Oil Context Weekly (W42)

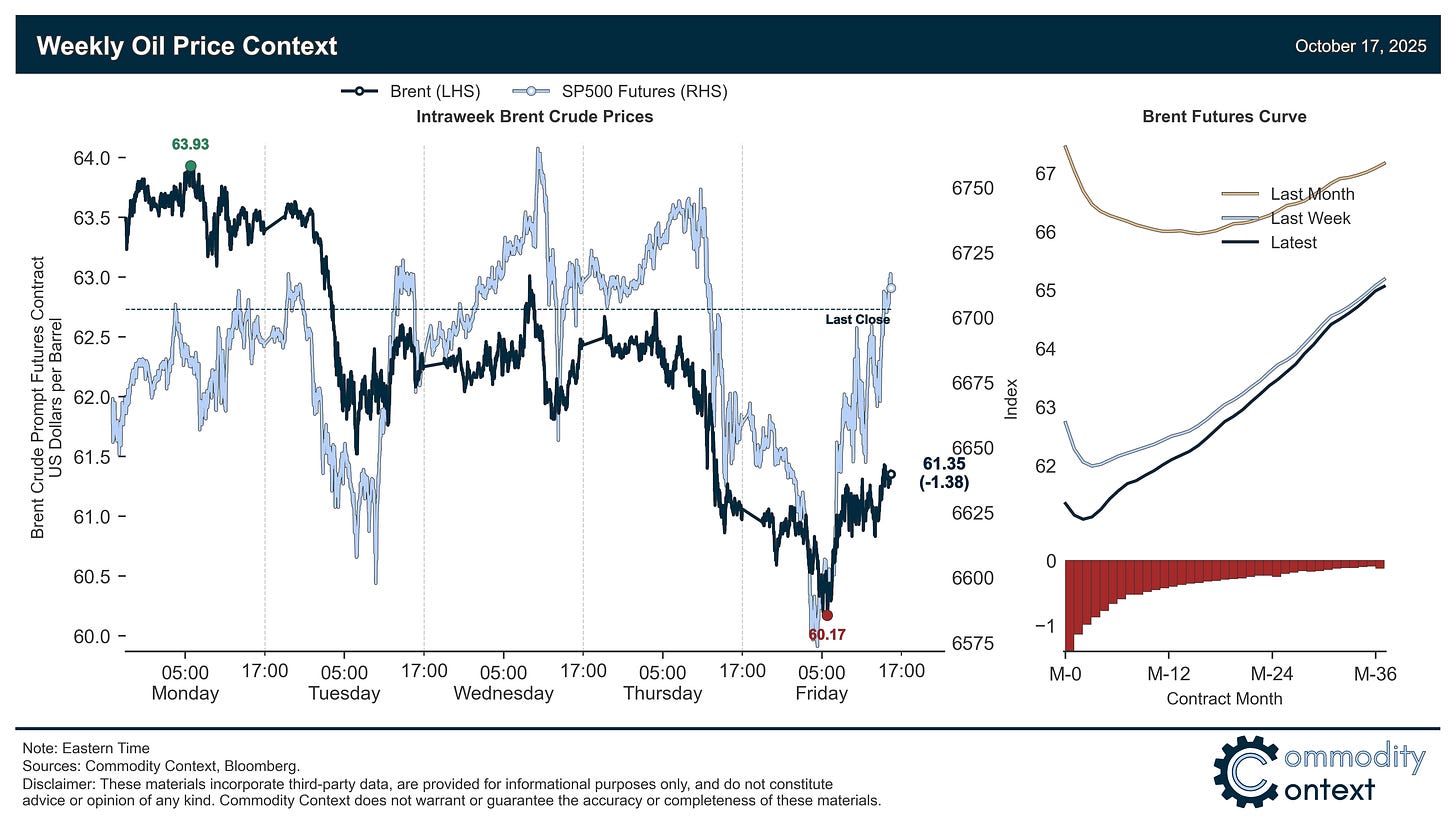

Crude prices fall, the curve sinks deeper toward full contango, and forward oversupply estimates grow while speculative selling pressure intensifies.

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

🎥 I spoke with BNN Bloomberg earlier this week about the IEA’s astronomically large global oil market supply glut scenario forecast for 2026, which couldn’t be done without some aggressive hand-talking (as seen in the below photo). I dig deeper in this write-up.

📰 I spoke with the Financial Times about Keystone XL and managed to get a “zombie” quote in the headline (US and Canada weigh revival of ‘zombie’ Keystone XL pipeline in trade talks)—both a spooky October win and an undead topic that we’ll return to shortly here. 🧟

🎙️ In the latest episode oil the Oil Ground Up Podcast, I spoke with my friend and fellow Substacker, Rob Connors of The Crude Chronicles, about the historical oil market stretches that best rhyme with our current brouhaha and what labour market indicators are telling us about the US oil patch.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

Flat Prices fell ~$1.50/bbl for Brent to end just above $61/bbl—around the barrel’s lowest weekly close since February 2021—and WTI crashed definitely into the $50s.

Timespreads weakened further as both Brent and Dubai are now sitting at the very edge of prompt contango while WTI remains comparatively more resilient—the last remaining refuge of 2025’s stubborn prompt backwardation.

Inventories data was mixed between builds in the US and Singapore and crude-driven draws in ARA Europe; most stocks remain around reasonable levels, generally following seasonal patterns; the exceptions are ARA crude (getting very low), Singaporean residual bunker fuel (high), and US gasoline (sideways vs typically steeper seasonal declines).

Refined Products were split between counter seasonally strengthening gasoline cracks and weaker diesel margins, with everything receiving a boost on Friday following confirmation of fire-related outages at the US’ largest Midwest refinery.

Market Positioning data from ICE (CFTC still offline due to US government shutdown) confirmed that speculative positioning in Brent crude continued to plunge and reached roughly the same level last experienced in the Liberation Day selloff; while we’re flying more than half-blind given the CFTC blackout, Brent positioning is reaching exceptionally oversold levels and will need to soon rationalize before the rout can durably continue.

As Well As the IEA ups its 2026 supply glut forecast to near-double 2020 experience, Venezuela risk mounts as Trump takes aim at Caracas, and the Iranian tanker fleet briefly stepped out of the shadows.