Oil Context Weekly (W43)

Crude prices and term structure rise from the dead 🧟 on the back of surprisingly harsh US sanctions on Russian oil that threaten to dramatically tighten what were weakening oil market balances

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

📰 I spoke with the Financial Times’ Unhedged column about what the latest round of harsher US sanctions on major Russian oil exporters means for the crude market: “This has the potential to be big, because it essentially applies Iran-level sanctions to Russian oil flows for the first time,” says Rory Johnston of Commodity Context. “Everyone [in oil markets] is trying to cover their butts in case these sanctions do stick, but the market so far is sceptical. We’ve heard this story a dozen or more times this year [but] nothing ever happens … This is either a massive, massive deal — or more nothing.” Read (much!) more on this topic below.

🎙️ In the latest episode of the Oil Ground Up podcast, I spoke with Arjun Murti, a Partner at Veriten LLC, author of the SuperSpiked Substack, and who previously spent decades on Wall Street before eventually serving as partner and co-director of Americas Energy Research at Goldman Sachs. We discussed the transition from super cycle to super volatility, as well as how best to anchor yourself in a market increasingly defined by foundational data disagreements between major public industry data providers like the IEA and OPEC.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

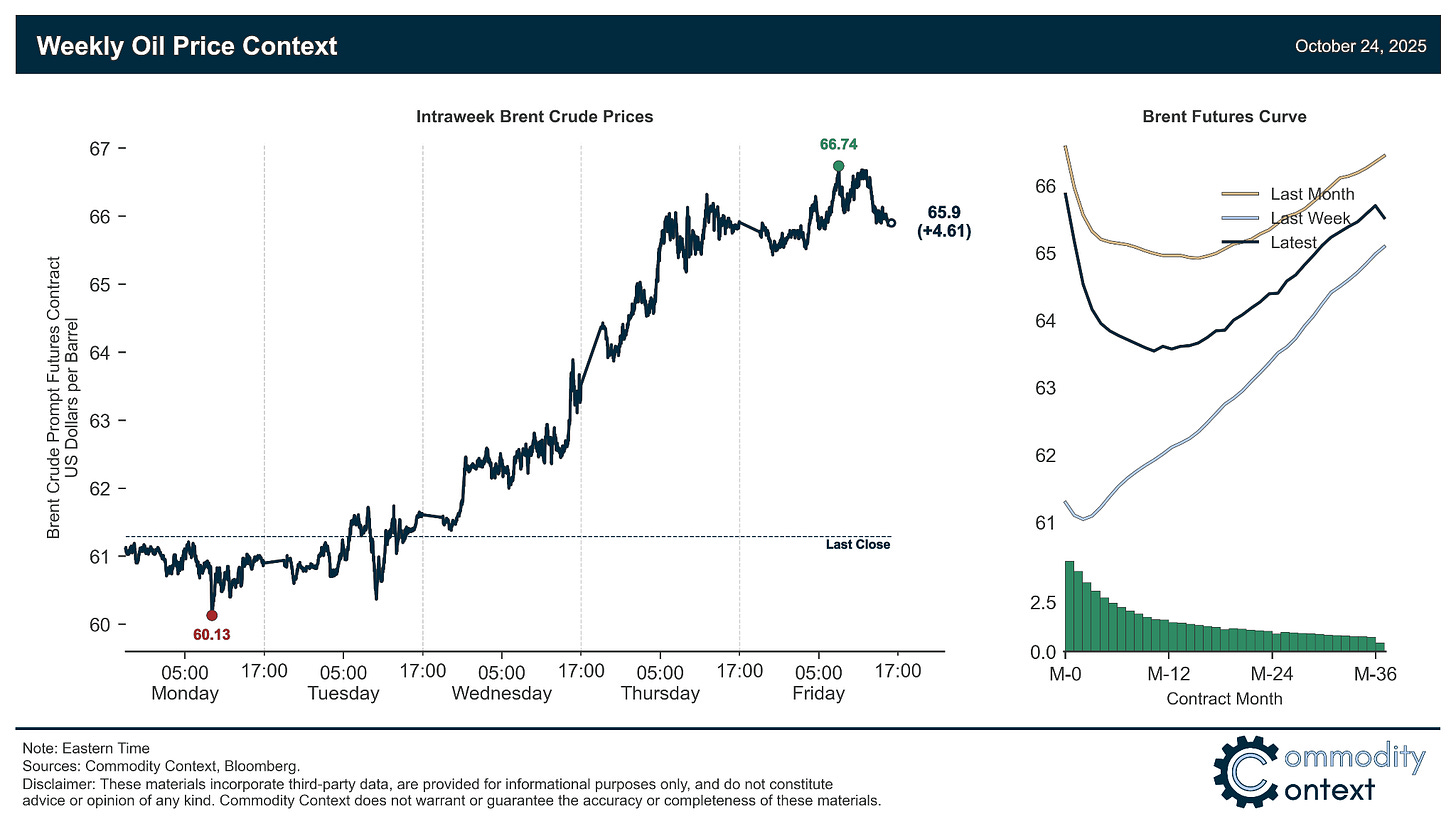

Flat Prices shot nearly $5/bbl higher on the back of news that the US was imposing harsher than expected sanctions on major Russian oil exporters; Brent climbed back from the edge of the $50s to settle just shy of $66/bbl.

Timespreads rocketed higher, reversing—and then some—the steady weakening over the past month in just two days following the US-Russia sanctions news; the curve shot up from the brink of across-the-board contango back to another pronounced “smiley-face”.

Inventories data revealed declines for the US and ARA Europe but Singaporean stocks rose—only thanks to a very suspicious (and likely erroneous) spike in the stocks of middle distillates, though.

Refined Products were also impacted by the Russian sanctions shock as diesel—for which Russia is a major exporter—doubled the crude prices gains; diesel crack spreads were pushed up by ~$5/bbl while gasoline saw its refining margin weaken on the rising cost of crude feedstock.

Market Positioning data revealed that speculators were once again massive sellers of Brent contracts through Tuesday, bringing the net spec position to its lowest since the September 2024 net-negative experience and gross shorts to their highest level on record—this primed the market for the explosive Russia-rally we witnessed over the latter half of the week.

As Well As what these US sanctions on major Russian oil companies mean for Moscow’s oil trade, the broader oil market, and how—if at all—they change the 2026 oversupply story.