Oil Context Weekly (W46)

Ukrainian attack on major Russian oil port shocks oil market back to life just as WTI was on the edge of prompt contango.

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

🎙️ On the latest episode of the Oil Ground Up podcast, I spoke with Francisco Monaldi, the director of the Latin America Energy Program at the Center for Energy Studies at Rice University’s Baker Institute for Public Policy, about the historic build-up of US military forces off the coast of Venezuela and what it might mean for the Venezuelan oil industry.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

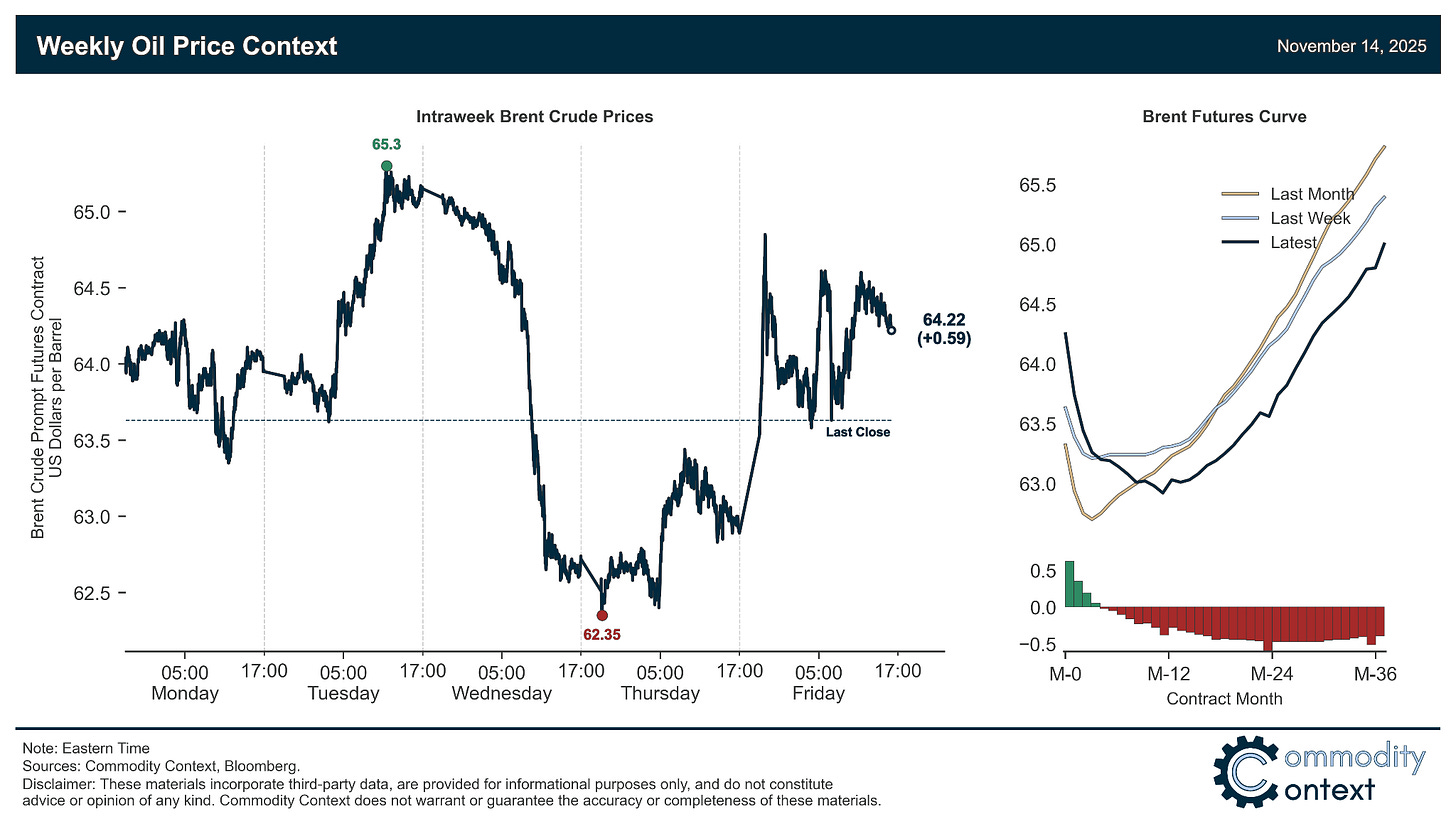

Flat Prices ended the week less than $1/bbl higher, with Brent closing just above $64/bbl; prices fell sharply on Wednesday on little news before rocketing higher again on Thursday evening following a Ukrainian missile and drone attack on a major Russian oil port.

Timespread weakness was initially concentrated in WTI crude, which slipped into a penny of outright prompt contango, but the front-end of all major benchmark curves was sent sharply higher following the attack on Russia’s port of Novorossiysk.

Inventories data leaned bearish with across-the-board builds reported for the US, ARA Europe, and Singapore; US crude and crude-derived fuel stocks remain very low while ARA reported a very large crude inflow pushing it to the top of its seasonal range.

Refined Products continue to strengthen and the 3-2-1 crack hit its highest level since early-2024, with both gasoline and diesel prices outperforming thanks to low US inventories, ongoing—and entirely justified—Russian supply concerns, and the return of speculative inflows.

Market Positioning data showed modest speculative buying of Brent contracts, the net position of which stands not far off the midpoint of recent experience, but provided no particularly strong directional risk; gasoil, on the other hand, is beginning to look overstretched, with speculative gross length in ICE gasoil contracts this week hitting their highest level since 2022.

As Well As Ukrainian forces strike major Russian oil port, latest OPEC outlook chips away at hope for market bulls, IEA’s resurrected Current Policies Scenario forecasts steady oil demand growth through 2050, Carlyle assessing acquisition of Lukoil’s foreign assets, and Enbridge approves expansion of Canadian crude export capacity to US.