Oil Context Weekly (W45)

Crude prices fell, weighed down by both fundamental pressure and a broader equity market pullback; futures curves have resumed their descent toward prompt contango while refined product markets spiked

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

🎙️ On the latest episode of the Oil Ground Up podcast, I was joined by Kevin Birn, Global Head, Center of Emissions Excellence and Chief Analyst, Canadian Oil Markets, at S&P Global, to discuss the current position and both pipeline- and policy-dependent future of Canada’s oil sands industry.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

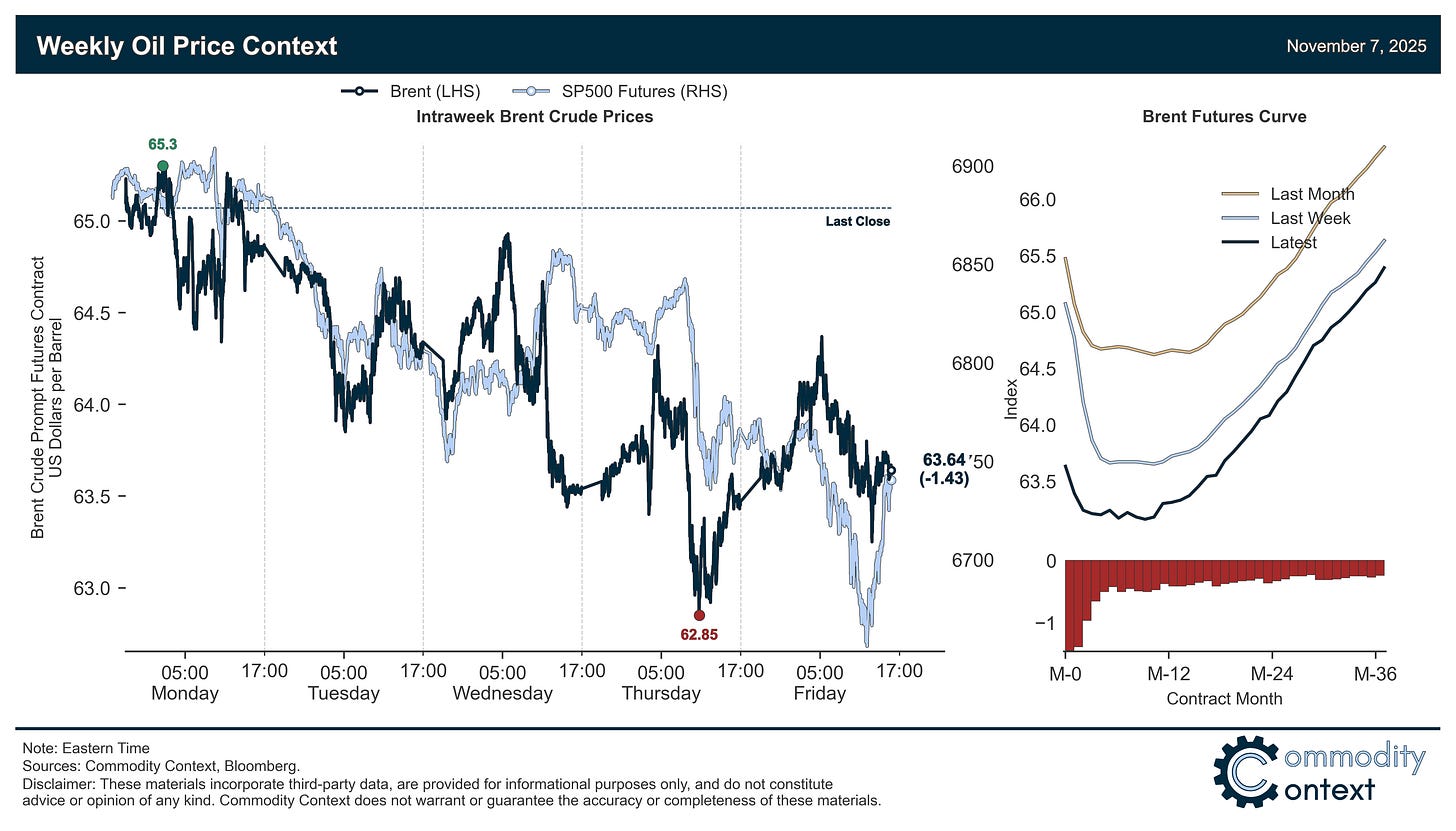

Flat Prices tumbled ~$1.50/bbl, with Brent ending the week below $64/bbl and WTI just below $60, straining under both fundamental pressure and caught in the pullback in broader risk assets.

Timespreads continued weakening as all major crude benchmarks, while holding onto slim prompt backwardation, marched toward prompt contango; at least thus far, the kneejerk tightness after the shock of additional US sanctions on Russian oil exporters has proven short-lived.

Inventories data revealed modest moves compared to the volatility of recent weeks; refined product stocks look tight in the US and gasoline inventories, in particular, are falling more rapidly than normal, scraping the bottom of its trailing seasonal average.

Refined Products margins shot higher thanks to ongoing refining capacity tightness—related to ongoing Ukrainian attacks on Russia’s refining fleet—and a rally that received an additional shot in the arm following the Trump administration’s public rejection of the Lukoil-Gunvor deal, which complicates the legal status of several refineries in Europe.

Market Positioning data confirmed that speculators were modest sellers of Brent crude over the past week through Tuesday, paring back some of the prior week’s massive sanctions-driven short-covering rally; speculative positioning in Brent remains in relatively-neutral territory, with plenty of upside if headlines allow but ample downside, too, given our recent bearish record. (And we still have no visibility on WTI given the US shutdown.)

As Well As OPEC+ blinks on production hikes for the new year, US kills Lukoil asset sale to “Kremlin Puppet” Gunvor, and Carney conditionally sets stage for scrapping Canada’s proposed oil and gas emissions cap.