Oil Context Weekly (W4)

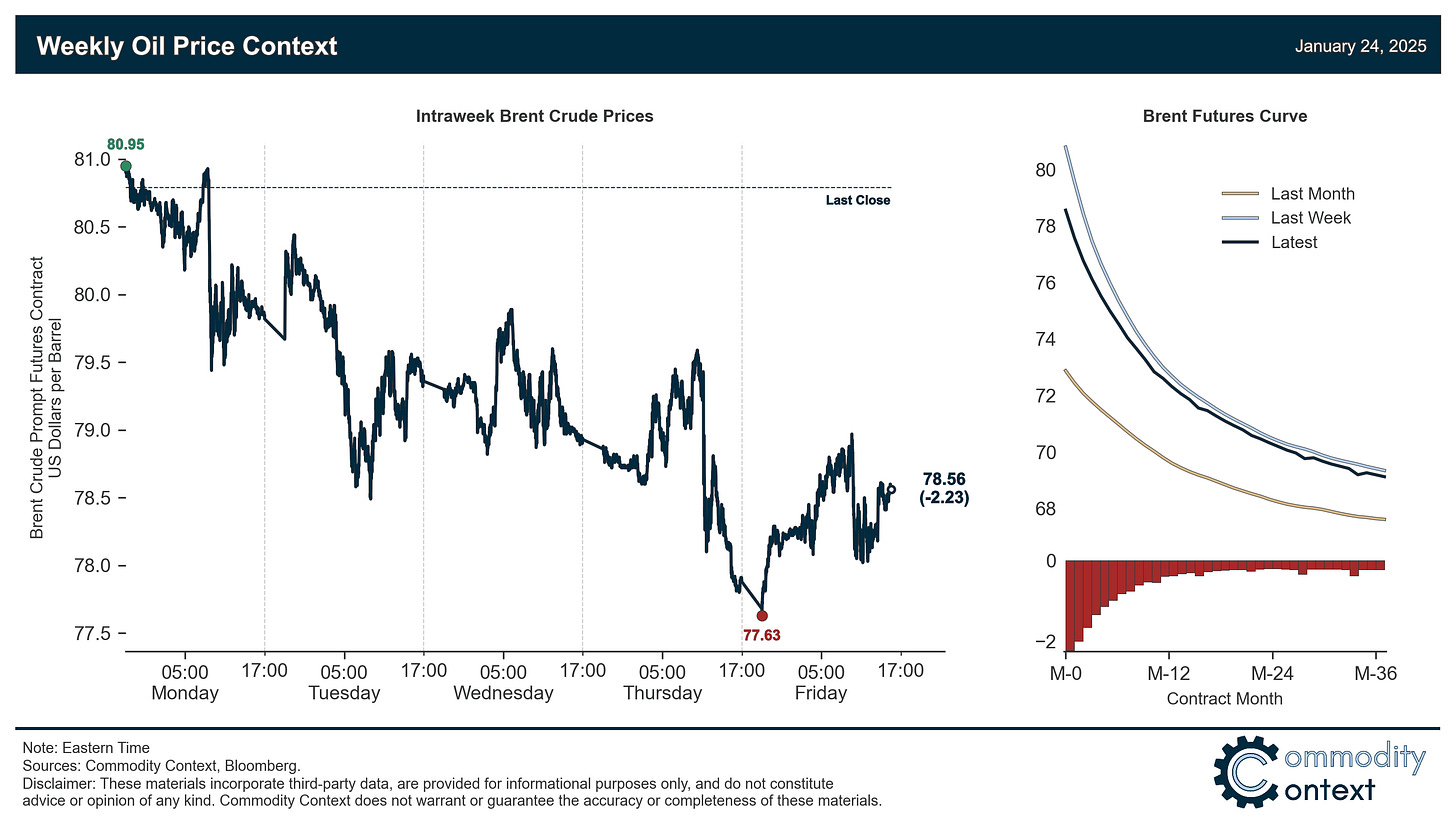

Crude closed lower on the week for the first time in 2025, with flat price declines led by prompt timespread weakness and punctuated by Trump once again attempting to jawbone the barrel lower.

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

It was a busy week in media, particularly concerning the ongoing—though, thankfully, now delayed—threats of oil-inclusive tariffs against Canada and Mexico. I spoke with

Bloomberg Opinion on how Trump’s Dream of Energy Dominance Relies on Canada,

CBC News about the physical, economic, and political fault lines exposed by the US tariff threat,

Globe and Mail about What Trump’s Energy Dominance Agenda Means for Canada, and

CBC News about the US’ ongoing structural dependence on Canadian crude despite Trump’s comments in Davos.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

Flat Prices closed lower on the week for the first time in 2025 following first a pullback of the delay of North American tariff risk followed by a second leg lower on the back of Trump’s public urging that OPEC hike production to lower crude prices.

Timespreads fell steadily from last week’s high-water mark for prompt backwardation before, at least temporarily, rebounding in Friday trading; while safely off recent highs, prompt Brent backwardation remains nearly double the level at which contracts began the year.

Inventories drew across the board; refined product stocks remain comparatively high while crude inventories are achingly low for this time of year, especially in the US where we haven’t yet seen seasonal building.

Refined Products weakened as both gasoline and diesel margins pulled back; gasoline crack spreads drifted lower against seasonal expectations of gradual firming while diesel margins fell in near-perfect lockstep with crude prices.

Investor Positioning data revealed that speculators were, surprisingly, net buyers of crude over the past week through Tuesday, bringing us to a fresh highest level since April 2024; that speculative length continued to accumulate over this past week, further amplifying my concern with the current notably overstretched positioning environment—there’s very little room for near-term price upside from here and an increasingly acute risk that prices rapidly pullback as profits are taken.

As Well As Trump’s first week: tariff updates, a flurry of oil-relevant executive orders, and the new US president urges OPEC to lower crude prices in his first week in the office.