Oil Context Weekly (W41)

Crude prices ended the week modestly higher as the barrel continued to get whipped back and forth on speculation ahead of Israel’s anticipated retaliatory strike against Iran

I joined CBC News last Friday [watch here] to discuss the oil market’s rally on Iran concern. And then the Financial Post [watch here] to review US election risks as well as Chevron’s asset sale to CNRL.

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

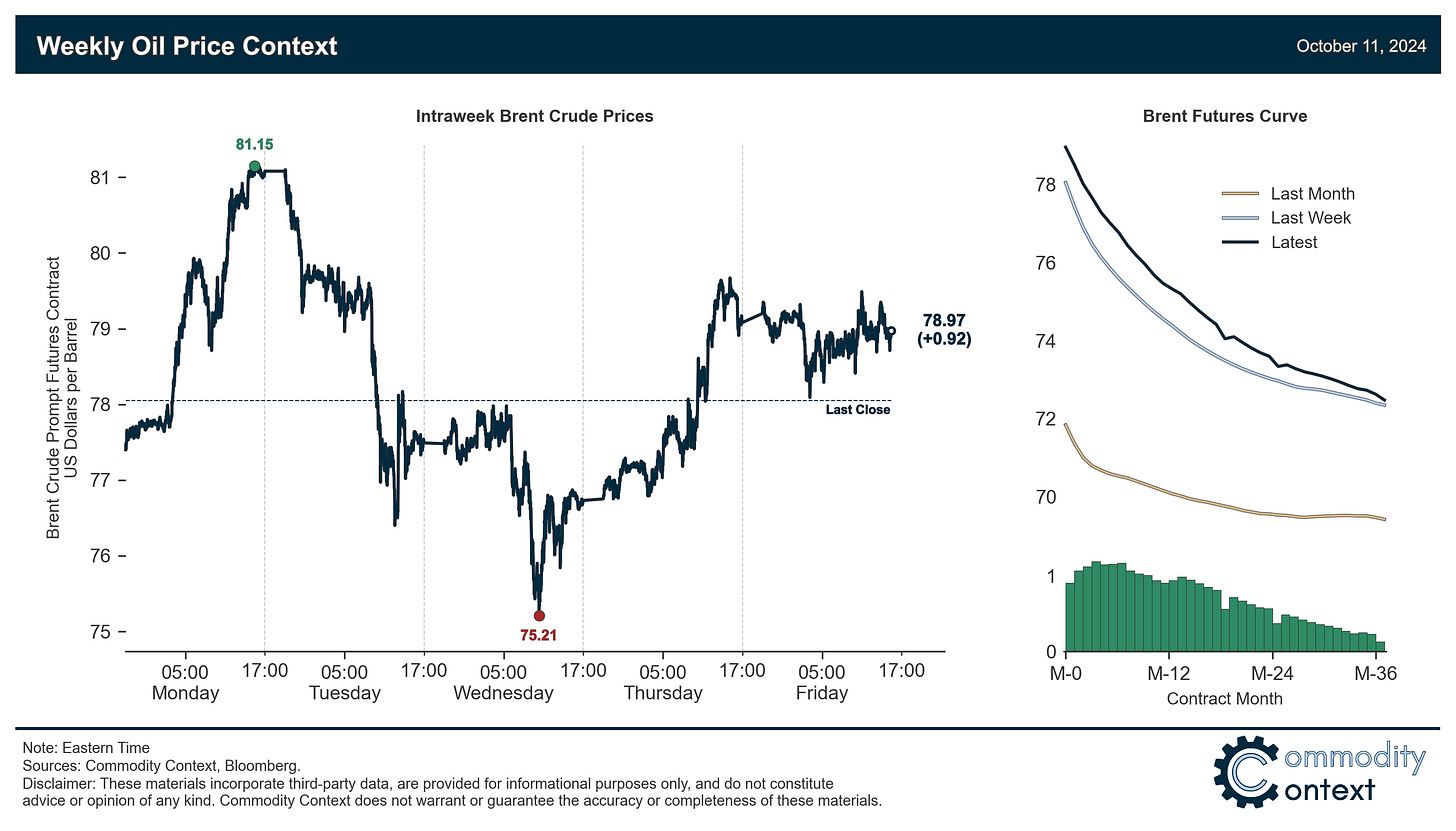

Flat prices ended just shy of a buck a barrel higher, with Brent closing around $79/bbl—down $2/bbl from Monday’s highs but up $4/bbl from Wednesday’s low—as the market waits for the next round of hostile exchange between Israel and Iran.

Timespreads have provided valuable checks on flat price exuberance, correctly presaging both the unsustainability of Monday’s continued rally as well as the violent pullback through Wednesday; however, while still maintaining healthy backwardation, term structure deteriorated overall with both prompt calendar spread and CFDs ending the week narrower.

Inventories data revealed weekly draws across all three tracked hubs, with US refined product draws—especially in gasoline—helping offset a build in crude amidst volatile, hurricane-disrupted data.

Refined Products continue to strengthen, with diesel margins rising modestly and gasoline crack spreads in NYH jumping back into the double digits (vs Brent) for the first time this month.

Positioning data confirmed that speculators bought the most crude futures and options contracts since March 2023 over the past week-through-Tuesday, bringing those positions back to the lower end of reasonable estimates of “neutral” positioning (i.e., level at which positioning normalization risk is directionally balanced); the crude market has now mostly exhausted its speculatively-oversold rocket fuel that helped propel Brent back toward $80/bbl.

As Well As plenty of ammunition for crude’s vibe-based trading, market still waiting for next exchange of fire between Israel and Iran, the delicate diplomatic reality of the Gulf monarchies in the mounting Israel-Iran conflict, Baghdad appears to finally have gotten control over chronically problematic Kurdish crude production, and Chevron’s sale of Western Canadian oil assets to CNRL furthers the ongoing Canadianization of the industry.