Oil Context Weekly (W9)

Crude prices weakened alongside other major risk assets this week as hot money continued to pull back from oil, while term structure stabilized signaling a lack of fundamental pullback justification.

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

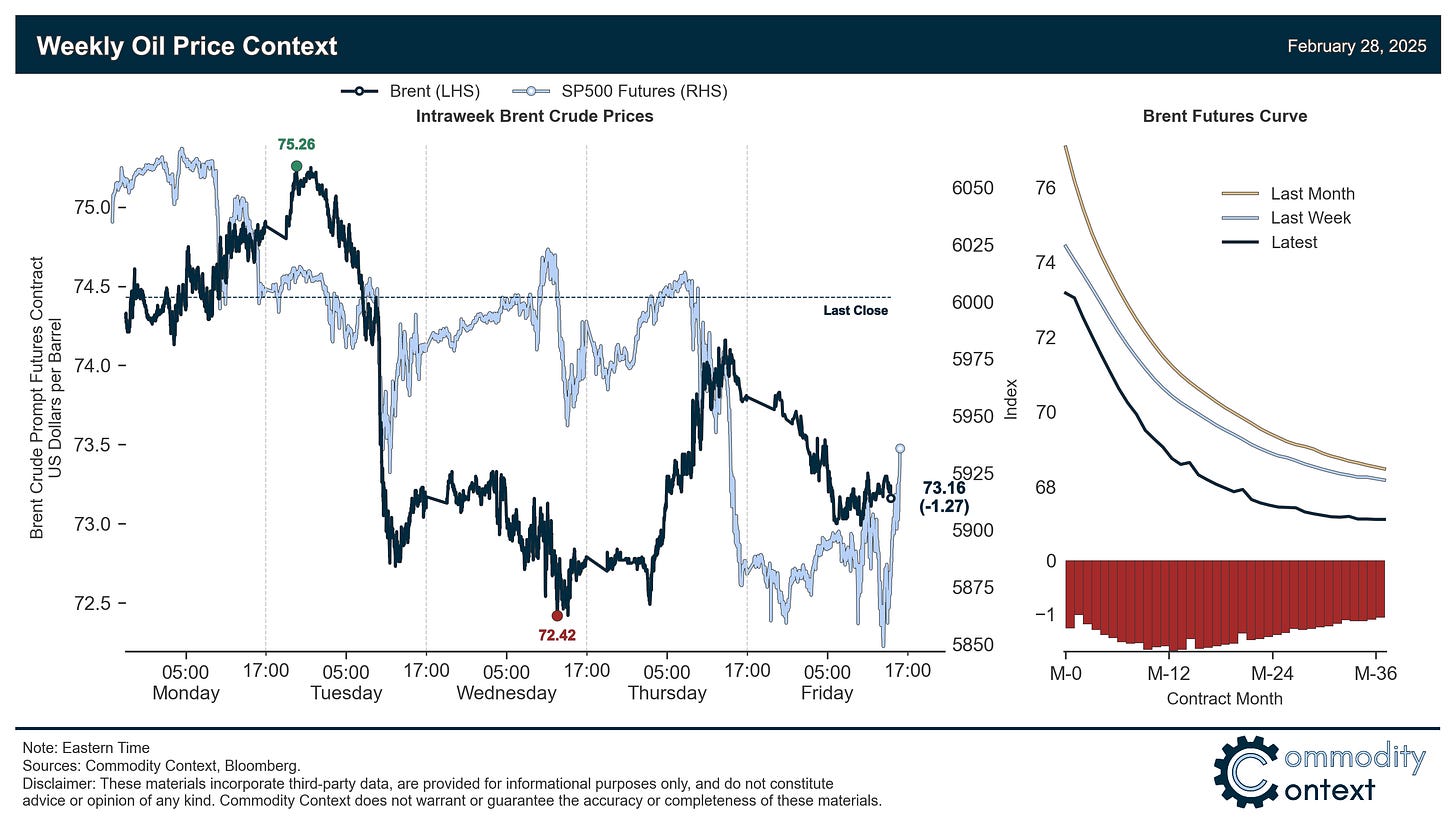

Flat Prices fell ~1.25/bbl for Brent to finish the week just above $73/bbl, pulled lower by cross-asset risk-off flows accentuated by the largest withdrawal of hot money since last September.

Timespreads were flat-to-up in contrast to weaker flat prices, signaling a stabilizing physical market vs. the volatile and negative-tilt to broader cross-asset sentiment.

Inventories drew across all major tracked hubs, with the market for crude and dirty products, like fuel oil, far tighter than still-oversupplied clean products, like gasoline and diesel, that built counterseasonally in the US.

Refined Products crack spreads weakened given sizable, counterseasonal builds of both US gasoline and diesel; both major road fuels are running softer than this time last year.

Market Positioning data revealed that speculators embarked on their steepest weekly selling of crude futures and options contracts since last September, bringing speculative positions into rough balance and while momentum may continue weighing on prices over the next week or two the balance of durable positioning risk has once again shifted bullish.

As Well As Trump moves to clamp down on Venezuela's oil trade as he axes licenses, Atlanta Fed US GDP nowcast craters on tariff front-running, heavy sour crude and high sulphur fuel oil markets tighten, and we once again await a last-minute decision on US tariffs against Canada and Mexico, which are set to take effect on March 4th.