Oil Context Weekly (W38)

Crude prices fall despite an early-week rally on Russian supply concerns, while Brent term structure begins to improve and refined product margins remain seasonally elevated.

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

At the end of this report you’ll also find my weekly, 40-page Oil Market Positioning Data Deck, tracking and contextualizing shifts across the most important paper petroleum contracts.

🎙️ In the latest episode of the Oil Ground Up podcast, I was thrilled to get the opportunity to speak with Dr. Ilia Bouchouev, the former President of Koch Global Partners where he launched and managed the global derivatives trading business for over 20 years, about his work on the oil market’s Virtual Barrels—see his book and new YouTube channel of same name.

We discussed the who’s who in Commitments of Traders report and the relationship between oil market fundamentals, market agents (different types of participants), and ultimate crude oil price discovery. Come for the fascinating theoretical frameworks informed by Ilia’s real world experience, stay for how they can help you better understand the current transitional oil market. [LINK]

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

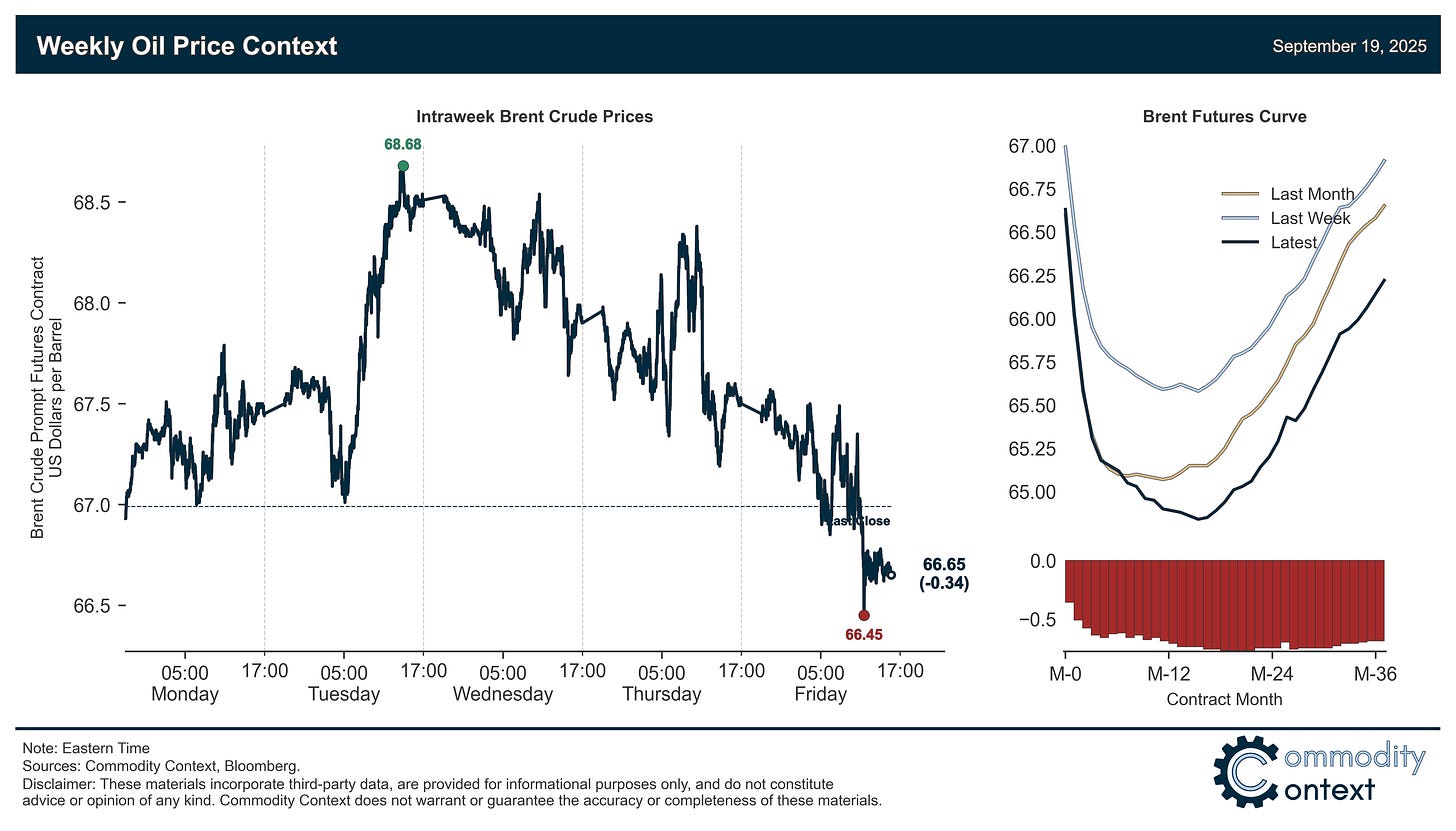

Flat Prices rose initially—peaking below $69/bbl (Brent basis) on Tuesday following reports of potential forced Russian export cuts—but prices gradually drifted lower on demand concerns and easing sanctions-related tensions, with Brent ending the week just below $67/bbl.

Timespreads were mixed: Brent crude prompt spreads climbed, WTI remained flat-ish, and Dubai spreads fell but from uniquely lofty prior levels—the more stable Dec/Dec calendar spreads strengthened for all three.

Inventories data leaned bullish as stocks fell in Singapore and ARA Europe but US headline stocks built modestly (though US crude stocks experienced a large, late-season draw); broadly, we continue to see persistent reaccumulation of previously-depressed stocks of middle distillates like diesel and gasoil.

Refined Products, like gasoline and diesel, continue to show seasonal strength, benefiting (briefly) from attacks on Russian refineries but, more structurally, being held aloft by bottlenecks and unexpected outages across key refining regions.

Market Positioning data confirmed that speculators were net buyers of crude futures and options contracts through the week ending Tuesday, which also happened to be the high-water mark for prices; while surely lower today given the subsequent selloff, even at these levels the potential upside impulse of this deeply depressed speculative position is far larger than the risk of further sharp selloffs.

As Well As pressure on Russia’s oil industry mounts and Iraq reportedly edges closer to restarting Kirkuk-Ceyhan (again).