Oil Context Weekly (W50)

Crude prices fell despite Trump’s seizure of a Venezuelan tanker and more Ukrainian attacks on Russian oil in a show of either the market’s apathy or the weight of worsening fundamentals—perhaps both?

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

🎙️ In the latest episode of the Oil Ground Up podcast, I was joined by Doug Terreson, former Head of Energy Research at Evercore ISI and Morgan Stanley, to parse the dynamics of the currently chaotic and confusing global oil market in the context of his decades analyzing the industry, jumping from his call in the late-1990s for “The Era of the Super Major” to the modern Super Surplus that has the market panicked about prices next year.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

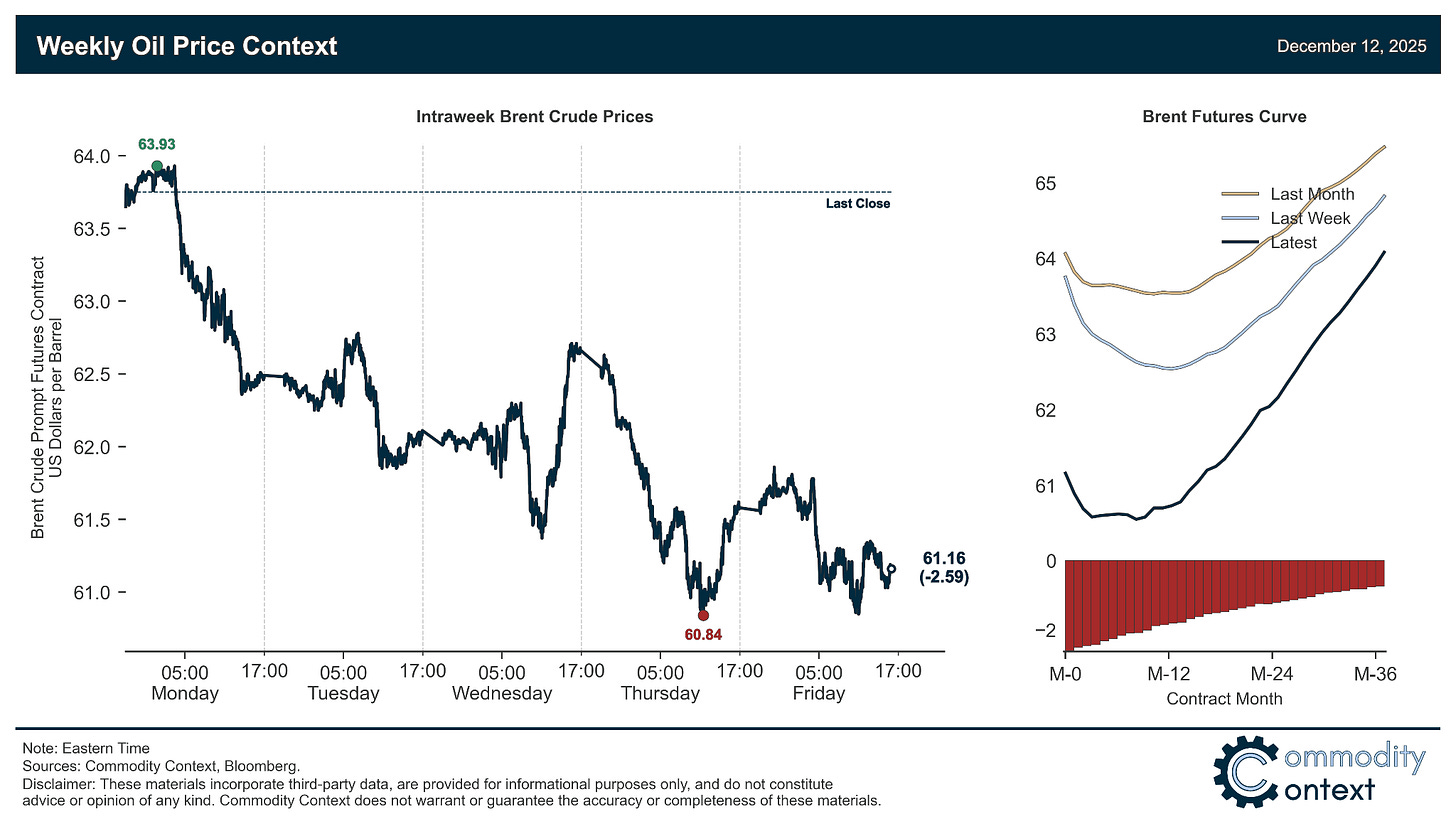

Flat Prices fell roughly $2.50/bbl for Brent to close just above $61/bbl (<$1/bbl higher than year-to-date lows set in April) as the barrel continued to grind lower despite a never-ending series of flashy headline risks, punctuated, this week, by the US seizure of a shadow fleet tanker carrying Venezuelan crude.

Timespreads weakened again, with prompt spreads of all major crude benchmarks falling 10-30c per barrel; Dubai crude saw its prompt spread hammered hardest (~-30c) but beware the pattern of weakening spreads through the first half of the month (and strengthening ahead of monthly contract expiry).

Inventories data were mixed between builds across Singapore and ARA Europe and a headline draw in the US; in the US, draws were driven by crude and NGLs but refined products built aggressively.

Refined Products margins continued to fall back to earth as gasoline cracks fell to ~$12.50/bbl vs. Brent (vs. a seasonal norm of ~$10) and diesel cracks fell to ~$31.50 (vs. a seasonal norm of ~$25/bbl and an ex-crisis norm of more like ~$20/bbl or less)

Market Positioning data confirmed that speculators were once again sizable sellers of Brent crude contracts, pushing the net spec position in Brent to well oversold levels and tilting positioning-related price risk to the upside; on the other hand, the ongoing deflation of the previously overbuilt spec position in ICE gasoil contracts has helped drive the decline in middle distillate margins mentioned above.

As Well As Trump escalates standoff with Maduro by seizing a Venezuelan tanker, more Russian tankers (and now offshore production assets) go boom, misleading headlines decry “billion barrel glut” on water, the Trump admin confusingly approves of the Ottawa-Alberta energy pact explicitly meant to reduce Canadian oil export dependence on the US, and an ounce of silver is now worth more than a barrel of oil.