Oil in 2024: A Year of Fragile Stability

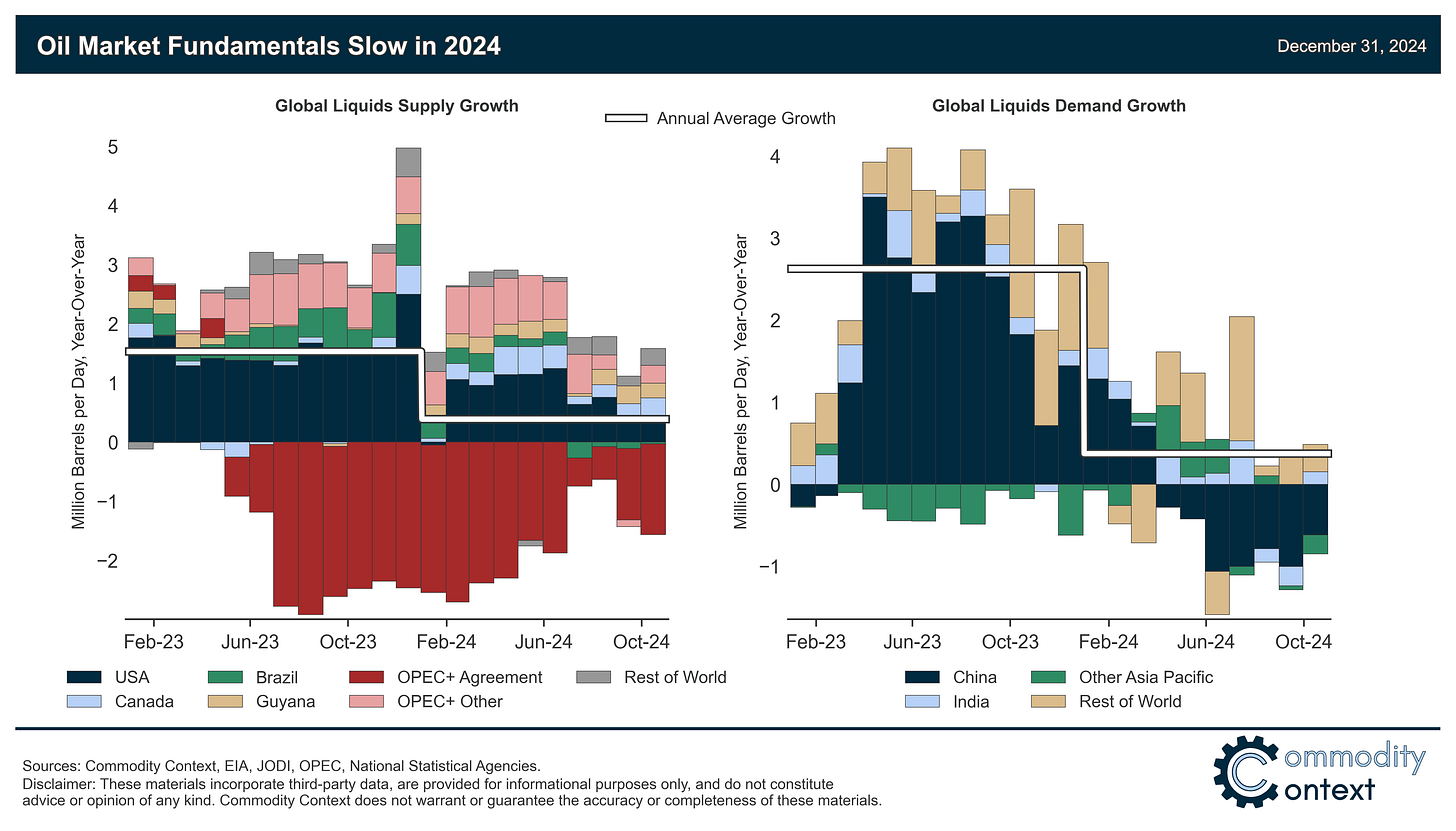

Crude prices declined modestly through 2024 but volatility eased, despite plenty of headline risk, as growth in both supply and demand slowed.

Happy New Years Eve and congratulations on making it through another year in the oil market!

Below you’ll find my reflections on a year that, while often buffeted by politically-risky headlines, ended up trading within the tightest annual range in a half-decade, though that newfound stability was inherently precarious.

If you’re already subscribed and/or appreciate the free summary, sharing my research and hitting the LIKE button is one of the best ways to support my ongoing work.

When juxtaposed with the tumult of the past half-decade, 2024 was a slow and steady year for crude markets.

OPEC+’s ~4 MMbpd of effective production cuts remained the key determinant of crude prices this year; but, OPEC+ achieved this balance by largely sitting on its hands compared to last year’s flurry of new cuts and deals.

But while OPEC+ support was the core pillar, prices only maintained their altitude thanks to slowing non-OPEC+ supply, with the fastest decelerations seen in the US and Brazil.

Chinese demand growth estimates for 2024 have been slashed by 50-75% on the back of historic real estate weakness, direct substitution in heavy trucking, and electric vehicle penetration that, together, look to have prompted the second average annual demand in decades.

Geopolitical events took a backseat despite the onslaught of politically-risky headlines continuing through 2024, while speculative capital flows took a front seat as buying and selling pressure came in increasingly predictable, positioning-driven waves.

2024 was a year of precarious stability in the oil market, especially when compared to the truly unprecedented tumult of the half decade now behind us. While it was by no means a quiet year for the world writ large, geopolitical upheavals failed to durably dislodge the barrel from a steadily sinking range, weighed down by slowing demand growth. Prices reached a high-water mark in the low-$90s (Brent basis) in April before steadily grinding lower and reaching a low in the high-$60s in September on the back of record-setting speculative selling pressure, with contracts spanning just more than $20/bbl over the year but ultimately ending a mere $2.50/bbl lower than where we started in January.

Supply growth slowed as the pace of US output gains decelerated materially on lower prices, Brazil returned to its historically more typical pattern of production disappointments, and OPEC+ worked on holding together its crisis-level of market support. But demand growth also slowed markedly, with China shifting from last year’s dominant impulse to the largest drag on global consumption in 2024.

With all of 2024 now in the rearview mirror, let’s revisit some of the key issues that drove the market this year, including OPEC+’s evolving stance on production cut management, the deceleration of non-OPEC+ supply growth, the renewed contraction in Chinese demand, the tightest annual trading range over the COVID era despite plenty of headline risk, and the prominent role of speculative capital flows that culminated in September’s all-time bearish positioning.

Data Note: All references to 2024 average supply and demand growth levels and paces are year-to-date average estimates through October, given that we won’t have initial for the full year until mid-February. I’m noting this up front to make for smoother reading without constant YTD modifiers throughout the remainder of the piece.