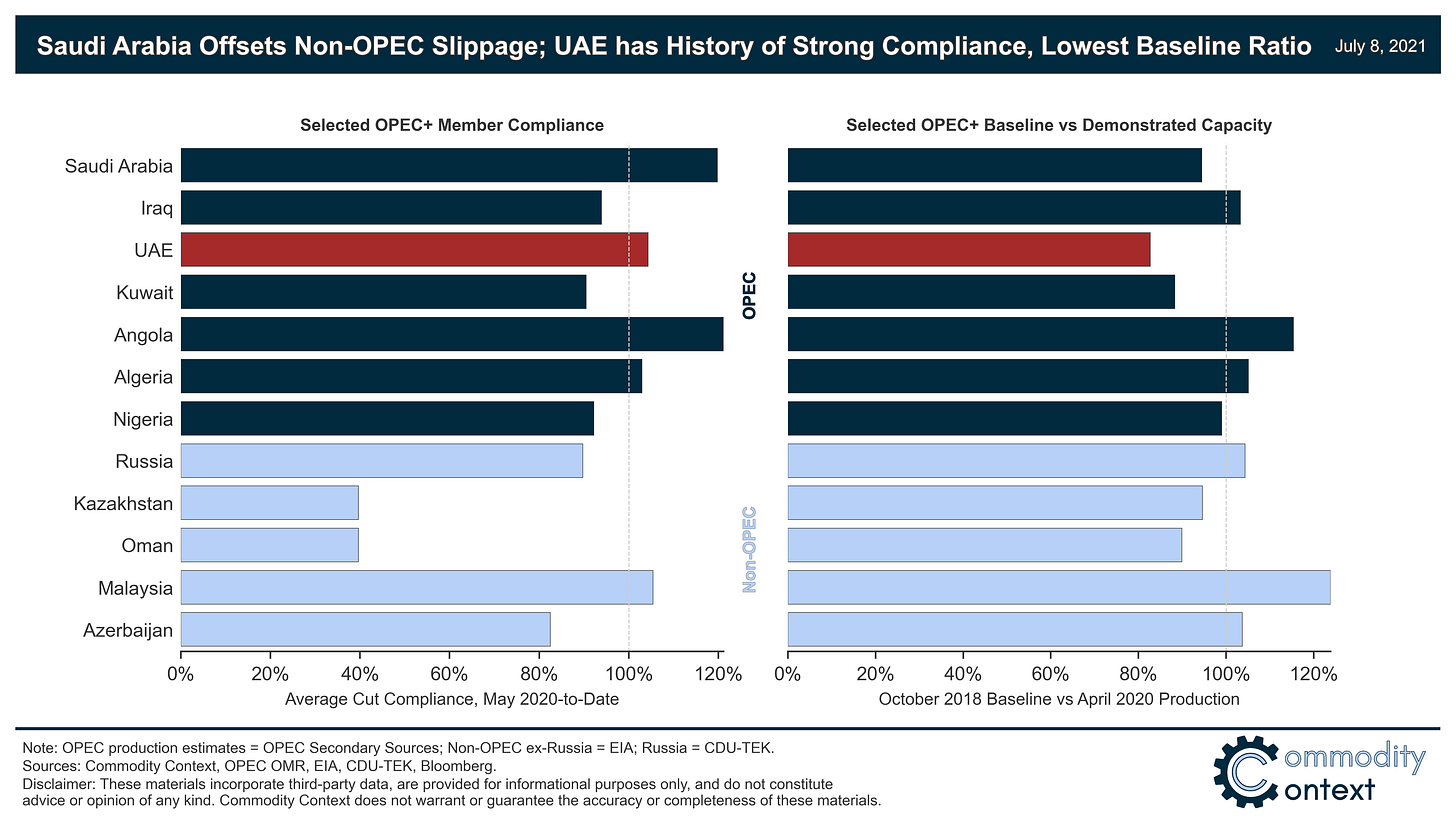

The UAE has a logical argument here. It is the second-largest producer behind Saudi Arabia to have averaged steeper-than-required cuts to-date and holds the largest deviation between the current baseline and demonstrated April 2020 production capacity within the alliance—83% vs 94% for Saudi Arabia and 104% for Russia. Its position is hardly unassailable, however, and it should be noted that the UAE’s capacity expansion investments occurred entirely while under a formal production restraint deal.

In response to the UAE opposition, Saudi Arabia drew a line in the sand that there would be no production hike without an extension of the deal (i.e., no first resolution without the second resolution). The discord emerging at what were supposed to be relatively straightforward meetings surprised observers, dragging on for days and concluding suddenly after a tumultuous weekend with parties walking away without a deal.

Why would Saudi Arabia draw such a line in the sand, especially when a re-basing would also benefit the Kingdom? Aside from a principle-of-the-matter opposition, Russia would have ended up on the wrong side of an April 2020 re-basing and Riyadh has shown a willingness to go out of its way to keep Moscow in the production pact.

While failed OPEC negotiations have historically resulted in a production surge and crashing prices as members rush to get their barrels to market (e.g., the aforementioned April 2020 price war), this time appears different. Members have publicly agreed that, absent a resolution, the existing terms will roll forward to April 2022. This means no production hikes, less supply to the market, and higher prices—at least for time being. Saudi Arabia, for its part, signaled its expectation for at least modestly tighter crude markets by raising its official selling price for the Kingdom’s core Asian market.

The collapse of OPEC+ negotiations may be positive for near-term crude prices, but is ultimately a pyrrhic victory for oil bulls. Even ignoring the now-heightened threat of a collapse of the production alliance, OPEC+ still needs to rationalize this spare capacity and soon. The longer it takes, the greater the risks of reawakening US shale investment or damaging the global economic recovery. In the meantime, the UAE and Saudi Arabia continue to play chicken, with enough spare capacity to sink the oil market twice over. The entire oil market will be on much more stable footing once these erstwhile allies get back on the same page.