Oil Context Weekly (W51)

Crude price fell to lowest level since 2021 amidst intense speculative selling pressure—and likely record net-short spec position—before Trump’s Venezuela blockade declaration arrested the rout.

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

🎙️ On the final Oil Ground Up podcast episode of the year, I spoke with Andy De La Rosa (TejanoBrown on Twitter) about his 15 years of experience in the wireline industry: how it works and how it’s changed over the past decade and a half.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

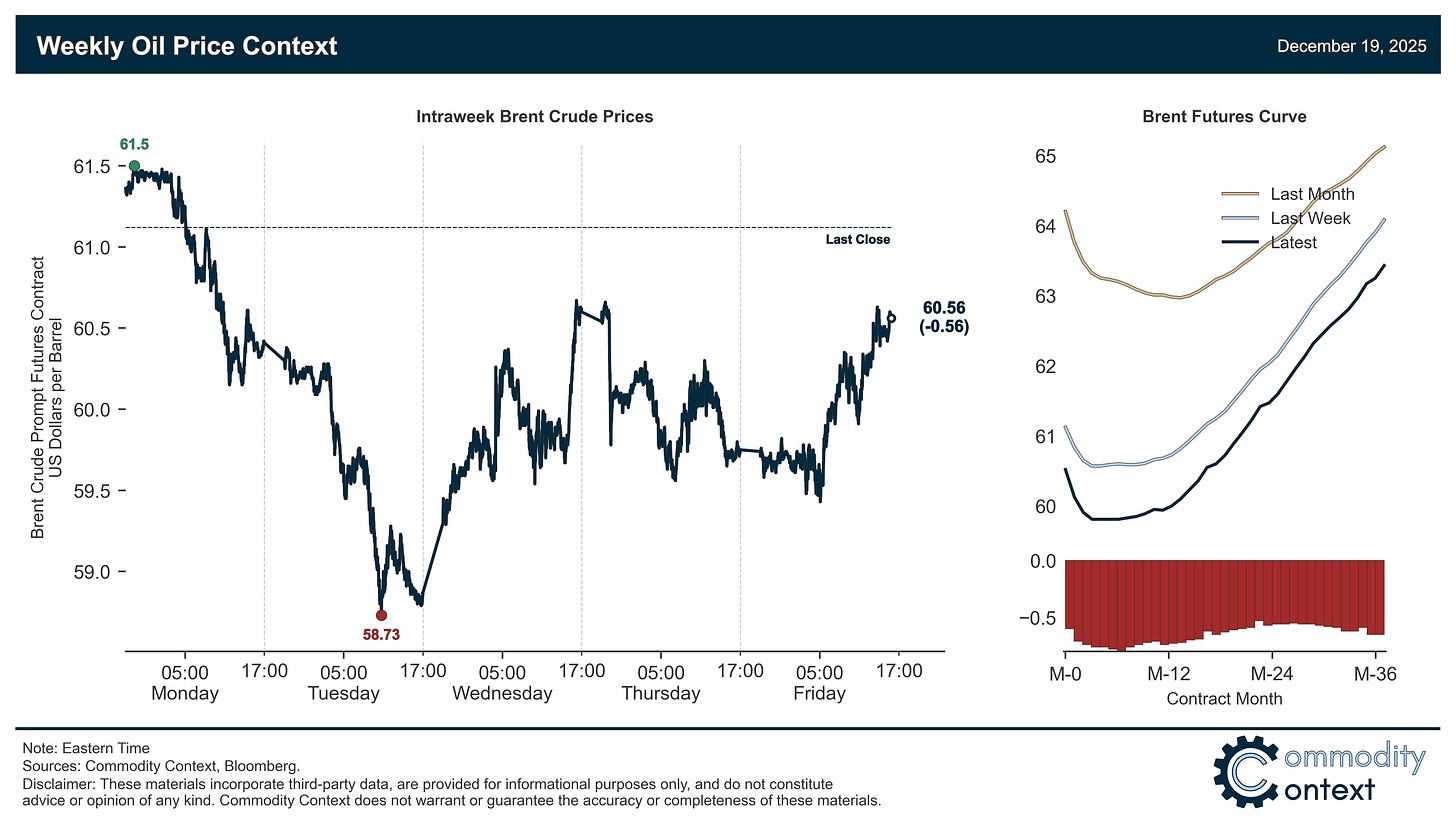

Flat Prices ended less than a dollar per barrel lower, just above $60/bbl Brent, after bouncing back from the lowest level since early 2021 (<$59/bbl Brent) on Tuesday amidst intense speculative selling pressure.

Timespreads stayed effectively flat in contrast to the decline in flat pricing, with prompt timespreads hitting their weakest point on Tuesday, alongside the flat price rout, before recovering.

Inventories data was mixed between headline builds in the US and ARA Europe and a draw in Singapore; overall, commercial stocks of light distillates, like gasoline, are rising at a faster than seasonal pace while inventories of crude and middle distillate remain relatively low.

Refined Products crack spreads fell further, bringing the refining margin for both gasoline and diesel back to around its seasonal norm heading into the final weeks of 2025.

Market Positioning data reveals speculators were, again, enormous sellers of crude and gasoil contracts; this paints an intensely overstretched, bearish picture of current crude positioning: Brent is not far off a record speculative short and lagged WTI data shows a record short position as of early December.

As Well As the latest on Venezuela as Trump declares “TOTAL AND COMPLETE BLOCKADE OF ALL SANCTIONED OIL TANKERS”.