Oil Context Weekly (W44)

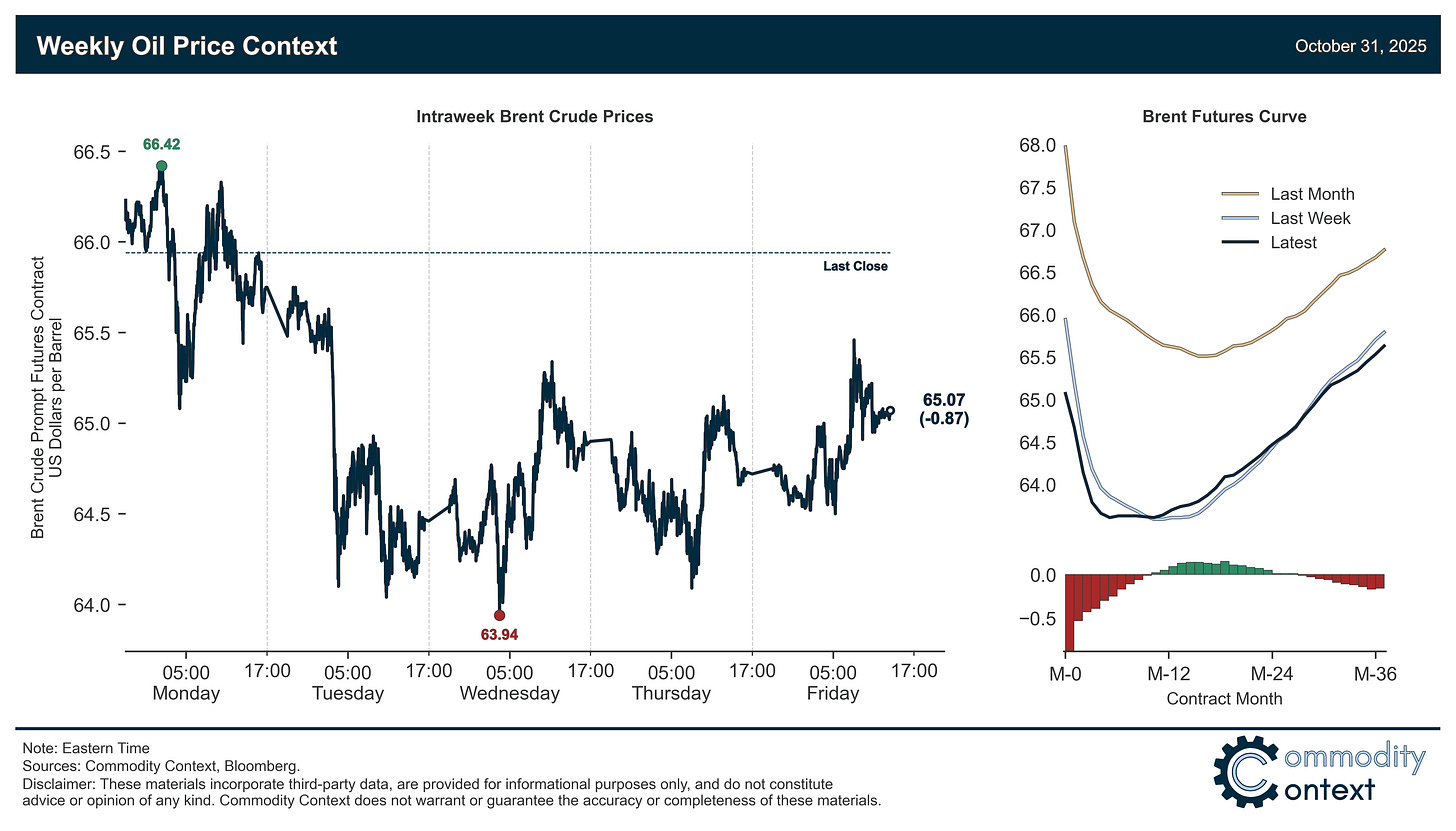

Oil prices pull back from initial Russia sanctions shock as concerns wane, and term structure slumps despite gargantuan US stock draw.

🎃 Happy Halloween Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

Flat Prices pulled back from last week’s Russia rally as concerns over the degree to which these new sanctions would knock a substantial volume of barrels off the market began to wane because both workarounds emerged and Trump signaled a less-than-overwhelming enforcement bias.

Timespreads pulled back from the heights of last week’s Russian sanctions rally but Dubai, in particular, continues to experience tighter prompt markets that likely reflect ongoing diversification demand from Indian refineries hedging their exposure to Russian flows; the Brent futures curve slipped weaker.

Inventories data leaned heavily bullish thanks to a truly gargantuan decline in US commercial petroleum stocks, which fell by their largest weekly volume so far this year; last week’s strange—and likely erroneous—build in Singaporean middle distillates stocks was more than reversed, as expected.

Refined Products strengthened further, with both gasoline and diesel cracks rising ~$2/bbl and both fuels sitting well above year-ago margin levels; refined product markets are benefitting from low and falling inventories combined with notable Russian sanctions risk in the middle distillates market.

Market Positioning data confirmed that speculative positioning in Brent crude contracts rose at its third-fastest pace on record, rising a colossal 119 million barrels net from deeply oversold levels back to a more neutral position; this shifts the market from a solid bullish tailwind to a more balanced risk profile.

As Well As OPEC expected to again announce a production hike this weekend, new Russia sanctions begin, and the Trump administration is reportedly planning imminent strikes on Venezuela.