Oil Context Weekly (W37)

Crude prices rise despite generally weaker term structure amidst deeply oversold speculative positioning likely headed higher again following a flurry of geopolitical headlines.

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

At the end of this report you’ll also find my weekly, 40-page Oil Market Positioning Data Deck, tracking and contextualizing shifts across the most important paper petroleum contracts.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

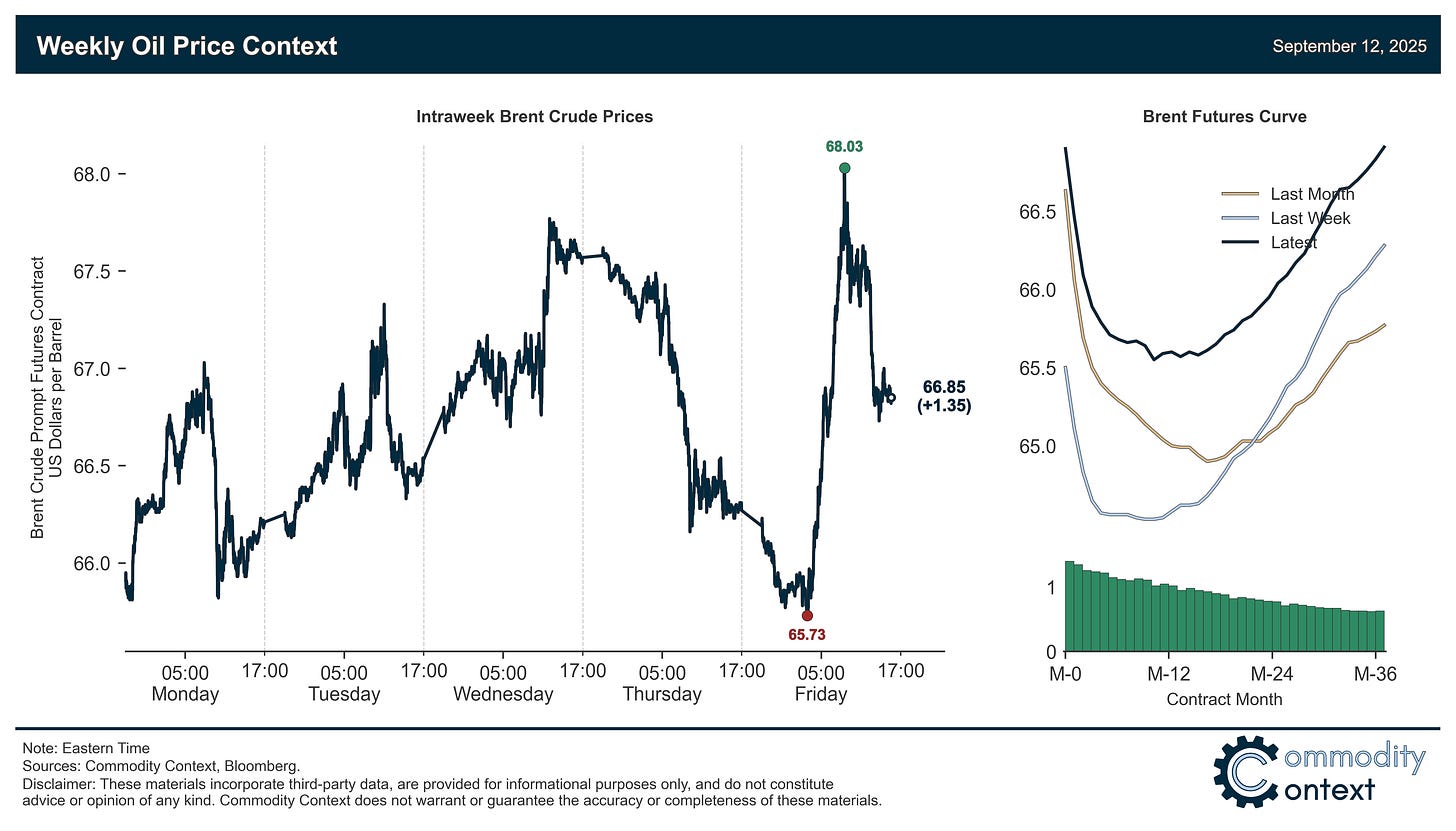

Flat Prices rose roughly $1.50/bbl for Brent to finish around $67/bbl, with plenty of geopolitical headlines—from Russia to the Middle East—rustling the already oversold speculative paper barrels despite the confirmation of yet more planned OPEC+ crude production and the steady march of increasingly bearish fundamental outlooks from forecasters like the IEA.

Timespreads for Brent and WTI spent the week drifting lower before Russia-related headlines modestly perked up the front of the Brent curve, which still ended with prompt around 45c compared to WTI’s even weaker sub-30c level; Dubai, meanwhile, bucked this weakening trend and prompt spreads rose from 90c to 120c through Thursday before exploding higher to around 160c per barrel through the end of Friday trading.

Inventories data leaned bearish thanks to a very large US headline build that drowned out draws in ARA Europe and Singapore; US stocks of crude and distillate are back at or above year-ago levels—after spending all year well below—and middle distillate stocks in ARA and Singapore are, similarly, in a much healthier position than the concerning levels of two months ago.

Refined Products markets eased slightly on the week but remain seasonally strong, with front-end structure of both the US gasoline and diesel trending more backwardated over the past month.

Market Positioning data confirmed that speculators returned to heavy crude selling last week that brought their overall position back to near recent lows and well below levels seen earlier this year, which continues to tilt positioning-related risk to the upside and make prices especially sensitive to geopolitical headlines like we saw this week.

As Well As Ukrainian drone strike interrupts key Russian oil export terminal, US urges G7 allies to impose tariffs on India and China in retaliation for Russian oil purchases, and the IEA looks set to resurrect its discarded business-as-usual scenario case.