Fly, You Fools: Oil’s Uneven Demand Recovery

Jet Fuel Demand Still Has Furthest to Climb, Gasoline Likely Already Exceeding Pre-Pandemic Levels

Unlike other commodities (e.g., lumber, steel) that received a surprising pandemic consumption boost, global oil demand remains depressed below pre-COVID levels.

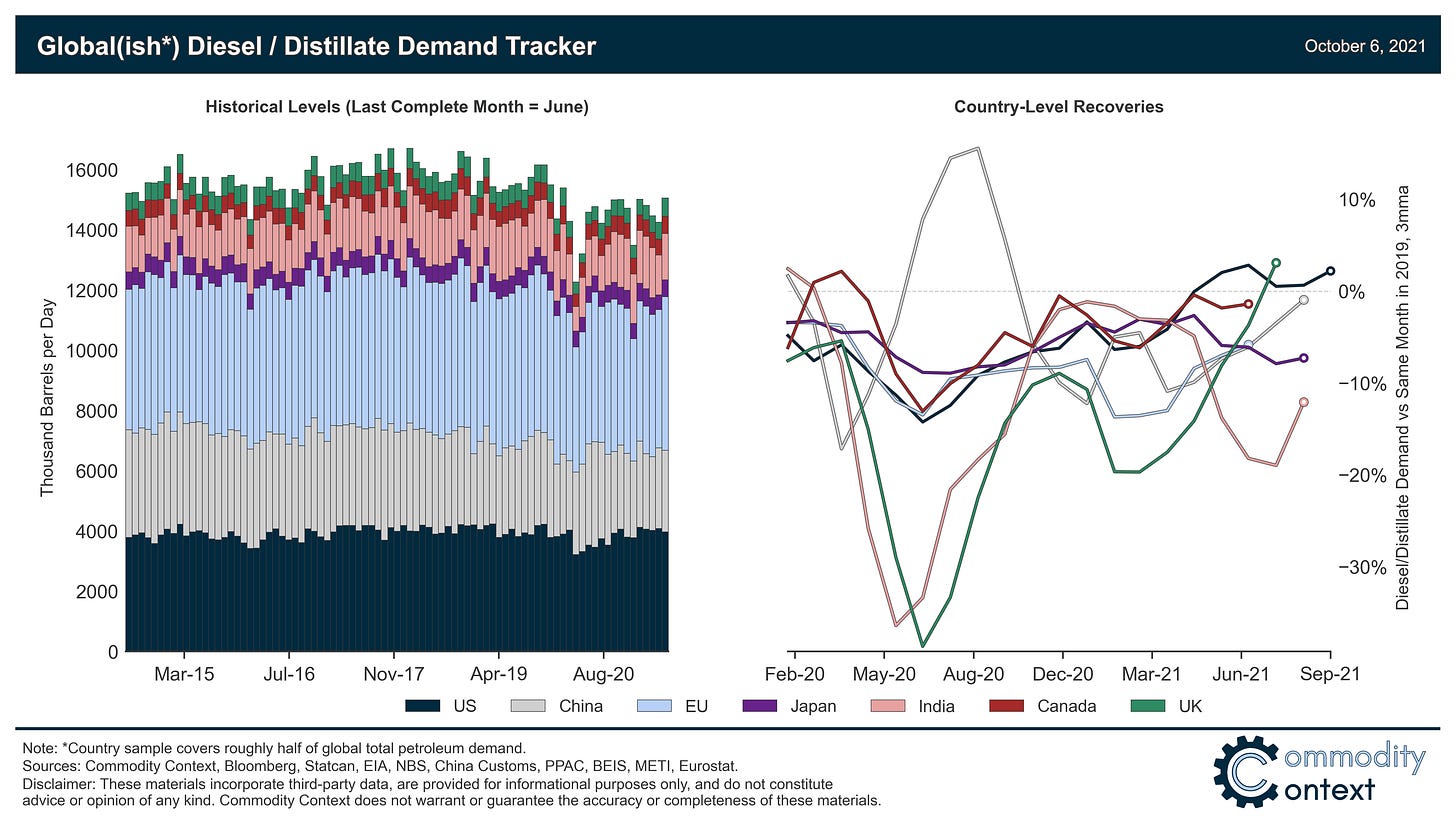

Of the two major road fuels, gasoline consumption has seen a full recovery and has likely already surpassed pre-pandemic volumes, while distillate demand has remained relatively steady over the course of the pandemic.

It’s unsurprisingly jet fuel demand that continues to lag well below the pre-pandemic norm and accounts for the bulk of remaining COVID demand damage, with ongoing volatility in air travel trends.

Jet fuel will be the most important demand recovery category over the coming year, with the potential to contribute upwards of 4 MMbpd overall oil demand lift from June levels if pre-pandemic growth rates can be restored.

While many commodities—lumber, steel, copper, etc.—have experienced a surprising boost to demand as locked-down economies shifted spending away from services toward durable goods, oil continues to struggle with weak demand given still-depressed global mobility, particularly in air travel. While headline oil demand has yet to fully recover to pre-pandemic levels, not all petroleum products have suffered equally. Understanding the differentiated nature of the initial oil demand collapse can give us a better sense of how we are going to get back to and, in due course, exceed pre-pandemic consumption.

Oil demand is complex; a barrel of crude yields many different products as it makes its journey through a refinery. Each of these products have their own unique demand dynamics, which the pandemic has emphasized to the extreme. To illustrate this point, let’s look at what I think of as the “Big 3” petroleum products: gasoline, diesel, and jet fuel.

Quick note: this discussion will use a sample of global consumers for which I have disaggregated demand for different petroleum products at the national level. This sample currently represents just over half of total global petroleum demand. (For a *very* rough total global figure you can multiply the “Historical Levels” on the below charts by 2.) The “Big 3” petroleum products represent roughly 70% of total product demand in this sample.

Gasoline: Comeback Kid Drives the Barrel Higher

The price (of gasoline) at the pump is likely top-of-mind when most people think about the price of oil and the fuel dominates the market for passenger vehicles throughout most of the world. Typically, gasoline demand ebbs and flows seasonally, rising through the summer “driving season” and falling into winter, with the difference between these highs and lows typically in the 12-14% range.

Then along came COVID: cities locked down and we stopped driving into the office, dropping kids off at co-curriculars, and visiting friends and family. Gasoline consumption collapsed by almost 40% but bounced back pretty quickly after the initial lockdowns, only for a second major COVID wave to drive an exaggerated seasonal downturn in Winter 2020/21.

Since then, gasoline demand has fully recovered and likely exceeds pre-COVID levels today, having received a boost from increased highway traffic as summer vacationers opted for pandemic road trips over international air travel. Some of that road tripping is expected to fall back as travelers once again take to the skies over the coming year, but gasoline appears to have mostly returned to its modest pre-COVID growth trajectory.

Diesel: Ol’ Reliable Kept Us Going Through the Worst of the Pandemic

Diesel—also known as gas oil or distillate depending on where you’re living—is the petroleum product most associated with industrial activity like construction, mining, and long-haul transport and is also a significant passenger fuel in regions like Europe. While gasoline consumption yo-yo’ed through the pandemic, demand for good ol’ diesel remained fairly steady. The impacts of the economic downturn were largely offset by the surge in shipping and logistical services: people didn’t buy less, they just had it all delivered directly to their home.

Over the past month or so, diesel demand has experienced a boost on the back of gas-to-oil fuel switching amidst the acute energy crisis in Europe and Asia. Since natural gas prices in crises-stricken regions are well above $200/bbl in oil-equivalent terms, facilities that have feedstock flexibility have been switching from natural gas to diesel or fuel oil (more on the pricing impact at the end). Industry sources put the possible fuel-switching volume in the ballpark of 500 thousand barrels per day, which is certainly material but far smaller than the potential contribution that would come from a recovery in air travel.

Jet Fuel: Pulled Out of a Nosedive but Trouble Gaining Altitude

Jet fuel—end use of which is pretty self-explanatory—was the fuel most battered by the COVID border lockdowns and international travel restrictions. Consumption of jet fuel fell by nearly 75% in the early months of the pandemic and the demand damage has been longer lasting, still down at least 1/3 as of June 2021 compared to where we’d expect it for this time of year.

There is little doubt that jet fuel is the final battlefield of the oil demand COVID recovery, with still-depressed business travel and wary international vacationers at the forefront. When considering how much further jet fuel demand can climb, it’s important to remember that jet fuel demand growth was much stronger than that of gasoline or diesel pre-pandemic. If jet fuel can regain that pre-COVID trend growth rate—i.e., there is no permanent post-COVID behaviour change—then jet fuel demand in this sample could rise by roughly 60% or almost 2 MMbpd (implying upwards of 4 MMbpd globally) from June 2021 levels.

Current air traffic activity indicators remain mixed, however, with strong growth in the US, Canada, and Japan and weakening conditions in China and India. A global deceleration of COVID case counts will provide tailwinds to jet fuel demand into the end of the year, but the risk of reacceleration and continued mix of country-level recoveries—not to mention any potential for longer lasting behaviour change—push any likely global recovery to pre-COVID levels into mid-2022.

Global petroleum product consumption has nearly recovered to pre-pandemic levels, but unsurprisingly jet fuel remains the largest hole in demand. Gas-to-oil switching may provide some near-term support but ultimately presents only a fraction of the potential demand still waiting to recover in air travel. Unfortunately, while the recovery in jet fuel demand is trending positive, air travel activity is increasingly volatile across the globe, which will make this last leg of the COVID recovery particularly bumpy.

PS: a quick note on gas-to-oil fuel switching and crack spreads

The past month has seen a fairly stark reversal of fortune in crack spreads. Gasoline had spent most of the pandemic as the strongest part of the barrel but is now easing back, while diesel and jet fuel have rallied. General jet fuel strength does likely reflect some true air travel recovery, but the recent rally is too steep and correlated with diesel, particularly in Europe and Singapore, to be unrelated; likely that both diesel and jet fuel are being driven higher by oil-to-gas switching (as discussed in the distillate section above) rather than any durable improvement in core end markets. It is also important to note that despite these higher crack spreads, true refinery margins in Europe and Asia are also facing acutely inflated costs of everything from natural gas to electricity to emissions, which likely offsets at least some of the product price gains.